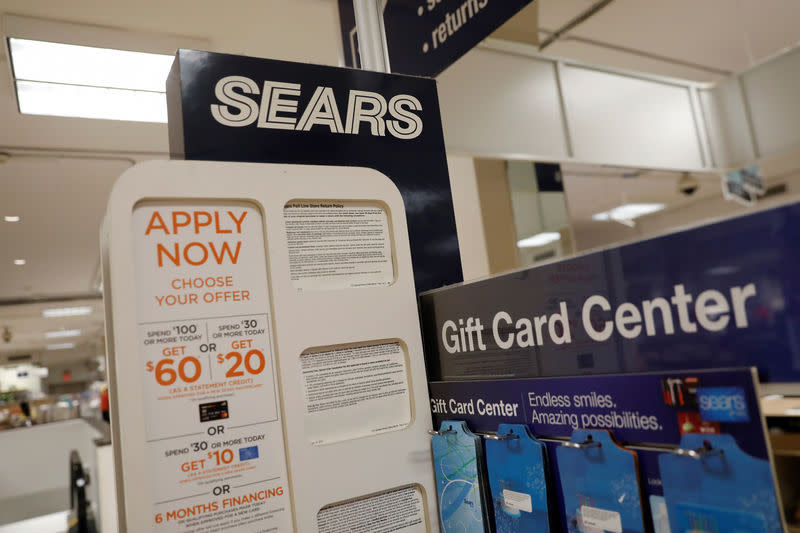

How Sears killed itself, explained in one number

During his 14-year reign as Sears CEO, money manager Eddie Lampert has consistently forgotten to make one of the most important investments ever for a retailer: plowing money into the thousands of Sears and Kmart stores he was overseeing.

It’s Lampert’s bizarre withholding of capital to keep Sears and Kmart stores — dating back to the merger of the two he orchestrated in 2004 – relevant in the age of Amazon shopping and alongside a resurgent Walmart that has the once iconic retailer on the precipice of death. While the likes of Walmart and Target have invested in improving their in-store and online shopping experiences, Sears (SHLD) and Kmart locations feel like a time capsule from 1989.

“I used to buy my washer and dryer from Sears, but they don’t have the brands anymore and it’s not a good place to shop,” says Ted Gavin, managing director of bankruptcy consultancy Gavin/Solmonese.

The stores are so irrelevant at this point that the underlying real estate Sears owns is worth more than the boxes selling housewares and food, says Jordi Guso, a lawyer at Berger Singerman.

Capital expenditure-to-revenue ratio

One metric says it all on Lampert’s lack of action on store investment. Sears has consistently spent a mind-bogglingly low 1% or so a year of its annual revenue on capital expenditures since 2005, according to Bloomberg data. In 2017 alone, the cash-strapped Sears spent a meager $80 million on capital expenditures to support the look and feel of its more than 1,000 stores (and on other projects).

What’s known on Wall Street as the capital expenditure-to-revenue ratio is how industry pros measure if a retailer is investing enough in its stores to stay competitive. A low number over time suggests a retailer may not be properly planning for its future.

Others in retail have left Sears in the dust on spending. For instance, department store retailer Macy’s (M) spent 1.9% of its annual 2017 sales on capital expenditures and has consistently spent about 2% through the years. For its efforts, Macy’s now mostly has stores featuring cool-looking shops from top brands and a solid-performing online business. Not the case for Macy’s rival Sears down at the other end of the mall.

Meanwhile, Walmart (WMT) spent 2% of its sales last year on capital expenditures – this measure has been higher than 4% several times for the retailer in the past 13 years. Today, Walmart’s locations feature things like giant vending machines to pick up online orders and snazzy grocery section layouts.

Walmart rival Kmart has stores that in some cases are beyond repair.

Sears has paid dearly for its unwillingness to invest more. The company has produced negative same-store sales at Sears and Kmart for 15 straight quarters. Net losses have been the name of the game for the past eight years.

Sears did not return Yahoo Finance’s request for comment on this story.

Sears has hired advisory firm M-III Partners to prepare a bankruptcy filing that could arrive as soon as this week, according to a report in The Wall Street Journal. Sears is still looking at other restructuring options as Lampert seeks to avert a messy overhaul in bankruptcy court, the Journal says. But with a $134 million debt repayment on Oct. 15, a bankruptcy filing for Sears may be the only feasible outcome to keep the lights on another year.

Sears shares have lost 45% in the last five sessions and trade at meager 34 cents a share. Most bankruptcy experts Yahoo Finance talked with say a filing by Sears is likely before Monday.

M-III Partners didn’t return Yahoo Finance’s request for comment.

Brian Sozzi is an editor-at-large at Yahoo Finance. Follow him on Twitter @BrianSozzi

Read more:

Philip Morris International tries risky move of making cigarettes extinct

PepsiCo isn’t looking at a ‘substantive’ breakup, CFO says

3 massive problems J.C. Penney’s new CEO must solve

Snap CEO reportedly says its redesign was botched in an internal memo