Hedge fund makes £1.1bn takeover bid for TalkTalk

Telecoms group TalkTalk (TALK.L) has received a £1.1bn ($1.4bn) takeover approach from a London hedge fund, which hopes to take the business private.

TalkTalk said in a statement on Thursday it had received a preliminary offer from Toscafund Asset Management to buy the business for 97p per share.

The offer values TalkTalk at around £1.1bn and represents a 16% premium on Wednesday’s closing price.

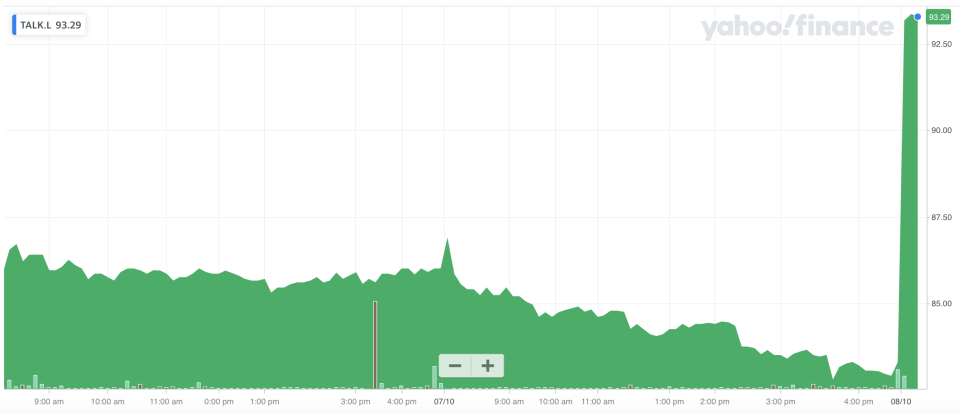

Shares in TalkTalk jumped 13% to 94p at the open in London on Thursday.

A spokesperson for TalkTalk confirmed the board had recently received the approach and had decided to progress talks after considering the offer and input from advisors. Barclays and Deutsche Bank are advising TalkTalk.

The telecoms company warned investors that a firm bid was not certain. Toscafund’s approach is contingent on a number of preconditions, including the support of TalkTalk’s executive chairman Sir Charles Dunstone.

TalkTalk said it would make a further statement when appropriate.

READ MORE: Market pressure eases as US fiscal policy and a Democratic win appear in focus

TalkTalk is one of the UK’s biggest telecoms providers, with 4.2 million customers. It offers phone, TV and broadband services. The business had revenue of £1.5bn last year and made a profit of £131m.

Prior to the takeover offer, shares in the business had fallen around 30% since the start of the year.

Toscafund is a long-time investor in TalkTalk and already owns 30% of the business. It is TalkTalk’s second biggest investor. Sky News reported in July that Toscafund made an undisclosed 135p a share takeover bid last year but the offer was rejected by TalkTalk’s board.

Toscafund is one of the UK’s best-known hedge funds and manages over $4bn of client money. The business was founded in 2000 by former banking analyst Martin Hughes, who has been nicknamed the “Rottweiler” in the financial press for his aggressive pursuit of companies he targets.

A spokesperson for Toscafund declined to comment on the TalkTalk bid.

WATCH: Profits jump at Tesco