Year in Review: Canadian companies that had the worst 2017

It’s been a great year for Canadian companies… with notable exceptions. Some businesses and brands couldn’t seem to stay out of the news over the last 12 months. Here are Yahoo Canada Finance’s picks for companies that had the bumpiest rides in 2017.

No. 3: BOMBARDIER

In February, the Federal government announced it was loaning $372 million to the Montreal-based aerospace and transportation giant. Shortly after, Bombardier announced it was cutting 14,500 jobs worldwide, including 2,000 in Canada. Next, the six highest-paid company executives revealed they were taking over $32 million in bonuses, leading to a protest outside company headquarters.

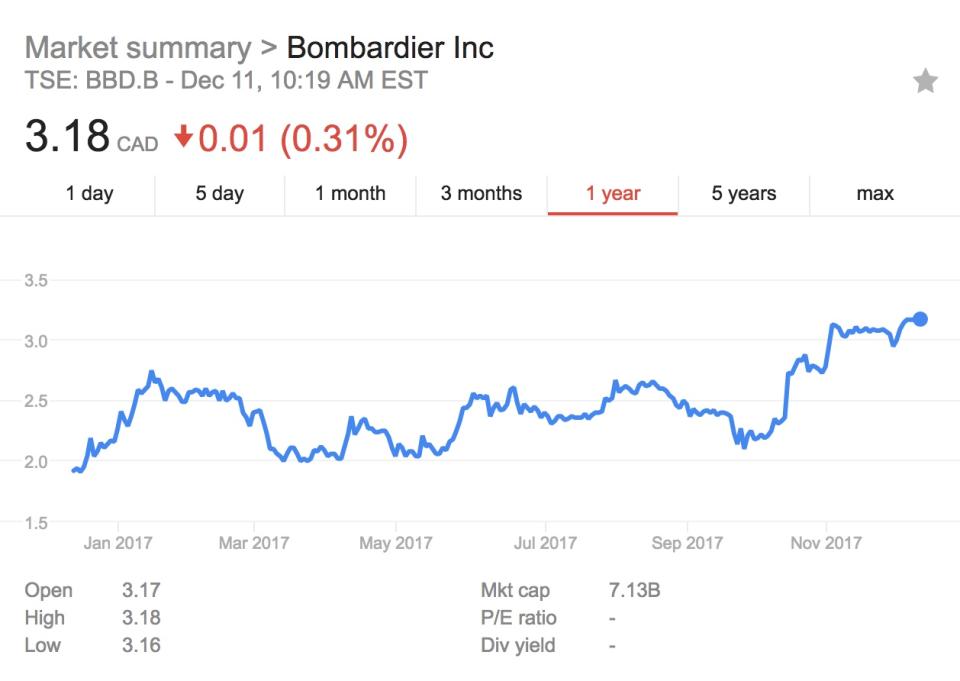

Bombardier had its share of drama outside Canada as well. Brazilian aerospace company Embraer accused it of selling its CS100 jet at unrealistically low prices because the difference would be made up by $3 billion in bailouts from the Canadian government. The World Trade Organization agreed to Brazil’s request to launch an investigation into this shortly after Bombardier’s war with American multinational Boeing, which also accused Bombardier of dumping their new C-Series jet at a reduced price on the U.S. market. It culminated in Washington imposing a 300 per cent anti-dumping tariff on the jet. It’s been quite a roller-coaster for Bombardier, and its stock price reflects this.

Those who live in the City of Toronto have a few additional reasons to protest. After signing a lucrative $1 billion dollar contract with the Toronto Transit Commission in 2009, Bombardier has, to date, delivered fewer than 31 per cent of the vehicles it had undertaken to do, citing “supply chain issues.” While waiting for delivery, the TTC has paid millions to keep the previous fleet running, which experts say should be taken off the road.

No. 2: HOME CAPITAL

This Toronto-based company is one of Canada’s largest alternative mortgage lenders. Through its main subsidiary Home Trust, it primarily provides mortgages and credit cards to people who are self-employed, have no credit history (newcomers to Canada) or whom for another reason have been turned away from traditional banks.

The problem really began when, in 2014, it came out that certain underwriters were falsifying documents and pushing through many new mortgages to people who didn’t really qualify for the loans. According to Financial Post, one underwriter was processing as much as six times the $10 million per month level. An internal investigation known as Project Trillium was launched, which resulted Home Trust severing ties with two brokerages and 45 brokers. These entities and individuals made up 10 per cent of the loans originating in 2014.

In addition, stricter regulations also slowed down the mortgage approval process, causing a further revenue decrease. Instead of being honest with investors about the broker issues, Home Capital attributed the slowdown in originations to factors such as cold weather and macroeconomics.

In April, the Ontario Securities Commission filed formal changes against the company and an investigation was launched over fraudulent mortgages and unfulfilled disclosure obligations. On April 26, 2017, shares plunged almost 65 per cent due to investor panic, the same day Home Capital announced that it needed a $2 billion loan to offset the almost $600 million drop in high-interest savings account deposits. Billionaire investor Warren Buffett came to its rescue in June, taking a nearly 20 per cent stake in the company providing it with a $2-billion line of credit.

No. 1: SEARS CANADA

No Canadian company has had a rougher 2017 than this one.

On June 22, the retailer filed for creditor protection and also said it planned to lay off 17 per cent of its 17,000 employees and close 59 locations. That day, two separate meetings were held for its Toronto head office employees. One group was treated to breakfast at the Fairmont Royal York Hotel. The other group of 300 employees was herded into a room at the Metro Toronto Convention Centre and let go en masse. Not even water was served.

But that was the least of the former employees’ problems; people who’d been with the company as long as 38 years were told they would receive no severance pay and a significantly reduced pension from the one they were entitled to. Mere weeks later, Sears Canada said it was awarding $9.2 million in retention bonuses to 43 executives and senior managers and 116 store general managers, leading to a serious public backlash.

The Sears Canada pension fund is currently underfunded by $270 million, and lawyers for pensioners and retirees are still fighting to get it back. YouTube footage (below) of a desecrated Sears Canada store during the liquidation sale also emerged, during which shoppers complained prices were even higher than during the regular sale period.

Its stock price over 2017 is a flatline worthy of Grey’s Anatomy.