WEX's Q2 Earnings & Revenue Miss Estimates, Decline Y/Y

WEX Inc. WEX reported lower-than-expected second-quarter 2020 results.

Adjusted earnings of $1.21 per share (excluding 45 cents from non-recurring items) missed the Zacks Consensus Estimate by 16% and decreased 46.9% year over year. Total revenues of $347.1 million fell short of the consensus mark by 1.7% and decreased 21.4% year over year.

In response to the WEX’s implementation of several cost cut initiatives due to the COVID-19 crisis, the company expects its total saving to be approximately $60-$65 million for the year.

Notably, WEX’s shares have declined 14.7% in the past year compared with 6.4% growth of the industry it belongs to.

Revenues by Segment

Fleet Solutions revenues (59% of total revenues) decreased 24% year over year to $204.4 million. The downside was due to weak finance fee revenues and payment processing revenues related to two major North America portfolios.

Average number of vehicles serviced was 15.1 million, up 8% from the year-ago quarter’s figure. Total fuel transactions processed fell 17% from the year-ago quarter’s tally to 127.9 million. Payment processing transactions fell 19% to 103.1 million. U.S. retail fuel price declined 28.9% from the year ago quarter to $2.07 per gallon.

Travel and Corporate Solutions revenues (15.7%) of $54.5 million were down 40% year over year. The downtick can be attributed to weakness in the finance fee revenues and payment processing revenues .The coronavirus pandemic’s adverse impact on travel volumes strained the segment’s revenues. Purchase volume decreased 68% to $3.2 billion.

Health and Employee Benefit Solutions revenues (25.4%) of $88.2 million jumped 6%, year over year, on 15% growth in the average number of Software-as-a-Service (SaaS) accounts in the United States to 14.5 million.

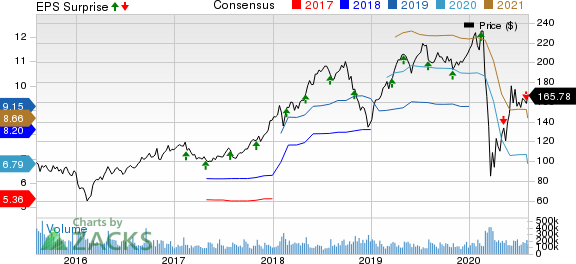

WEX Inc. Price, Consensus and EPS Surprise

WEX Inc. price-consensus-eps-surprise-chart | WEX Inc. Quote

Operating Results

Adjusted operating income decreased 40.2% from the prior-year quarter’s figure to $99.4 million. Adjusted operating income margin declined to 28.7% from the year-ago quarter’s 37.7%.

Balance Sheet

WEX exited the second quarter with cash and cash equivalents of $1.3 billion compared with the $861.2 million witnessed at the end of the prior quarter. Long-term debt was $2.7 billion, nearly flat with the previous quarter’s reported figure.

Currently, WEX carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1(Strong Buy) Rank stocks here.

Performance of Other Business Services Companies

Equifax EFX reported better-than-expected second-quarter 2020 adjusted earnings of $1.60 per share, which beat the Zacks Consensus Estimate by 22.1% and improved 14.3% on a year-over-year basis.

IQVIA Holdings IQV reported second-quarter 2020 adjusted earnings per share of $1.18, which beat the consensus mark by 12.4% but fell 22.9% on a year-over-year basis.

Robert Half RHI reported second-quarter 2020 earnings of 41 cents per share, which beat the consensus mark by 17% but plunged 58% year over year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Robert Half International Inc. (RHI) : Free Stock Analysis Report

WEX Inc. (WEX) : Free Stock Analysis Report

IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report

To read this article on Zacks.com click here.