Would Shareholders Who Purchased Bright Scholar Education Holdings'(NYSE:BEDU) Stock Three Years Be Happy With The Share price Today?

While it may not be enough for some shareholders, we think it is good to see the Bright Scholar Education Holdings Limited (NYSE:BEDU) share price up 19% in a single quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 32% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

View our latest analysis for Bright Scholar Education Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, Bright Scholar Education Holdings actually managed to grow EPS by 39% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

The modest 1.2% dividend yield is unlikely to be guiding the market view of the stock. Revenue is actually up 35% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Bright Scholar Education Holdings further; while we may be missing something on this analysis, there might also be an opportunity.

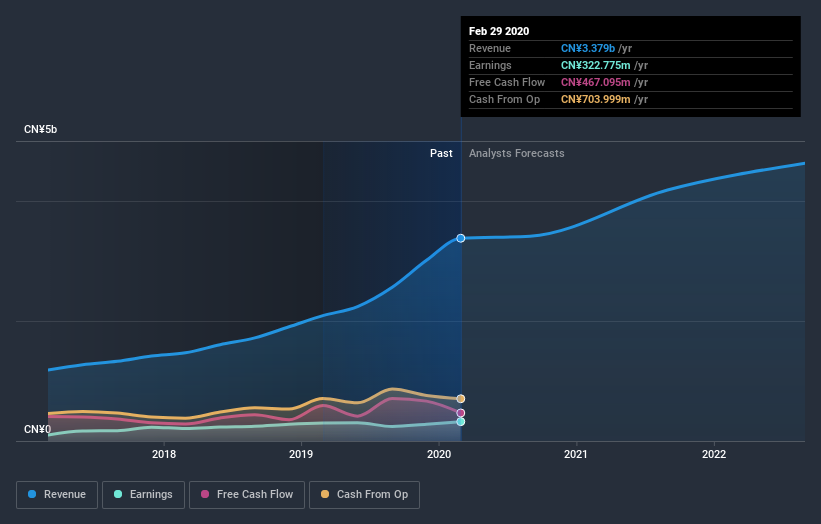

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Bright Scholar Education Holdings has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Bright Scholar Education Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

The last twelve months weren't great for Bright Scholar Education Holdings shares, which cost holders 18% , including dividends , while the market was up about 8.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 12% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand Bright Scholar Education Holdings better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Bright Scholar Education Holdings , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.