Is It Time To Consider Buying Photo-Me International plc (LON:PHTM)?

Photo-Me International plc (LON:PHTM), which is in the leisure business, and is based in United Kingdom, saw significant share price movement during recent months on the LSE, rising to highs of UK£0.99 and falling to the lows of UK£0.85. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether Photo-Me International's current trading price of UK£0.89 reflective of the actual value of the small-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at Photo-Me International’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

View our latest analysis for Photo-Me International

What's the opportunity in Photo-Me International?

Great news for investors – Photo-Me International is still trading at a fairly cheap price. My valuation model shows that the intrinsic value for the stock is £1.46, which is above what the market is valuing the company at the moment. This indicates a potential opportunity to buy low. What’s more interesting is that, Photo-Me International’s share price is theoretically quite stable, which could mean two things: firstly, it may take the share price a while to move to its intrinsic value, and secondly, there may be less chances to buy low in the future once it reaches that value. This is because the stock is less volatile than the wider market given its low beta.

What kind of growth will Photo-Me International generate?

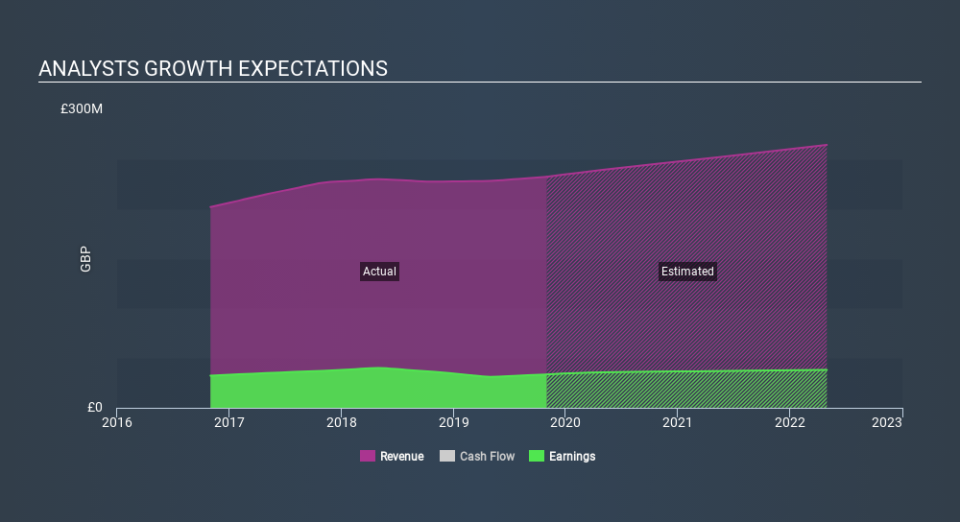

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. With profit expected to grow by a double-digit 12% over the next couple of years, the outlook is positive for Photo-Me International. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

What this means for you:

Are you a shareholder? Since PHTM is currently undervalued, it may be a great time to increase your holdings in the stock. With an optimistic outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as financial health to consider, which could explain the current undervaluation.

Are you a potential investor? If you’ve been keeping an eye on PHTM for a while, now might be the time to make a leap. Its prosperous future outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy PHTM. But before you make any investment decisions, consider other factors such as the strength of its balance sheet, in order to make a well-informed buy.

Price is just the tip of the iceberg. Dig deeper into what truly matters – the fundamentals – before you make a decision on Photo-Me International. You can find everything you need to know about Photo-Me International in the latest infographic research report. If you are no longer interested in Photo-Me International, you can use our free platform to see my list of over 50 other stocks with a high growth potential.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.