Tears, 'Lam-bros' and volatility: A look back at Canada's year of cannabis

Four backup credit cards were hidden underneath the counter of the St. John’s, N.L. pot shop at the stroke of midnight on legalization day, according to Bruce Linton, the ceremonial salesperson who rang up Canada’s first gram of recreational cannabis on Oct. 17.

With reporters in town from as far away as China and Denmark to capture the inaugural nationally-legal, non-medical pot purchase in a G7 country, the founder and co-chief executive officer of Canopy Growth Corp. (WEED.TO) wanted to avoid an awkward mishap derailing a moment he had worked towards for years.

Newfoundland and parts of Labrador see midnight earlier than anywhere else in the country, making Linton’s Tweed-branded retail store on Water Street an obvious choice of venue. With the press assembled and cameras rolling, the carefully orchestrated sale went off without a hitch. It was what happened next that caught Linton off guard.

An illicit drug that’s sent thousands of Canadians to prison, and caused countless family rifts and lost jobs, had become akin to a can of beer — legal for adults of age to buy, possess and consume. The weight of the moment was not lost on many in attendance who lined up for hours in the cold for a chance to witness the first sale, and buy legal recreational cannabis in a legitimate store for the first time.

“A lot of people cried,” Linton told Yahoo Finance Canada. “For them, some stigma or arrest, or parental or sibling disapproval related to cannabis was gone. It was more emotional than I would have thought.”

With a market capitalization over $14 billion, Canopy has emerged as the dominant player in Canada’s cannabis boom. The company has operations in 12 countries across five continents, and has over 4.3 million square feet of production capacity. Google the word “weed.” Canopy is the top result.

Linton himself is widely-seen as the industry’s de facto spokesperson. He’s not a flashy guy, a point underscored by his choice of vehicle, a Ford Flex he bought used from a rental service. An exotic car would be a serious faux pas at Canopy.

“I’ve seen many people with very fancy cars, none of them work here,” he said of his Smiths Falls, Ont.-based company.

He openly disparages Lamborghini owners, or “Lam-bros,” as he calls them.

Perhaps people who pal around with Snoop Dogg don’t require a shouty 500-plus horsepower supercar to let others know they’ve arrived.

For Linton, there is no understating the importance of recreational cannabis legalization and what’s in store for the burgeoning sector. The invention of the telephone, the advent of airbags in cars, and the end of alcohol prohibition in the United States are among his recent points of reference.

‘A dog’s year’

Linton’s seemingly boundless enthusiasm was mirrored by scores of investors throughout 2018, many of whom had never owned a stock before buying cannabis shares. Pouring their savings into Canopy and its peers, they rejoiced with the jaw-dropping rallies and cringed through the eye-watering declines.

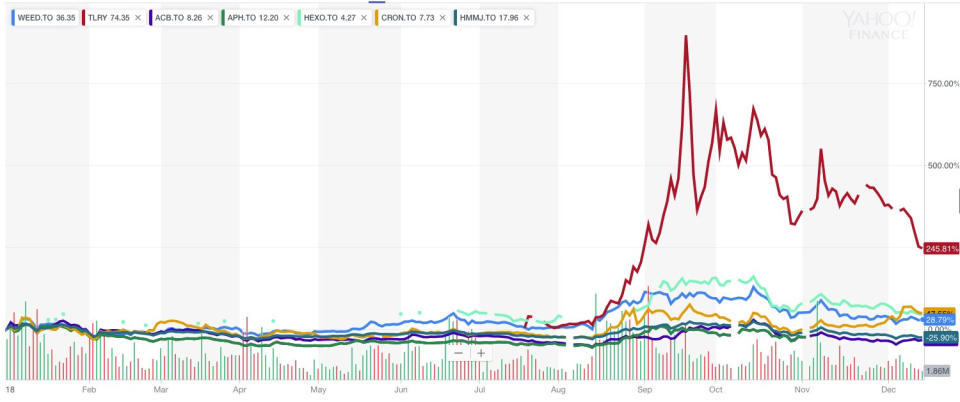

The Horizons Marijuana Life Sciences ETF (HMMJ.TO), which counts Canopy as its top holding, followed by Aphria Inc. (APH.TO), Aurora Cannabis Inc. (ACB.TO), and Tilray Inc. (TLRY), surged more than 78 per cent before plunging 42 per cent in the span of a few months this year.

