A Quick Analysis On Northern Star Resources' (ASX:NST) CEO Salary

Stuart Tonkin has been the CEO of Northern Star Resources Limited (ASX:NST) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Northern Star Resources.

See our latest analysis for Northern Star Resources

How Does Total Compensation For Stuart Tonkin Compare With Other Companies In The Industry?

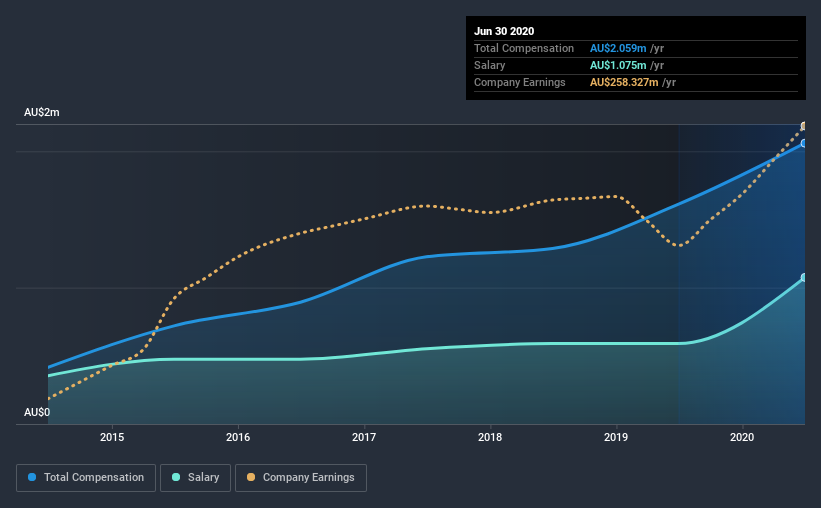

According to our data, Northern Star Resources Limited has a market capitalization of AU$10b, and paid its CEO total annual compensation worth AU$2.1m over the year to June 2020. That's a notable increase of 28% on last year. Notably, the salary which is AU$1.08m, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from AU$5.7b to AU$17b, we found that the median CEO total compensation was AU$2.5m. So it looks like Northern Star Resources compensates Stuart Tonkin in line with the median for the industry. What's more, Stuart Tonkin holds AU$15m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2020 | 2019 | Proportion (2020) |

Salary | AU$1.1m | AU$590k | 52% |

Other | AU$984k | AU$1.0m | 48% |

Total Compensation | AU$2.1m | AU$1.6m | 100% |

Speaking on an industry level, nearly 69% of total compensation represents salary, while the remainder of 31% is other remuneration. Northern Star Resources sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Northern Star Resources Limited's Growth Numbers

Northern Star Resources Limited has seen its earnings per share (EPS) increase by 5.8% a year over the past three years. Its revenue is up 41% over the last year.

It's great to see that revenue growth is strong. Combined with modest EPS growth, we get a good impression of the company. We wouldn't say this is necessarily top notch growth, but it is certainly promising. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Northern Star Resources Limited Been A Good Investment?

Boasting a total shareholder return of 200% over three years, Northern Star Resources Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

As we touched on above, Northern Star Resources Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But the company has been found wanting in terms of EPS growth over the past three years. At the same time, shareholder returns have remained strong over the same period. We would like to see EPS growth from the business, although we wouldn't say the CEO compensation is high.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 1 warning sign for Northern Star Resources that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.