How the new stamp duty rules affect you

Property buyers could save thousands of pounds thanks to a new tax break announced today by Chancellor Rishi Sunak.

Stamp duty is charged to the majority of people who purchase a home in England and Northern Ireland. However, it has been accused of slowing down the property market and discouraging people from buying new homes.

Mr Sunak has temporarily loosened the rules on stamp duty and offered exemptions to buyers of properties. Those buying properties worth £500,000 or less will pay no tax, while those purchasing more expensive homes will benefit from reduced costs.

The move is intended to kickstart a property market which has slumped since the start of the coronavirus outbreak. Reducing stamp duty makes it cheaper to purchase properties and it is hoped this will aid the country’s recovery from the pandemic.

The stamp duty holiday will start immediately and run until March 31 2021. Mr Sunak said nine in 10 buyers would no longer pay any stamp duty.

Based on the average property price of £248,000, this would save a typical buyer £2,460 in tax. Someone purchasing a £500,000 property should save £15,000.

However changes to stamp duty are likely to be an expensive way of boosting activity in the housing market. At present, the tax raises about £12bn for the Exchequer each year, a figure that is likely to fall under the new rules.

The Government estimates this stamp duty cut will cost £3.8bn in lost tax revenue.

Those purchasing a second home or buy-to-let property will also benefit from lower stamp duty rates, paying 3pc on the first £500,000 of a property's value.

Who does stamp duty apply to?

Stamp duty is applied to most property transactions in England and Northern Ireland. Buyers in Scotland and Wales have similar but separate tax regimes for property purchases.

In Scotland buyers must pay Land and Buildings Transaction Tax and in Wales they are subject to a Land Transaction Tax. No changes to these taxes have been announced.

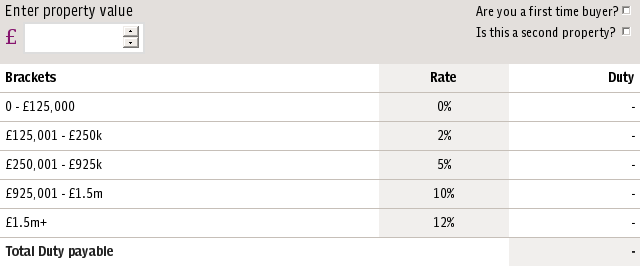

What are the usual stamp duty rates?

Under normal circumstances, stamp duty is charged on all transactions in England and Northern Ireland where property or land is sold for £125,000 or more.

However, first-time buyers have an exemption, meaning they do not pay stamp duty on purchases of up to £300,000 and 5pc on the value of transactions between £300,000 and £500,000.

For other buyers, a tax of 2pc is charged on the the the value of the property between £125,001 and £250,000, 5pc on £250,001 to £925,000, 10pc on £925,001 to £1.5m, and 12pc on anything above that amount.

Those purchasing a second home or buy-to-let property face a three percentage point surcharge on these rates.