BlueBay Scraps Bet Against UK Bonds on Labour Win, BOE Outlook

(Bloomberg) -- One of the UK bond market’s most vocal bears is scrapping a bet against gilts, saying Labour’s big election win and an upcoming interest-rate cut will give them a short-term boost.

Most Read from Bloomberg

Biden Narrows Gap With Trump in Swing States Despite Debate Loss

Biden’s Defiant Interview Unlikely to Calm Democratic Nerves

A $14 Billion Walmart Heir Joins Novogratz Urging Biden Exit

Iran Elects President Who Wants to Revive Nuclear Talks With West

Trump Distances Bid From Second-Term Agenda Pushed by Allies

Mark Dowding, chief investment officer at RBC BlueBay Asset Management, closed his short gilt position initiated in January for a profit this week. He had been bearish since 2021 because of the UK’s deteriorating public accounts and elevated inflation.

While Dowding hasn’t shaken his long-term pessimism just yet, he predicts UK bonds will gain from near-term political stability after Keir Starmer won a landslide victory in Thursday’s vote. He also sees high chances of the Bank of England cutting interest rates next month.

“Starmer will probably have a honeymoon period and that should benefit gilts,” said Dowding. “And in the short term, there is a window for a BOE rate cut in August.”

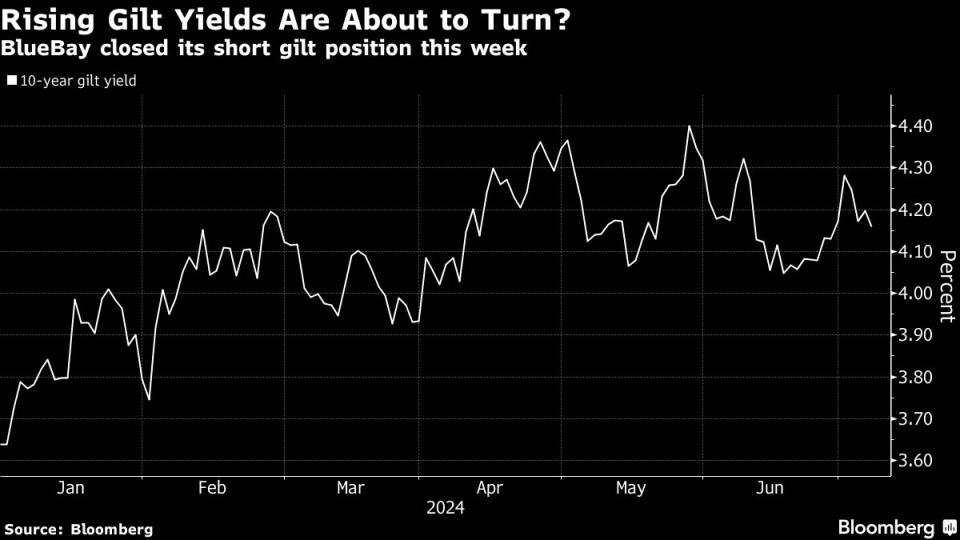

The yield on 10-year gilts has risen more than 60 basis points from the start of the year to earlier this week when Dowding took profit.

UK bonds and the pound gained Friday on expectations Starmer’s Labour Party will usher in calmer and more moderate policies, turning the page on years of turmoil marked by the 2022 gilt crisis, Brexit and the Scottish referendum.

Bets on BOE monetary easing remained stable after the vote, with the market implying a 60% chance of a quarter-point rate cut next month and almost fully pricing two reductions this year.

Dowding also said the BOE might scrap active bond sales linked to the quantitative tightening program under the new government, another reason for him to close the short bet. The central bank is currently reducing its bond stockpile by £100 billion ($128 billion) a year via a mix of sales and maturing securities, and is due to revisit its policy in September.

Longer term, the RBC CIO would look for a new entry point to return to a short position, as he is still concerned inflation will prove sticky and that the UK’s fiscal accounts will weaken further.

“I think there will be another trade toward higher UK yields,” he said. “But this likely comes later in the third quarter after inflation moves up and the honeymoon for Starmer starts to fade.”

--With assistance from Greg Ritchie and James Hirai.

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

©2024 Bloomberg L.P.