NASDAQ-listed shares of the Nanaimo, B.C.-based Tilray briefly touched US$300 in late September, spiking more than 1,600 per cent above its US$17 initial public offering price in July. The stock closed at US$75.52 on Thursday.

“It’s been crazy. It’s gone from hope to despair multiple times for stockholders,” Craig Wiggins, one-third of an independent analysis team called TheCannalysts, told Yahoo Finance Canada. “We always joke in the cannabis sector that one year is sort of like a dog’s year. It’s seven years of everyone else’s lifetime.”

With cannabis illegal at the federal level in the U.S., the Canadian Securities Exchange (CSE), the country’s most junior bourse, became a magnet for cannabis producers with U.S. operations. Fifty-two companies piled onto the CSE Marijuana List in 2018, as of Dec. 12, to raise capital. Many did so by snapping up Canadian shell companies that were already publicly traded.

Meanwhile, the larger players went on a buying spree in what Pricewaterhousecoopers described in August as a “deal mania.” The first half of 2018 saw cannabis M&A activity in North America nearly double from a year earlier to 145 deals, according to Viridian Capital Advisors.

Speculation about transformative investments from mature companies beyond the cannabis sphere gripped investors eager to see their bets on the risky sector pay off. That long-awaited affirmation of pot’s investment appeal to major corporate buyers came on Aug. 15., when the New York-based company behind well-known beverages such as Corona beer boosted its position in Canopy with a staggering $5 billion investment.

Toronto-listed Canopy shares soared 128 per cent over the next month, before a sharp downturn days before Canadian recreational legalization.

Constellation Brands Inc.’s (STZ) decision to wade deeper into the cannabis sector also lifted shares of Canopy’s chief rivals, and the sector at large, by ascribing mainstream credibility to pot.

Greg Taylor, manager of the Purpose Marijuana Opportunities Fund, called the deal a “defining moment” for cannabis.

“That’s when it felt like this market really got legitimized. Once that happened, it seemed like we really got a pickup in interest from the U.S. and Europe,” he told Yahoo Finance Canada. “People thought, ‘This isn’t just a little niche fad. This is something global that is going to potentially create a massive industry.’”

Perhaps unsurprisingly, Linton saw it that way as well.

“It validated that if you actually keep your head down, work and think, third parties with quite a lot of capital, who do their research, will step in,” he said. “What surprised me is that decision validated a sector where at least 70 to 80 per cent of the actors are pretty busy trying to be cool and talk about ‘dank kush,’ and not actually do work.”

Most analysts will say they expect a handful of large, well-managed players to seize control as the industry matures in step with the legal recreational and medical markets. Linton sees cigarette maker Altria Group Inc.’s (MO) recent $2.4 billion investment in Toronto-based cannabis producer Cronos Group Inc. (CRON.TO) as a sign of what’s to come.

Molson Coors Brewing Co. (TAP) announced its Canadian unit will form a joint partnership with HEXO Corp. (HEXO.TO) in early August to explore cannabis-infused beverages.

Rumours also swirled in 2018 about a potential deal between Coca-Cola (KO) and Aurora. Guinness beer and Crown Royal Canadian whisky-maker Diageo Plc. (DEO) was said to be talking to a trio of Canadian Cannabis firms at one point.

Still, the anticipated avalanche of blockbuster investments in cannabis in the wake of the Canopy-Constellation deal has yet to truly materialize. The beer and wine-maker’s shares have dipped about 17 per cent since mid-August, and a number of analysts cut their ratings on the stock after the deal with Canopy was announced.

