Transocean (RIG) Q4 Loss Wider Than Expected, Sales Lag

Transocean Ltd. RIG posted fourth-quarter 2019 adjusted loss of 43 cents a share, wider than the Zacks Consensus Estimate of a loss of 31 cents and also the year-ago loss of 34 cents due to higher year-over-year costs and expenses.

Meanwhile, this offshore drilling powerhouse generated total revenues of $792 million, missing the Zacks Consensus Estimate of $818 million. But the top line improved 5.8% from the prior-year figure of $748 million. Strong revenues from the Ultra-deepwater and Harsh Environment floaters along with increased dayrates led to this outperformance.

Segmental Revenue Break-Up

Transocean’s Ultra-deepwater floaters contributed to 63.4% of total contract drilling revenues while Harsh Environment floaters and Midwater floaters accounted for the remainder. In the quarter under review, revenues from Ultra-deepwater and Harsh Environment floaters totalled $502 million and $278 million each, indicating a 9.8% and 9.9% improvement from the year-ago reported figures of $457 million and $253 million, respectively.

Revenue efficiency was 96.2%, marginally lower than the third-quarter level. The figure was in line with the year-ago number.

Dayrates and Utilization

On an encouraging note, average dayrate in the quarter under review rose to $317,700 from the year-ago level of $293,100 owing to an uptick in activity in the Asia Pacific and Australia. The company witnessed year-over-year higher average revenues per day from midwater floaters. Overall, fleet utilization was 61% during the quarter, down from the prior-year utilization rate of 62%.

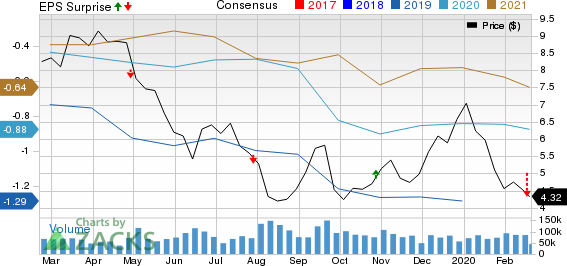

Transocean Ltd. Price, Consensus and EPS Surprise

Transocean Ltd. price-consensus-eps-surprise-chart | Transocean Ltd. Quote

Backlog

Transocean’s backlog recorded at $10.2 billion as of February reflects a decline of $2 billion from the year-ago figure. Since its last fleet status update in October 2019, the company has been successful in securing $366 million worth additional contracts, courtesy of new deals and extensions of its existing projects.

Costs, Capex & Balance Sheet

Transocean’s costs and expenses rose 10.72% year over year to $836 million. Operating and maintenance costs also increased to $575 million from $497 million a year ago. The company spent $128 million on capital expenditure in the fourth quarter. Cash provided by operating activities totalled $147 million. The company had cash and cash equivalents of $1.8 billion on Dec 31, 2019. Long-term debt was $8.7 billion with debt-to-capitalization ratio of 42.28% as of the same date.

Guidance

For 2020, the company expects its adjusted contract drilling revenues to be $3.3 billion, indicating no change from the 2019 figure. Meanwhile, capital expenses for 2020 are anticipated to be $857 million.

Full-year operating and maintenance costs are predicted to be $2.1 billion. Further, the company projects its G&A expense to be approximately of $183 million.

Zacks Rank & Key Picks

Transocean has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space are Contango Oil & Gas Company MCF, Devon Energy Corporation DVN and California Resources Corporation CRC, each carrying a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Transocean Ltd. (RIG) : Free Stock Analysis Report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Contango Oil & Gas Company (MCF) : Free Stock Analysis Report

California Resources Corporation (CRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research