Reality check: Can B.C.'s new foreign-buyer tax cool Vancouver's housing market?

The British Columbia government broke new ground this week, announcing a hefty tax on foreign homebuyers in the Metro Vancouver area, something Ontario quickly said it will watch closely as a possible way to cool off Toronto's hot housing market.

The B.C. tax will force buyers who aren't Canadian citizens or permanent residents to pay an extra 15 per cent of the fair market value of any residential property they acquire, on top of the existing land-transfer fee — an extra $300,000 on a $2-million home, for example. Finance Minister Mike de Jong said revenue from the surcharge would be used to fund housing, rental and support programs.

Analystsdisagree on how much foreign buyers are driving up prices in the Vancouver-area market, as opposed to other factors like low interest rates, zoning issues, a lack of social housing and the city's all-around appeal.

But regardless, the government is hoping that its tax will soften demand for homes and make housing more affordable, de Jong and Premier Christy Clark said.

Experts and people in the industry who CBC News spoke to were of several minds.

Won't buyers just find loopholes?

The legislation to enact the new 15 per cent tax tries to pre-empt several possible loopholes by making the tax mandatory whether the buyer is:

- A non-resident foreign citizen.

- A corporation either incorporated outside Canada or controlled by foreigners.

- A trust where the trustee, or even just one of the beneficiaries, is a foreigner.

But that still leaves some major gaps, according to the opposition provincial NDP housing critic, David Eby.

"As a Canadian or permanent resident, I could set up a company and fully capitalize it with foreign money and there's nothing stopping me from buying up as many properties as I wish without paying any of this tax," Eby said in an interview.

In other words, foreigners could potentially still acquire Vancouver-area homes free of the new tax through a corporation, as long as the majority of the voting shares are domestically controlled, even if none of the equity shares are (which is a common-enough corporate structure used in firms like Google, Facebook and Bombardier to keep effective control in the hands of the company founders).

Another loophole is that the new tax doesn't apply to pre-sale condos and homes until they're completed and title is registered, Eby said, which means foreign speculators can still snatch up properties under development and then flip them later, as long as it's done before the new homes are inscribed on the provincial property registry.

"We have a problem where speculators are buying all the units in a development and scalping them like hockey tickets, and this won't catch that," he said.

There's also the possibility a Canadian citizen or resident could incorporate a company in Canada to buy a Vancouver-area house, and then when they want to sell it to a foreigner, they merely sell the shares of the corporation. Title to the home never changes hands, so it doesn't necessarily become subject to the new transfer tax.

B.C. Finance Ministry communications director Jamie Edwardson said that's "fairly standard contract law" and agreed that the tax might not be incurred, but pointed out that the government's proposed legislation includes an anti-avoidance rule that would still catch any schemes set up for the purpose of dodging the tax.

"If you structure your affairs to avoid paying the tax, we will audit you and the tax applies," Edwardson said.

Bottom line? "I don't think there is any limit to human creativity, especially when it comes to avoiding taxes," Vancouver real estate lawyer Sky Anderson said. That said, Anderson was of the view that most of these loopholes won't be exploited in practice.

"Few people, in my experience, are willing to let another individual, even a family member, have absolute control over their company and their property simply to avoid a tax."

Will the tax tame housing prices?

The bigger question is, whether or not some buyers find loopholes, what the overall effect of the tax will be on Metro Vancouver's red-hot housing market. As of May, prices were up another 30 per cent from the year prior, according to the Greater Vancouver real estate board.

North Vancouver real estate agent Roland Lewis said that in the short term, he sees the new transfer levy having a price-tamping shock effect as foreign buyers absorb the surprise that properties they had their eye on will now cost 15 per cent more.

But long term, for average house prices, "it really will do nothing," he said, citing the fact foreign buying tends to happen at the high end of the market.

