Woman with dementia locked into 10-year home-heating contract — with a $15K lien on her property

When Matt Fuchs needed money to hire a home-care worker for his 82-year-old mother, who has dementia, he figured getting a line of credit based on the equity in her house would be easy.

After all, the home was mostly paid off.

Instead, the application was denied over a $12,500 lien on the property for home heating and cooling equipment. Fuchs says he and his mother knew nothing about it. The lien was later increased to more than $15,000.

Fuchs says the lien was put there after a company called Nationwide Home Comfort showed up at Mercedes Chacin de Fuchs's door in 2017 and convinced her to sign a 10-year rental contract for a furnace and air conditioner.

"They came in and convinced somebody that has cognitive issues that they needed something they didn't need," Fuchs told Go Public.

He says his mom, who also has Parkinson's disease, told him the salesperson said the company was part of a provincial environmental program that saves homeowners money.

"She was duped. No doubt," Fuchs told Go Public. "Later, when I found out that this was a widespread problem across Canada, I got even more disgusted."

Tens of thousands of Canadians are locked into similar "unconscionable" deals, says paralegal John Robinson, who fights such contracts in court, including that of Fuchs and his mom.

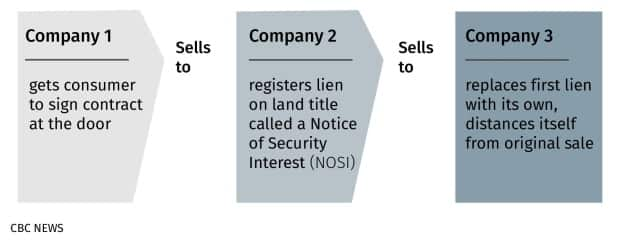

How it works, according to Robinson, is an HVAC company sells the contracts, mostly to seniors, people with disabilities or those with English as a second language. Then a different company buys that contract and starts collecting the monthly payments — providing "financing."

That way, Robinson says, the financing company can say it had nothing to do with how the contracts were signed.

Those companies then slap liens on the property for the equipment, usually right away, that often aren't discovered by the homeowners until they go to sell or refinance, he says.

In tiny print and written in legalese, Chacin de Fuchs's contract says the company has "the right to register a security interest" on the property and that the owner waives the right to get a copy of the registration.

Robinson says land title departments in some cities allow companies to register security interests, or liens, without informing homeowners.

The HVAC companies "don't [inform owners] because if they did, no one would agree to these agreements. No one would sign them," Robinson said.

It's a convoluted web of companies, he says, that often make a lot of money off the backs of the most vulnerable.

Less than a month after Chacin de Fuchs signed, her contract was taken over by a financing company called Home Trust, which slapped a $12,500 lien on the property.

A year later, in November 2018, the contract was sold to Crown Crest Capital, which replaced the first lien with its own security interest for more than $15,000.

Few answers

Getting answers from some of the companies is tough. Go Public found a lot of their websites are shut down, the phone numbers are out of service, and the emails bounce back.

Home Trust didn't reply to Go Public's repeated requests for comment. Nationwide Home Comfort is no longer operating, according to its former director Roman Berson, who now heads up two other HVAC companies.

WATCH | Woman with dementia locked into 10-year home-heating contract:

He says any claim of misrepresentation by the salesperson is "completely false" — Berson says Chacin de Fuchs invited the representative into her home by booking an appointment and that their vehicle was clearly marked with the Nationwide logo.

He says all Nationwide's contracts now belong to Crown Crest Capital and another company.

Crown Crest Capital, owned by Simply Group — a major player in the HVAC industry — said in an email to Go Public it has "worked so hard to counter bad practices" in the industry and has supported consumer protection reforms.

"Sometimes, customers facing financial challenges try to renege on their commitments after years of complaint-free leasing by claiming to have been misled at the time they signed up," wrote vice president of customer experience Tasleemah Ladak.

The Fuchs family is suing the companies involved.

In its statement of defence, Crown Crest Capital denies all allegations, saying it is only the financial institution that took on the contract after it was signed.

In her email, Ladak also says less than 0.01 per cent of its accounts end up in litigation. The company would not say how many customers it has.

Ladak also said Crown Crest Capital does not have any liens on properties but instead registers "interest in the leased equipment" so future homeowners know the equipment won't automatically become theirs.

Robinson calls that last point "semantics" saying, "it makes no difference what you call it, everyone knows what a lien is … it's the same thing."

Crown Crest Capital also says it regrets the Fuchs sued before reaching out to the company directly.

Another family, Joddy Prevost and his wife Cherie Prevost of Tillsonburg, Ont., found liens of almost $17,000 on his dad's property after Norm Prevost passed away in November 2019. He'd signed the contract two years earlier, when he was 73.

"It was Ontario Energy Savings that was on all the papers, but when we called … they said, 'No, we just installed, you need to call whoever you purchased it from,'" Cherie said.

They were finally told the contract was owned by Utilebill, another major player in the industry.

Utilebill wanted $21,000 to buy the contract out, so Joddy hired a lawyer to negotiate with the company, ultimately paying $15,600.

The couple says they felt they had no choice but to pay. Neither Ontario Energy Savings nor Utilebill responded to Go Public's questions.

Fix is failing

Robinson, the paralegal, says such liens hold consumers hostage because people who sell or refinance their homes have no choice but to pay out the contract if they want to remove the lien.

Consumer protection agencies across the country have received over 2,000 complaints about HVAC contracts in the last five years.

Ontario has laid the most charges, 1,235, against HVAC companies under its Consumer Protection Act, but its convictions are low, just five since 2017.

The province has a "consumer beware list" where the public can search for details on all charges laid against businesses and owners.

Cases involving these contracts have been flooding the courts, with consumers suing the companies over the contracts and vice versa, says Robinson.

He says the business — mostly led by just a few multimillion-dollar companies — is so lucrative it's worth it for the companies to fight in court or pay consumer protection fines.

In 2017 and 2018, Alberta and Ontario banned these kinds of door-to-door sales and required more transparency with the contracts.

Manitoba is set to follow, but Robinson says bans are just a small "Band-Aid" for a big problem.

He says the changes did nothing for the tens of thousands of Canadians still stuck with contracts and says some companies have learned to work around the rules — by soliciting new customers over the phone and under false pretenses, to get to the doorstep and say they were invited by the homeowner.

The rules also fail to address liens.

"Stop that and you'll solve the problem, because then they have no incentive … There's no monetary incentive," Robinson said.

The Fuchses' case is now winding its way slowly, because of the pandemic, through the courts.

Robinson was able to negotiate a temporary removal of the lien with Home Trust — before Crown Crest Capital took over the contract — so the family could secure the line of credit and get the home care his mother needs. The lien was then put back on.

Submit your story ideas

Go Public is an investigative news segment on CBC-TV, radio and the web.

We tell your stories, shed light on wrongdoing and hold the powers that be accountable.

If you have a story in the public interest, or if you're an insider with information, contact GoPublic@cbc.ca with your name, contact information and a brief summary. All emails are confidential until you decide to Go Public.

Read more stories by Go Public.