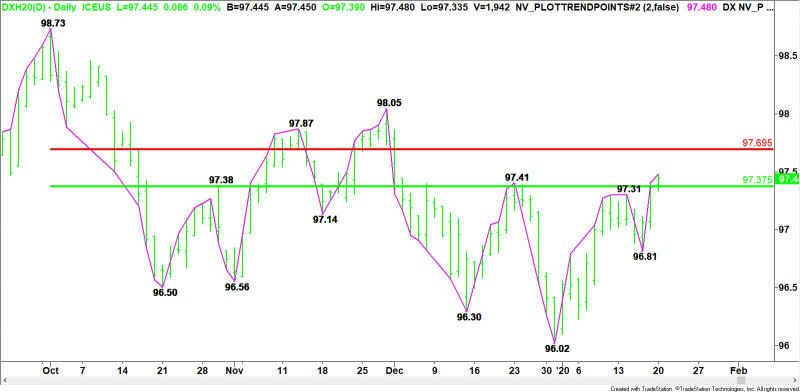

U.S. Dollar Index Futures (DX) Technical Analysis – Holding 97.375 Could Lead to Test of 97.695

The U.S. Dollar is trading higher against a basket of currencies on Monday even with the U.S. on a bank holiday. The price strength reflects last week’s better-than-expected U.S. economic data. On Friday, the U.S. reported that homebuilding surged to a 13-year high in December. Earlier in the week, reports showed retail sales rose as well as the Philadelphia Fed manufacturing index.

At 09:52 GMT, March U.S. Dollar Index futures are trading 97.455, up 0.096 or +0.10%.

On Monday, the index is being boosted by the Euro which hit a one-week low. The Japanese Yen is also hovering around an eight-month low. In other news, Fed Fund futures show that investors don’t expect the U.S. Federal Reserve to cut rates when it meets next week.

Daily Swing Chart Technical Analysis

The main trend is up according to the daily swing chart. The uptrend was reaffirmed earlier today when buyers took out the last swing top at 97.410. The main trend will change to down on a trade through the last swing bottom at 96.810.

The main range is 98.730 to 96.020. Its retracement zone is 97.375 to 97.695. The index is currently trading inside this zone. It is controlling the near-term direction of the Dollar Index.

Daily Swing Chart Technical Forecast

Based on the early price action and the current price at 97.455, the direction of the March U.S. Dollar Index the rest of the session on Monday is likely to be determined by trader reaction to the main 50% level at 97.375.

Bullish Scenario

A sustained move over 97.375 will indicate the presence of buyers. If this move continues to generate enough upside momentum then look for the rally to possibly extend into the main Fibonacci level at 97.695.

Bearish Scenario

A sustained move under 97.375 will signal the presence of sellers. This could trigger a near-term break into 97.310, followed by a minor 50% level at 97.145.

This article was originally posted on FX Empire