“Had their stock doubled, or went up 30 per cent, you would have seen 11 (new) actors in the space,” said Linton. “But most people who are running these companies have to think about shareholders and getting fired.”

Taylor sees lingering hesitation as foreign investors continue to size up the market, and how best to access it. Curiosity about how things will play out with legalization in the U.S. is another factor, he said.

“If you’re an American company, there is this gray area of how big an investment you can make in the space before you start risking some of your U.S. listing status,” he said. “The other thing that’s in the back of everyone’s mind is how fast the U.S. market is opening up. Some people are saying, ‘Instead of making a billion dollar acquisition in Canada, why don’t we wait and we can do it organically in the U.S. in another six months to a year.”

For many, 2018 will go down as the year cannabis started to come into its own politically in North America. California, the most populous U.S. state, became the sixth to allow recreational sales as of Jan. 1. The passage of the U.S. Farm Bill on Dec. 12 will allow American farmers to plant and harvest hemp as an agricultural product, not a controlled substance like marijuana. The change could spur scientific research aimed at unlocking the health and wellness potential of non-psychoactive hemp-derived CBD.

‘How the hell do we do this?’

In Canada, the legalization hype is still being met with chronic product shortages and frustrated consumers. Flustered politicians are pointing fingers at the licensed producers, and vice versa. Both continue to grapple with a patchwork of new provincial policies governing markets where demand remains far from clear.

“It was a bit of a mess,” said Taylor. “As much as I think everyone expected some stumbles out of the launch of recreation in Canada, there is still a bit of surprise about how bad it’s been to get the shelves stocked.”

For better or worse, Linton wagers more Canadians will remember that recreational cannabis was legalized on Oct. 17 than could tell you what day the Thanksgiving holiday was this year. Given the sheer number of unknowns, he said the roll-out went better than he expected.

“There was no reference to, ‘How the hell do we do this?’” he said. “How much do people want? What format do they want it in? Will they go to a government website and give their ID and a credit card? Or will they want to go to a store? The answer was, they want a lot. They want it in any format you can get to them. And yes, they will buy it whatever way.”

‘The inversion of the Canadian mullet’

Strict government-imposed advertising rules prevent licensed producers from making claims about good vibes and fun in general, but Linton can’t deny there is a stoner’s sense of humour that comes with selling pot, even on an industrial scale.

Canopy’s recreational Tweed brand, he explains, should feel like “the inversion of the Canadian mullet.” (A party in the front and business, in this case a high quality product, in the back.)

Looking into 2019, Linton sees scientific research from the medical side filtering down to recreational applications as Ottawa get’s set to release regulations for things like edibles and beverages. It’s a lot like the way automakers test new technology on the race track before building it into showroom vehicles, he explains.

“The great products that are going to happen in recreational are going to be entirely informed by the science done for medical,” he said. “We have a very large base of scientists working for us.”

Linton also expects big changes in the way cannabis is perceived, especially as medical applications, CBD and non-smoking formats rise in popularity. The debate around where cannabis should be smoked, he said, will be irrelevant in a matter of months.

Canopy claims to get tens of thousands of calls per month from people curious about medical access and first-time recreational smokers. For the latter Linton’s mantra is “Remember, you’re not Snoop. So start in the shallow end. Dose low. Go slow.”

Medical cannabis is, of course, a far more serious business. Linton recalls a recent chat with a former addict who got hooked on heavy prescription opioids after a car accident. Seeing the real-world application of Canopy’s scientific research could explain Linton’s relentlessly optimistic disposition.

“They used our product to migrate off of it. They described going from a zombie-state with only one purpose, to being a really good and interactive person again. That’s a pretty big deal. That happens day in, day out,” Linton said. “You’d think by the time you get over 50, baseless optimism would wear off. But it doesn’t.”

Download the Yahoo Finance app, available for Apple and Android.