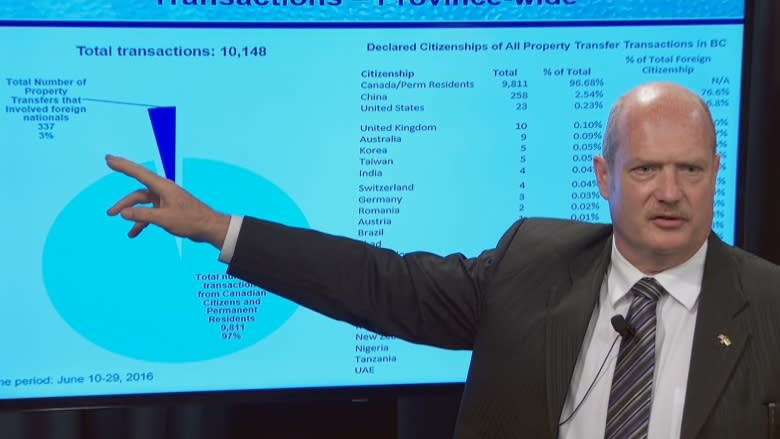

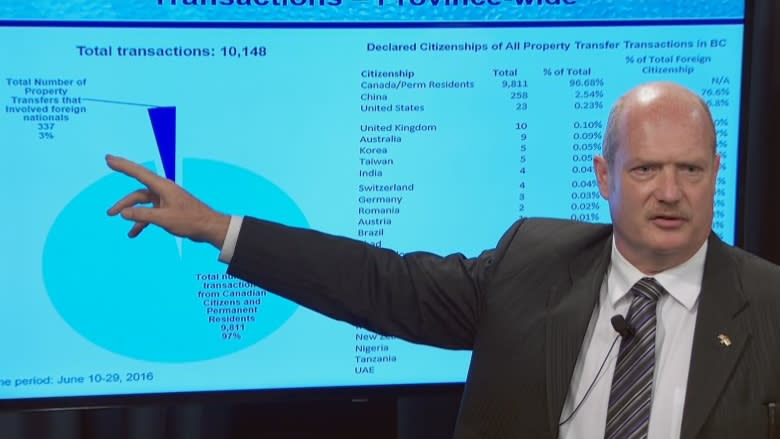

"Folks have to understand what segment of the market foreign ownership does occupy and if 15 per cent really does make a difference to them. That foreign ownership portion of the market... I think people think it's much bigger than it really is."

However Tom Davidoff, a professor at the University of British Columbia's business school who focuses on housing and the economics of real estate, said there's "no question" the new tax will put a chill on foreign demand for Vancouver-area housing.

"I just find it hard to believe people will be willing to pay in large numbers this 15 per cent surcharge," he said.

"Part of what draws foreign money to Vancouver is the feeling that 'I'm safe here.' When you start to throw up roadblocks, alternative investments start to be more attractive."

Davidoff speculated some foreign money might now look to other Canadian cities like Victoria, Kelowna, B.C., or even Toronto. Which means the problem of unaffordable housing might just get punted elsewhere.

Should Ontario enact a similar tax in the GTA?

The new B.C. tax has inspired Ontario's finance minister. Charles Sousa said Tuesday he "welcomes" the move and will "be looking very closely" at it in the months ahead for the Greater Toronto Area, where prices for detached, single-family homes are up around 20 per cent year-over-year.

That scorching pace will only intensify if investor cash now diverts to Toronto from Vancouver.

"Even if two to three per cent of that money would come here, any increase in demand is going to put pressure on our prices, so the government should be looking at that proactively," Toronto real estate agent and real estate blogger David Fleming said.

Ontario would have to follow B.C.'s lead and update its land-transfer rules to be able to collect information like a buyer's nationality and the identity of the beneficial owners behind a homebuying corporation or trust, but it's nothing that hasn't been done elsewhere.

"We're living in a brave new world," UBC's Davidoff said, "where internationally mobile capital is actually chasing single family homes and apartments. That didn't use to happen as much.

"So any place that is feeling like it's a target should start to implement these kinds of taxes."