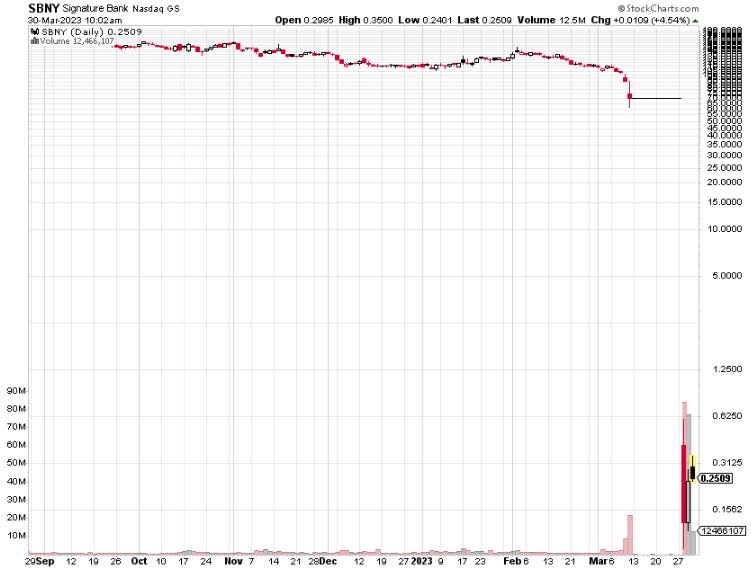

Signature Bank stock plunged to a few pennies and then soared 288% after trading in the failed bank's stock reopened

After being halted for more than two weeks, shares of Signature Bank reopened for trading.

The stock crashed 99.9% from $70 to just $0.09 on Tuesday, and has since surged as much as 288%.

Signature Bank trades under the ticker symbol "SBNY" and is in the process of being acquired.

Signature Bank stock has reopened for trading after being halted for nearly three weeks, and the stock is seeing some wild volatility.

The collapsed bank's stock was halted on March 13, one day after its seizure by the FDIC was announced and just a few days after the downfall of Silicon Valley Bank.

On Tuesday, trading reopened at $0.41, and shares later crashed to as low as $0.09, representing a 99.9% decline from its price of $70 when trading was halted.

But on Wednesday and Thursday, speculative traders piled into the stock, bidding it up to as high as $0.35, representing a two-day gain of as much as 288%.

It's unclear why traders piled into the stock on Wednesday and Thursday aside from wild speculation to eke out some gains before the stock is ultimately delisted.

To be clear, there is no remaining equity value in Signature Bank despite its stock trading in an extremely volatile range over the past few days.

Some of the bank's assets are in the process of being acquired by a subsidiary of New York Community Bancorp, in which Flagstar Bank will buy $12.9 billion of Signature's loans at an extreme discount of $2.7 billion. The FDIC is still trying to sell off other assets held by Signature Bank.

But that's not stopping traders from speculating in a volatile stock, trying to make a profit. Similar speculative trading has been seen in Silicon Valley Bank stock after it also reopened for trading on Tuesday.

Read the original article on Business Insider