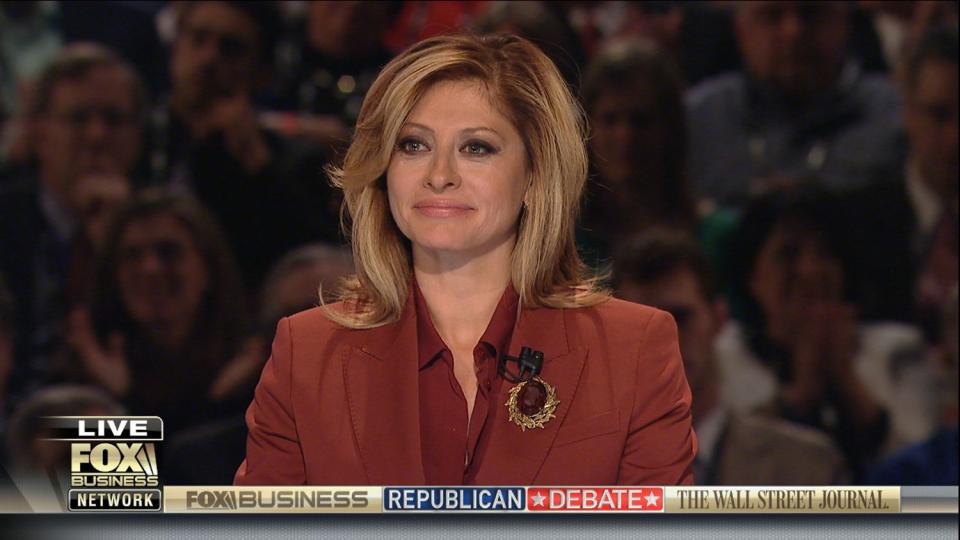

Splurge or Save? Buy a Home? Switch Careers? Maria Bartiromo Tackles Top Pandemic Money Questions

Maria Bartiromo is making the most of her time stuck at home during the coronavirus pandemic, interviewing everyone from Dr. Anthony Fauci to President Donald Trump, from entrepreneur Mark Cuban to Delta CEO Ed Bastian, all in an effort to reveal COVID-19's impact on the American economy — and what comes next.

"I actually am more productive than I ever have been," says the Fox Business host and finance expert, who on Monday will celebrate her five-year anniversary of hosting FBN's Mornings with Maria, airing 6-9 a.m. ET on weekdays.

“I've been so grateful to be able to have this incredible front-row seat to what's going on in business and the markets," adds the 52-year-old Bartiromo, whose 30-year career made her a question on Jeopardy! earlier this month.

As she enters a new chapter on television, Bartiromo is determined to continue sharing her encyclopedic knowledge of the markets from her home studio, especially for this year's high school graduates, who are entering what some are calling one of the worst job markets in modern history.

"The truth is the class of 2020 is facing a very difficult moment in time, but at the same time, learning a hard lesson right out of the gate that you have to adapt to what's thrown at you and deal with the reality of the situation," says Bartiromo, fresh from delivering Iona College's commencement speech earlier this month.

However, Bartiromo still believes "there are plenty of opportunities now for the class of 2020, given the fact that we are seeing the digital economy accelerate telehealth and tele-education, buying online and deliveries."

Her No. 1 advice for graduates? "Know what you're good at, love what you do, work hard because there are no shortcuts and always do the right thing," she tells PEOPLE over the phone. "Because no matter what happens to you in the future, whatever industry it is or geography, you will always understand that your reputation is the one thing that will always follow you. So you need to cherish it and protect it."

RELATED: 7 Ridiculously Easy Ways to Save Money While Shopping Online

Fox Business Maria Bartiromo

Read on for more of Bartiromo's financial insight and answers to some of everyday folks' most pressing financial questions during the pandemic.

When will the economy bounce back?

Bartiromo doesn't "want to paint too rosy a picture," but she's optimistic. "I think that we will see a comeback in the economy — I don't think it will be an immediate snapback," she says. "I think we're going to have a second half that is certainly much better than the first half. I interviewed President Trump [earlier this month], and the president called the third quarter a transition to greatness, and I do see the third quarter as somewhat of a transition. I think we will see growth in the third quarter as businesses continue to open. Today, we've got all 50 states having some kind of a reopening, whether it's partial or all, and so this is going to take time, but by the third quarter you will see that transition to growth. And then in the fourth quarter, you will see more growth. And I think in 2021, we'll continue to see more of a rebound."

