Reflecting on National Western Life Group's (NASDAQ:NWLI) Share Price Returns Over The Last Three Years

National Western Life Group, Inc. (NASDAQ:NWLI) shareholders should be happy to see the share price up 17% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 43% in the last three years, falling well short of the market return.

See our latest analysis for National Western Life Group

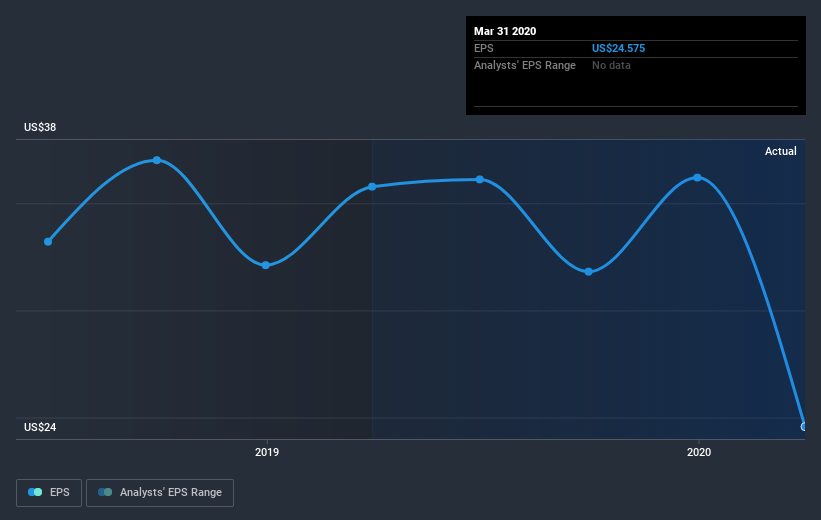

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

National Western Life Group saw its EPS decline at a compound rate of 5.9% per year, over the last three years. The share price decline of 17% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. The less favorable sentiment is reflected in its current P/E ratio of 8.00.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into National Western Life Group's key metrics by checking this interactive graph of National Western Life Group's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 19% in the last year, National Western Life Group shareholders lost 23% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3.0% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand National Western Life Group better, we need to consider many other factors. For example, we've discovered 1 warning sign for National Western Life Group that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.