Here is Why the Bank Charter Will Transform SoFi Technologies (NASDAQ:SOFI)

This article first appeared on Simply Wall St News .

SoFi Technologies, Inc. ( NASDAQ: SOFI ) had its "buy the rumor "moment yesterday after the stock rallied almost 13%. The main driver behind the move is likely the expectation that the company will get the regulatory green light for its bank charter.

We can expect more volatility as the earnings report date is closing in, set for November 10.

See our latest analysis for SoFi Technologies .

After a long ranging period in the summer, SoFi stock broke out, rallying over 50% from support. The market is pricing in the favorable outcome of the company's effort to acquire Golden Pacific Bankcorp.

However, this is not the first time SoFi tried to become a bank. Originally it applied for a bank charter in June 2017 but withdrew the application after senior executive changes. After applying for a national bank charter in July 2020, the company received conditional approval 3 months later.

Yet, the acquisition of the Golden Pacific Bankcorp would speed up the plans and bring multiple benefits.

Increase lending capabilities: Banks operate by using deposits to offer loans. As lending is the primary source of revenue, the company will be able to expand its lending capabilities.

No relying on third-party banks: By being a bank, SoFi won't have to rely on third-party banks to provide the capital, driving operations costs down.

Improved marketing and pricing control: While obtaining a national bank charter gives credibility to the company, newfound pricing control will allow them to go after a larger market share. While already competitive in their prices, the lower cost will let a very flexible approach – from higher EBITDA that will fuel the further growth to more competitive pricing that will capture a more significant market share.

In the investor presentation, the company reflected on the positive EBITDA impact of a bank charter.

How Long Before SoFi Reaches Profitability?

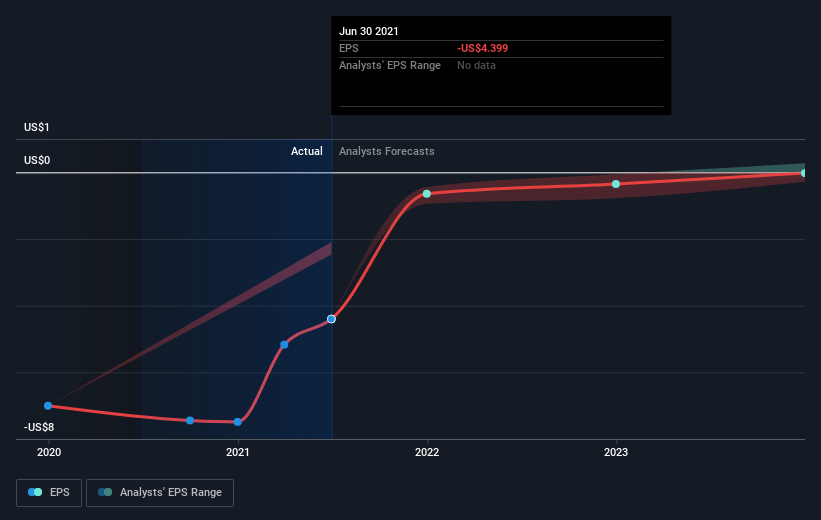

According to the 8 industry analysts covering SoFi Technologies, the consensus is that breakeven is near.They anticipate the company to incur a final loss in 2022 before generating positive profits of US$28m in 2023.Therefore, the company is expected to break even roughly2 years from now.

What rate will the company have to grow year-on-year to break even on this date? Using a line of best fit, we calculated an average annual growth rate of 69%,which signals high confidence from analysts.If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Underlying developments driving SoFi Technologies' growth isn't the focus of this broad overview,however,keep in mind that generally,a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

However, there's one issue worth mentioning. SoFi Technologies currently has a relatively high level of debt.Typically, debt shouldn't exceed 40% of your equity, which in SoFi Technologies' case is 54%.Note that a higher debt obligation increases the risk around investing in the loss-making company.

Next Steps:

Between the stock rally and the company silently hiring an experienced bank executive, there are signs that the bank charter approval is close. As profitable as it looks, such a development might push the SoFi breakeven line even closer.

However, there are too many aspects of SoFi Technologies to cover in one brief article. Still, the key fundamentals for the company can all be found in one place – SoFi Technologies' company page on Simply Wall St . We've also put together a list of key factors you should further research:

Historical Track Record: What has SoFi Technologies' performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

Management Team : An experienced management team at the helm increases our confidence in the business – take a look at who sits on SoFi Technologies' board and the CEO's background .

Other High-Performing Stocks : Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here .

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com