$40B LNG facility is the light at the end of a long tunnel for Canada's natural gas sector

On Tuesday morning, hours after LNG Canada announced it would go ahead with its $40-billion export facility on the West Coast, analyst Martin King gave a presentation about the state of the oil and gas industry at the Calgary Petroleum Club in the city's downtown.

The LNG announcement is massive for the natural gas sector, but King had some cold truth for hundreds of people who came to hear him despite the heavy snow outside. Until the LNG export facility is up and running, he said, there is little reason for optimism.

King even skipped through a few presentation slides showing his forecasted prices for the next few years, joking "I won't depress you too much with those."

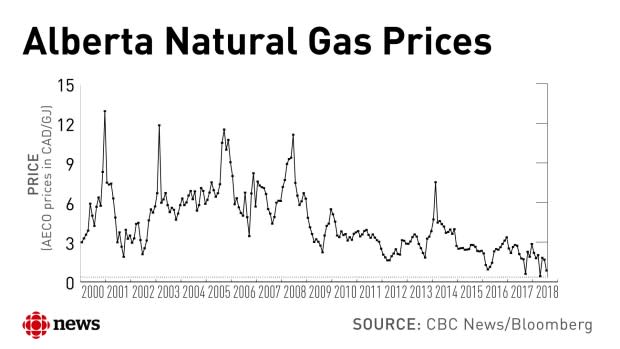

Technological innovation led to a rise in natural gas production in North America and demand hasn't grown nearly as much, which has caused prices to sag for several years.

In Alberta, some gas companies have shut-in their wells because they don't see the point of producing gas when prices are this low.

Rough ride

In 2014, natural gas was selling for more than $4 for 1,000 cubic feet in Alberta, compared to an average of just over $1 in the second quarter of this year. For some perspective, a decade ago, prices were in the double digits.

LONG READ | LNG advocates believe the Kitimat project will open Canada up to a massive export market - here's how

"It looks like there will be lots of supply and low prices," said King, with GMP FirstEnergy, in an interview with CBC News. "The pressure keeps building on Canadian gas."

While population growth, new natural gas-fired power plants, and oilsands expansion could increase demand for natural gas in the coming years, experts say the long-term fix is having a facility to export natural gas to countries around the world. That's where LNG Canada comes in.

The massive megaproject on B.C's coast is the first natural gas export facility in the country. Until now, Canada has exported all of its natural gas to the United States, which is also awash in the fuel.

In 2017, Canada exported more than eight billion cubic feet per day of natural gas, worth more than $9 billion. The LNG Canada facility alone will be able to export about two billion cubic feet per day and fetch higher global prices.

"The next couple of years will be tough but this gives some hope that eventually we will get away from only selling into the saturated North America market," said Jackie Forrest, with the ARC Energy Research Institute.

"This is getting us a foot in that growing Asian market and we are really positioned well to ship to Asia because of our proximity to the market."

An LNG lifeline

Construction begins immediately, according to LNG Canada, and the new facility will be operational sometime in the early 2020s. Globally, it marks the first time a company has approved a new investment in a greenfield LNG export project in five years, according to Wood Mackenzie, an energy research firm.

While several LNG projects proposed for the B.C. West Coast have been delayed or shelved in recent years, experts say now that one facility will be built, others may follow suit.

As Canada enters the international LNG export market beyond North America, other countries are also building LNG terminals, so there will be competition to attract investment from large oil and gas companies.

The United States, for instance, is expected to more than double its LNG export capacity in the next few years and a dozen more proposed projects are waiting approval by the country's energy regulator.

While the current climate is rough for natural gas producers, at least companies know it should improve in about five years.

"Certainly, sentiment-wise, it's a good boost for them," said King. "It's going to take time but it is a situation which will improve."

That's worth something, especially for a sector long-starved of any reason to be cheerful.