Third of Pearson's shareholders vote against CEO's £7.2m pay package

Pearson has suffered a significant shareholder revolt against controversial changes to its remuneration policy, which will grant its new chief executive a multimillion-dollar pay package.

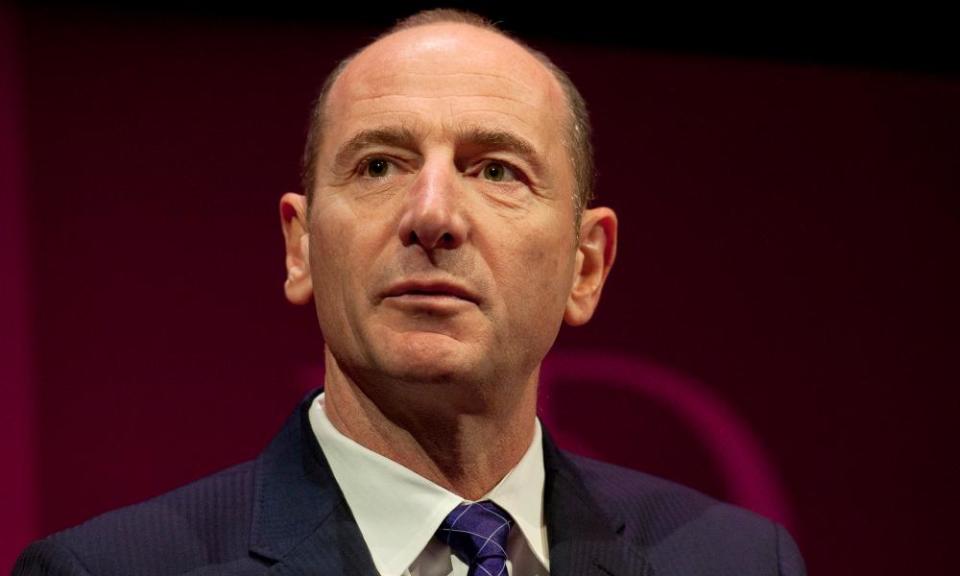

Almost a third of investors in the FTSE 100 educational publishing group voted against the plans, which will award a $9.3m (£7.2m) one-off payment to the incoming boss, Andy Bird.

The British executive, who is the former chairman of Walt Disney’s international operations, is based in Los Angeles and will remain there when he takes up the top job at Pearson on 19 October.

Pearson thanked the majority of its shareholders for supporting the proposal, but noted that a “significant minority” of investors had rejected its plans.

Under the new directors’ remuneration policy, Andy Bird will receive a salary of at least $1.25m fixed until 2023, with the opportunity to double it if he meets certain performance targets.

Bird will also be allowed to make a one-off purchase of $3.75m of Pearson shares, equal to 300% of his salary, by 31 December 2020. He is in line to receive more shares worth $9.3m, which will be paid out in three instalments over three years.

Pearson said what it called its “co-investment plan” had an “unusual nature … in the UK market”. The company will contribute to Bird’s costs of renting an apartment in New York, which it noted is “to be used for business purposes”.

At the time of his appointment in August, Pearson’s chairman, Sidney Taurel, said the company was “delighted” to have secured someone of Bird’s calibre.

He had received multimillion-dollar annual remuneration packages while at Disney, and Pearson had to increase its offer to secure Bird, whom he described as an “outstanding candidate to lead Pearson in its next chapter”.

“We believe strongly that Andy is the right person to lead Pearson into an era of growth, building on the foundations already laid, to benefit all stakeholders,” said Taurel.

However, some of Pearson’s leading investors had expressed concerns ahead of the vote about the size of the pay award.

Bird, who has no experience in the education sector, has been a non-executive director on Pearson’s board since May. He replaces John Fallon, who is retiring and has run the company since 2013.

Bird faces the challenge of reinventing Pearson for the digital age, as the group has struggled to switch its dependency on selling printed books to students into a Netflix-style digital rental model.