Premier asks finance staff to review corporate rules

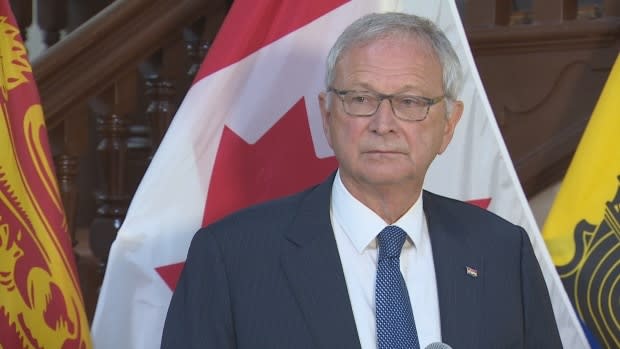

Premier Blaine Higgs has asked officials from the Department of Finance and Treasury Board to review New Brunswick's corporate rules and look at why they haven't been updated.

That comes after a CBC/Radio-Canada investigation showed how easy it is to register a company in New Brunswick, a province where corporations aren't required to disclose who really owns or controls them, something called beneficial ownership.

New Brunswick also doesn't require companies to have directors who are residents of Canada.

"I've asked finance and treasury to look at this," Higgs told reporters earlier this week.

"Is it a tax evasion situation? I know that departments are working with the federal government and what they made for changes back a few months ago. So if we are out of sync here and there's loopholes in New Brunswick, we need to close them."

Oceanic Fisheries N.B. was flagged by banks for receiving millions of dollars in suspicious transfers, according to records in the FinCEN Files, a 16-month-long investigation of the International Consortium of Investigative Journalists (ICIJ), BuzzFeed News and partners. The suspicious activity reports are not proof of wrongdoing.

The company's corporate records list a sole director in South Africa and a registered office address in Saint John. But there's no evidence that Oceanic Fisheries N.B. has any operations in New Brunswick, despite the initials in its corporate name.

The company has not responded to a list of questions sent by CBC/Radio-Canada.

New Brunswick Green Party MLA Kevin Arseneau has called for more transparent corporate rules, arguing that no one should be able to use the province's reputation in a misleading way.

"I certainly agree with my Green Party colleague here in that regard because it's certainly not intentional and we need to fix it," Higgs said earlier this week. The premier hasn't yet said exactly how he plans to "fix" the issues.

Changes considered in 2015, but never materialized

Five years ago, the government wrote a 140-page proposal aimed at modernizing the Business Corporations Act.

It suggested eliminating the option for corporations to use a post office box as its only registered address, with the idea that businesses should have a physical address where they can keep records.

It also considered adding a residency requirement as a way to "lessen the potential misuse of a [New Brunswick] corporation being used as part of an international securities scam or fraud," but suggested the province could lose some legal and accounting work to another province that doesn't have a residency rule.

Two government staffers were assigned full-time to the modernization, a job that included consulting a list of stakeholders. They ranged from law schools to other government departments, representatives from the insurance industry and major corporate players like Bell Aliant and the Irving and McCain groups, according to a copy of the list.

But changes were never made and now, the proposed changes are out of date, according to emails obtained by CBC News through access to information.

Since then, there have been "major structural changes in national and provincial statutes" to incorporate things like beneficial ownership and open data legislation, according to an email written by Charles Boulay, who the government directory lists as the executive director of registries with Service New Brunswick.

"It is my understanding that [the Executive Council Office] is way more interested in these new structural changes than some of the older house cleaning changes included in the 300+ revisions proposed during the last set of consultations," Boulay wrote in the June 23, 2020 email.

Without sufficient corporate law expertise in-house, Boulay estimated it would cost "most likely well over $100,000 which is not budgeted anywhere" to acquire that expertise from outside.

No one from Service New Brunswick was made available for an interview.

'A threat to the province's reputation'

The idea of a company setting up shop in New Brunswick, but not actually operating here, isn't new.

Nearly 30 years ago, a company in Saint John owned by Robert Maxwell — the late British billionaire media mogul and father to Ghislaine Maxwell — was found to have defaulted on a $100 million loan after his death. The company was registered in the province, using a now-defunct Saint John law firm's address, but didn't actually operate here, according to a CBC News story at the time.

Five years ago, when the government was discussing how to modernize its corporate legislation, it discussed the issue of "rogue companies" registering in New Brunswick and harming the province's reputation.

That's according to notes from a 2015 meeting between government representatives and the province's Financial and Consumer Services Commission (FCNB), a Crown corporation that serves as the financial and consumer services regulator.

No one from FCNB was made available for an interview with CBC News. But in a written statement, CEO Kevin Hoyt said the government asked for feedback on the province's lack of residency rules for directors back in 2015.

"In our response, we suggested the non-residency requirement may contribute to shell companies setting up in the province to conduct securities fraud outside of Canada, relying on the good name of New Brunswick to imply integrity," Hoyt wrote in the statement.

"Although such circumstances may be exceptional, there is a threat to the province's reputation."

FCNB also supported the government's plan to prohibit post office boxes from being designated as a corporation's registered office.

Province lags behind other jurisdictions

New Brunswick is lagging behind in making changes to its corporate rules, according to Vokhid Urinov, an associate professor in the University of New Brunswick's faculty of law.

"Everyone else is now moving to the direction of transparency — at the international level, at the federal level, in other provinces," said Urinov, who teaches tax law and other corporate law-related subjects.

"New Brunswick should simply follow these trends."

He would like to see the government require corporations to collect information on the ultimate owner of a corporation's shares. The federal government has already changed its legislation to require corporations to collect this information, Urinov said.

He said corporations should have to keep the information in a centralized registry so law enforcement agencies can easily access it. But the public also has a stake in being able to see information on beneficial ownership in a public registry, as the United Kingdom has already done.

"I think the public has a great interest that investment in Canada is legitimate, the Canadian economy is not contributing to money laundering, terrorist financing or tax evasion," Urinov said.

At least five provinces have introduced or passed legislation that would require companies to at least collect information on beneficial ownership, according to a survey of all provinces and territories.

Urinov would also like to see the province eliminate bearer shares, which allows ultimate shareholders to maintain a screen of anonymity.

"By allowing these corporations to be incorporated in Canada and with all these anonymity things, you may be contributing negatively to other countries' economy, if these corporations are doing some irresponsible things," Urinov said about the current rules.

"Why [should someone] come in, incorporate in Canada if their business is outside? There is something they are trying to probably hide."