Volatility 101: Should Outotec Oyj (HEL:OTE1V) Shares Have Dropped 46%?

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Outotec Oyj (HEL:OTE1V) shareholders for doubting their decision to hold, with the stock down 46% over a half decade. We also note that the stock has performed poorly over the last year, with the share price down 27%. The falls have accelerated recently, with the share price down 44% in the last three months. But this could be related to the weak market, which is down 22% in the same period.

Check out our latest analysis for Outotec Oyj

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Outotec Oyj moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

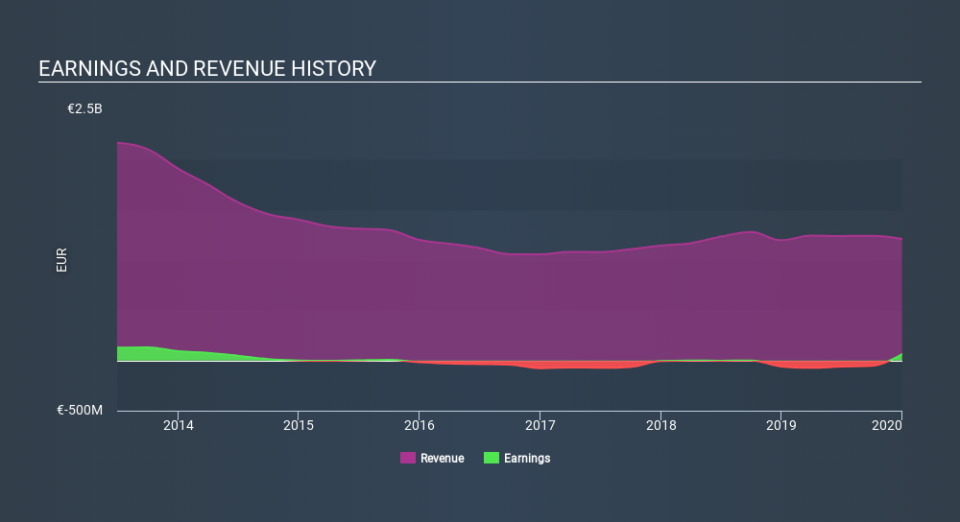

The revenue fall of 1.0% per year for five years is neither good nor terrible. But if the market expected durable top line growth, then that could explain the share price weakness.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Outotec Oyj has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 18% in the twelve months, Outotec Oyj shareholders did even worse, losing 25% (even including dividends) . However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Outotec Oyj better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Outotec Oyj you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.