What are people asking you for advice on — and what do you say?

"People are worried when money gets tight, right? Here we are all living at home, working from home," says Bartiromo. "Certain companies will not be able to avoid layoffs. People are thinking, 'How am I going to pay the rent? How am I going to keep up with my expenses?' This is one of those moments in time where if you were creating a cushion for yourself leading up to this, you are in a better position."

If you haven't created a cushion, Bartiromo says now is the time to start using her three-bucket system. "One bucket is your retirement money, and that you can do very easily," says Bartiromo. "If you work for a company that has a 401(k) plan, boom, you've got to join it ASAP, and then that's free money because your company will match that. That's retirement money that you're not touching at all until you retire."

"Your second bucket is going to be the bucket of savings for things that you want to save for," adds Bartiromo, pointing to goals like purchasing a home or paying for your child's college education and your daughter's wedding. "Whatever it is, you've got that savings that your money is earmarked for."

The third and final bucket is for your operating expenses. "This is the bucket that your check will go in, and you're going to pay [bills] out of that bucket," says Bartiromo. "If you're lucky enough to have more as you continue to fill up these buckets, you want to also create another bucket, which is a bucket of your fun money. If you want to go on a trip, you want to get yourself a gift, you want to fix up your kitchen — you have that extra money in another bucket."

Of course, many dreams might be further off now — and the funds in your buckets can be put to use to sustain yourself. "If you are thrown a curveball like what we have, you have those buckets to rely on," says Bartiromo. "You know that, ‘Okay, well, I have this cushion, I was saving this for my house, a country home someday. But you know what? I'm going to be tapping into that now.' I think that it's very important to understand how to earmark certain important things in your life and put some money away for them in their own bucket, because then you safeguard yourself from unknowns, like the one we’re in right now."

What if someone has been laid off and has no savings?

"The first thing you always have to do is take a look at the expense side of the ledger," says Bartiromo. "What are you spending your money on? Start doing an assessment of your own personal balance sheet and income statement. You're going to have to start identifying places to pull back. What does any company do when you're in a situation where business just slowed down? They start cutting costs. The individual needs to take on that same narrative, that same process of looking at where I can cut. Oftentimes, we are spending money that we don't even realize we're spending, and we're overspending on things. I bet you're going to be able to take out a lot of costs on just step one."

"Step two is you have to try to manage your income differently," she continues. "If you feel that you can have an opportunity to work from home and gain income from it, look for those opportunities. Obviously you want to get that stimulus check. When you get that stimulus check, don't blow it. Try to have it grow. Maybe, if you can, put some of it in one of your buckets. That's what you should be doing — not spending it, but putting half of it in some of your buckets that we talked about earlier. If you can put a portion of it in an investment account to try to build on it, that's not a bad idea either. But of course, it is probably going to your bills."

For people looking for new jobs or career shifts, which industries should they consider?

Bartiromo emphasizes the "industries that may be poised to open faster" and show growth. "I would say construction," she says. "I was on my bike the other day. There’s a lot of construction happening, and this is an industry that you can do while social distancing. Technology, telehealth, tele-education, online [retail], deliveries — those will all persist when we get out of this, in my view. They will also be the likely job creators over the near term."

Is it a smart move to take advantage of the CARES Act and move money out of your 401(k)?

"If you can avoid it, I would," says Bartiromo, who acknowledges that it's tempting to rely on 401(k) funds after Congress' CARES Act made it possible for employees to withdraw a maximum of $100,000 in hardship distributions while avoiding the steep 10% early withdrawal cost.

"If you can't avoid it, the government is giving you the opportunity that you won't get penalized," she adds. "But it's really money that is put away for when you truly need it in retirement."

RELATED: The Best Money Lessons for Kids of All Ages, Whether Just Starting Chores or Facing College Debt

Fox Business Maria Bartiromo

Alternatively, let's say you want to ramp up your 401(k) contributions. Is now a good time to do that?

