Steep drop in UK inflation is good news for savers

The steep drop in inflation to 0.2% will be a welcome respite for savers today with more than 530 inflation-beating deals now available on the market.

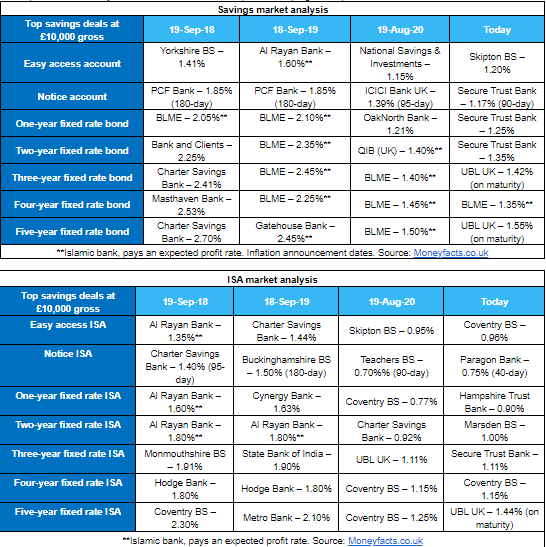

Standard savings accounts that can now match or beat inflation include 87 easy access accounts, 75 notice accounts, 78 variable rate ISAs, 134 fixed rate ISAs and 310 fixed rate bonds, according to analysis by moneyfacts.co.uk.

The figures are based on a £10,000 ($12,947) deposit and excludes regular savers and children’s savers.

This is a considerable increase on the previous year, with September 2019 seeing just 191 inflation-beating deals, based on the 1.7% Consumer Price index.

But savers need to move fast because inflation is predicted to climb to 1.8% by the third quarter of 2021 and no standard savings accounts are currently able to beat this.

“Speed is crucial when it comes to applying for the top savings rates in the market and if consumers wait too long, then they could see the deal cut or be pulled from the market entirely. It is safe to say that savers will be in a race against one another to secure the best returns in the months to come as the savings market remains very fluid,” said Rachel Springall, finance expert at Moneyfacts.co.uk.

During the past month there has been some competition within the savings market, primarily on short-term fixed bonds, which are ideal for savers wanting to lock their money away for over a year or more.

Within the easy access accounts market Skipton Building Society leads the way at 1.20%.

“There remains to be a notable difference between the top fixed rate bonds and fixed ISA rates so savers will need to consider their options while taking into consideration the personal savings allowance. Savers who are now coming off a fixed rate deal will also need to prepare themselves for a fall in interest when choosing a similar product today," added Springall.