The Walt Disney (NYSE:DIS) Share Price Has Gained 14% And Shareholders Are Hoping For More

Investors can buy low cost index fund if they want to receive the average market return. But in any diversified portfolio of stocks, you'll see some that fall short of the average. That's what has happened with the The Walt Disney Company (NYSE:DIS) share price. It's up 14% over three years, but that is below the market return. Unfortunately, the share price has fallen 13% over twelve months.

Check out our latest analysis for Walt Disney

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years of share price growth, Walt Disney actually saw its earnings per share (EPS) drop 23% per year.

Earnings per share have melted like a stack of ice cubes, in stark contrast to the share price. So we'll need to take a look at some different metrics to try to understand why the share price remains solid.

It could be that the revenue growth of 12% per year is viewed as evidence that Walt Disney is growing. In that case, the company may be sacrificing current earnings per share to drive growth, and maybe shareholder's faith in better days ahead will be rewarded.

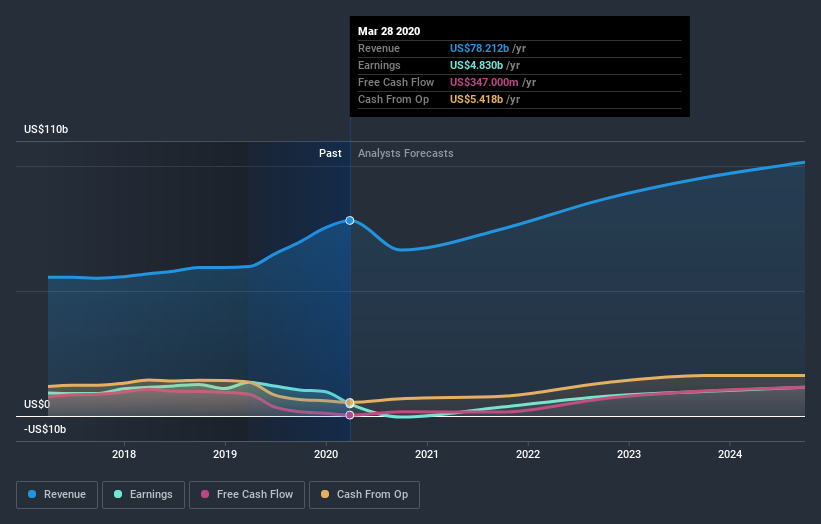

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Walt Disney is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Walt Disney in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We've already covered Walt Disney's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Walt Disney's TSR of 18% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

While the broader market gained around 19% in the last year, Walt Disney shareholders lost 13%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 3.2%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Walt Disney better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Walt Disney (including 1 which is shouldn't be ignored) .

But note: Walt Disney may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.