Tax season is almost here — get prepared with these expert-approved tips

Looking for more of the best deals, latest celebrity news and hottest trends? Sign up for Yahoo Lifestyle Canada’s daily newsletter, coming soon!

Yahoo Lifestyle Canada is committed to finding you the best products at the best prices. We may receive a share from purchases made via links on this page.

Tax season is nearly upon us, which means now is the time to start getting your important documents organized and ready to go. Whether you’re planning to have a professional look everything over or will be filing on your own, there are more options than ever to make the process go smoothly.

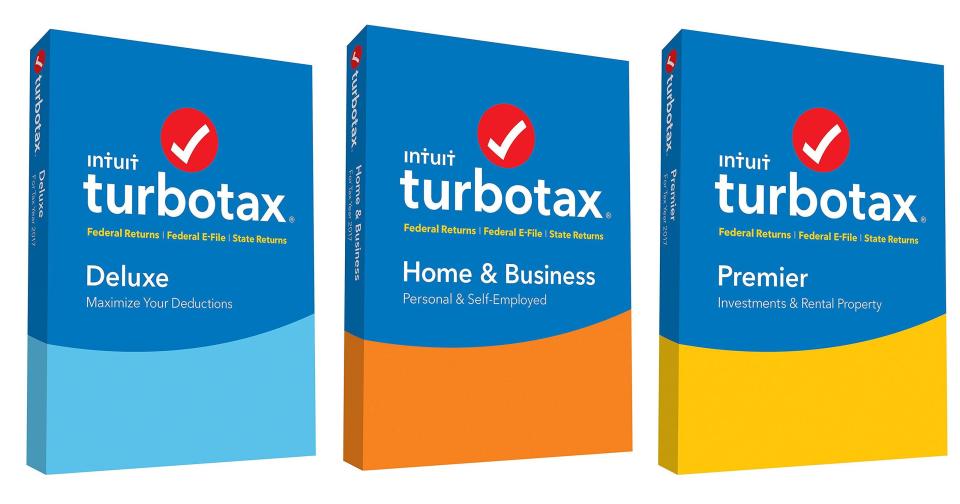

Software like Intuit’s TurboTax system are available to guide everyone from tax veterans to those who will be filing on their own for the very first time. There’s the free basic version for those who feel comfortable enough. This year, there’s also the option to receive expert help as you go, and the ability to pay for full service and have your tax returns completed for you.

ALSO SEE: The best TVs you can buy in Canada at every price point

As Canada’s top income tax software program (they’ve filed more than 45 million tax return filed between 2006 and 2018), the team behind TurboTax knows a thing or two about the whole process. We spoke to Susan Watkin, resident tax expert and educator, to get some of her top tips on what you need to know before getting started.

Understand which deadlines are important to you

In Canada, there are different deadlines to be aware of depending on your circumstances. For the majority of people, you’ll need to submit by Apr. 30, especially if you have an outstanding tax balance to pay. If you’re self-employed, or have a spouse or a common-law partner who is self-employed, the deadline to file your taxes is June 15, 2020.

Be prepared

Make sure you have everything you need to do your taxes. If there are things you know might be missing, you’ll want to work on getting them in order well before the deadline.

“For example, you can get statements from medical practitioners if you don’t think you kept all of your receipts, or even statements from pharmacies,” shares Watkin.

Take note of personal, as well as professional, changes

“Remember that even if tax rules or legislation don’t change much in the tax year, your personal situation might mean changes for your tax return,” Watkin cautions.

Think about what was new in your life within the past year (including home ownership, the birth of a child or the launch of a new business venture) and look in to see if that means your tax obligations have also changed.

Don’t forget about side hustles

“If you have a side-gig or are self-employed, don’t forget that you don’t have an employer that is collecting and remitting your income taxes for you,” warns Watkin. “Plan throughout the year to put a little bit aside so if you owe on April 30th because of this extra income, you won’t have a huge amount to save for.”

Ready to get started? Choose from one of TurboTax’s simple software programs now.

SHOP IT: TurboTax, from $20

Let us know what you think by commenting below and tweeting @YahooStyleCA! Follow us on Twitter and Instagram and sign up for our newsletter, coming soon.