Pandemic bonds were supposed to fund the cost of fighting the coronavirus — so why aren't they paying off?

A fund set up by the World Bank three years ago to help fight infectious diseases has done more to rack up fees for bankers and investors than it has to help doctors battle outbreaks, which is why some critics call it an expensive waste of money.

Between 2013 and 2016, an Ebola outbreak in West Africa killed more than 11,000 people, a tragic reminder of just how quickly deadly diseases can spiral out of control.

While there's still no cure for the disease, public health experts know that having adequate health care infrastructure can go a long way in keeping a lid on the spread of disease. But the cost of even basic medical equipment such as surgical masks or gloves can be prohibitively expensive for developing countries.

Which is why policymakers at the World Bank came up with what sounded like novel idea at the time: what if there was a way to use investors in market economics to help countries access cash to fight disease in a hurry in exchange for a reasonable return for taking on that risk?

Generous interest payments

With that, the pandemic bond was born. In 2017, the World Bank created what's officially known as the Pandemic Emergency Financing Facility, or PEF. The idea was simple: The fund would raise hundreds of millions of dollars from investors willing to contribute to a pool of money that developing countries could tap into as needed to help fight the next pandemic.

Outbreaks in rich countries aren't covered. The bond's payout was targeted toward the 76 poorest countries in the world, which are members of the World Banks's International Development Association, or IDA.

The benefit to global health seems obvious, but investors got a nice return out of the deal, too. Launched in the summer of 2017 and set to expire in July of this year, one tranche of the fund would pay out an annual interest of 6.9 per cent above the LIBOR rate, a benchmark interest rate set in the financial capital of London.

The other tranche was even more generous — 11.5 per cent above LIBOR every year for three years. At the current LIBOR rate, that means investors get a payout of more than eight and 13 per cent, respectively, if they own each tranche.

But there's a catch, of course. Investors get those interest payments annually, but if a pandemic breaks out and countries need the cash to fight disease, investors lose the principal they put in.

Despite the realistic risk of losing everything, there were twice as many people wanting to buy into the offering than there was space available. Demand like that suggests the market thinks the bond was a win-win.

"We expect this concept of fighting disease and providing disaster relief to be replicated in the future," analysts at the Man Institute said this week, and the World Bank confirms it is working on another version of it.

No funds for coronavirus as yet

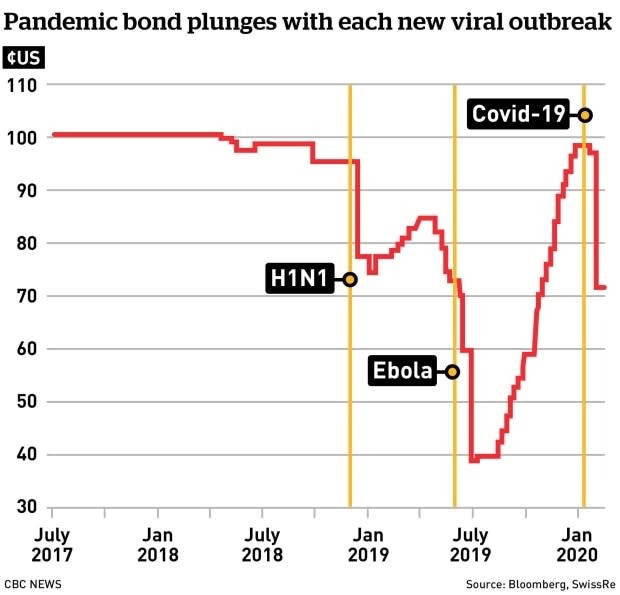

Investors gobbled up the fund at the time, but the coronavirus outbreak has caused the value of those bonds to plunge as low as 45 cents on the dollar this month, as some investors think the fund might soon be wiped out by expensive efforts to keep a lid on COVID-19.

Despite those fears, the fund has yet to actually kick in any money for the fight against the coronavirus — and that's what critics of the PEF say is its biggest weakness: it was set up to fail from the start.

Olga Jonas is among the system's harshest critics. She's currently a senior fellow at the Global Health Institute at Harvard University, but more than a decade ago, she was an economist at the World Bank at a time when avian flu was the disease keeping policymakers like her up at night.

Jonas says while the idea of a pandemic bond sounds good on paper, in practice, it is just an expensive waste of money.

"It's good for investors but useless as a funding mechanism for disease," she said in an interview. "From a public health perspective, they'd be better off just giving the money to me."

Her main criticism is that the triggers that must be met in order for it to pay out are far too onerous and complicated to make it useful. The fund's 386-page prospectus lays out the Byzantine series of requirements that have to be met before any money gets released.

The stipulations are dizzying and change depending on the speed, virulence and scope of any given outbreak.

An outbreak of a filovirus (Ebola is one type of filovirus) can pay out up to $250 million US, but only if there are at least 250 deaths. If the outbreak is considered "regional" — meaning there are cases in more than one country but fewer than eight — it will pay out $75 million. If it spreads to more than eight countries, the payout jumps to $87.5 million.

If it's lassa fever, however, the payout would be $35 million if the outbreak goes global. For Crimean–Congo hemorrhagic fever, it bumps up to $40 million, but only if the death toll hits 2,500 people.

"The money for these bonds could have been better spent in providing the WHO with funds or help strengthen health care provisions in poor countries at risk," said Bodo Ellmers, director of sustainable development finance at Global Policy Forum, an independent policy watchdog.

"It was an ideology-driven idea to get the private sector involved in humanitarian and emergency finance — and I think we have to say this has failed."

Perhaps the biggest reason the fund has failed to be of any use in the fight against COVID-19 is because China is home to the vast majority of cases — and almost all the fatalities — but the country isn't on the World Bank's IDA list of developing economies that the fund covers.

Any amount of money to fight disease in the world's poorest countries would no doubt be welcomed, but the scale of the coronavirus's damage so far illustrates another failure of the bond.

By conservative estimates, China has spent at least $10 billion trying to contain the coronavirus so far. By comparison, if the PEF were to fully pay out all available funds to the 75 eligible countries, it would amount to about $196 million, or eight cents per person — hardly enough to make a dent, Jonas estimates.

That's not to suggest the fund is entirely useless. Roughly $20 million US was put to work against an Ebola outbreak in the Democratic Republic of Congo in February of last year, followed by another $30 million in August.

That money certainly helped limit the damage, but since its inception, the fund has done more to help bankers and investors rake in fees and returns than it has helped doctors access resources on the ground.

Jonas calculates that since it was created, the fund has doled out just over $115 million US in fees and payouts to investors, versus a little more than $60 million to battle outbreaks.

"That's $2 in fees for every $1 it has paid out to actually fight disease," she said.

"It doesn't work."