"Yes, it is, absolutely," says Bartiromo. "In fact, the government is giving you as much leeway to make moves right now. I would put as much as you can in 401(k) if you can afford it. If it's actually cutting into your household bills and any other expenses that you have, then now is not the time to do that, but I'm always of the belief that you want to really take advantage of that 401(k) because your company is matching it. The younger you are, the more you want to just get in the habit of the money directly going in there, so that you don't even see the money. Because at some point when you do retire, you're going to have a nice nest egg and you're going to be able to live the way you want to and the way you were living when you had a steady income."

Many Americans have big deposits and/or payments due on things that they're not sure will even happen, such as school tuition in the fall. How would you approach that situation?

"Right now, universities are trying to work with families on this very issue," Bartiromo points out. "People are unsure if their child is going to go and live on campus, if they're going to have to continue home learning. So we're learning more and more about this, but certainly at a minimum, if you are a parent with a child at a university and you are looking at these additional bills coming at you, you need to call the university. They are actually dealing with this right now and putting plans in place to either say, ‘Okay, let's put this off, and your child can start in the January semester.' There are a lot of schools right now thinking about continuing in the fall semester online and then ramping up in January. So it depends on where you're located, which university you're talking about, but you certainly should be engaging with the university personnel right now."

Is now a good time to refinance your mortgage?

"You're not going to get a better time to refinance, frankly," says Bartiromo. "Right now rates are at such rock-bottom levels, and Jay Powell, the chair of the Federal Reserve, testified that we likely see rates at these levels or around these levels until 2023. However, as the economy continues to open, as things get a little stronger — as they will and we are expecting going into the third and fourth quarter — rates will bounce off of the bottom, but I'm not expecting a substantial change or spike in any way, shape or form anytime soon. So now would be the time, if you have the cash and the interest, to actually look at new homes or refinance your current home. You’re getting close to free money here. You're borrowing at such low levels. I don't know that you're going to see another time like this after we get out of this period for a long time."

If someone is considering moving away from a big city because of the pandemic, is now a bad time to sell a home?

"It depends on the market, certainly," begins Bartiromo. "But I do think that you're hitting your finger on something that is sort of hidden in plain sight, and I think that is the pressure that we're going to see on cities. Increasingly, as we learn more about working from home, about the vulnerabilities that we could find ourselves in being in crowded places, people are increasingly trying to avoid cities — big cities and density. I do think you're going to have a situation where cities will face a bigger strain than the boroughs and the suburbs. Sometimes that works for that person wanting to go to the city, so I suspect real estate prices will come down in cities. I suspect we could see tighter budgets in cities, and that will mean that city services will be strained."

"Selling your home right now? I think prices have come down quite a bit and there are a lot of people who expect prices to continue to come down, but it really is the area that you're referring to," Bartiromo continues. "The very, very, very high end has come down, but the middle-high end is actually still moving. Cities are seeing prices go down for sure, because people are fleeing cities. And by the way, they were fleeing cities before COVID-19."

What advice would you give someone whose income has gone up because of the federal government's $600 per week increase to unemployment benefits?

"I would put it in a savings bucket, because right now you're seeing a situation where some individuals are making more money by staying home than they're actually making by going to work," says Bartiromo. "And that could be a false sense of security. Don't kid yourself. This [unemployment] program will end. Right now it's scheduled to end on July 31. If the economy starts opening now in May, in June, and you're starting to see some temporary opportunities out there to get back into it, I would do that and not be complacent about this because once you get to July 31, you don't know if those opportunities are still going to be there. What you want to do is, if you are lucky enough to have more money than you thought you would, I would 100% put as much as you can into one of those buckets that you've been saving — maybe your operating account, where you're paying bills, maybe the savings account where you're saving for your wedding. Just put it away, and then you know that it's not going to get cut down."

How will working from home during the pandemic impact industries?

"Across business, people are rethinking the way they're doing things," she says. "And I think that if it works, then it may very well become something more sustainable later because I think managers today are recognizing new threats. It’s about confidence coming back — it's all about confidence, and people have to have confidence to go to a crowded restaurant, but workers also have to have confidence to go into their high-rise buildings, touch the elevator button and know that they're going to get back to life the way it was. In many corners, the confidence won't be there in that regard for a while. As a result, I think companies are thinking, well, let's see what we can accommodate for the home. Let's see how far we can push it and how much cost this could actually save. Yes, I do think we will see increasing trends working from home, whether it be a show or certainly other industries that are much more poised and adaptable to working at home."