A Broward ‘Mother Theresa,’ her cronies — and, the feds say, a $190 million Ponzi scheme

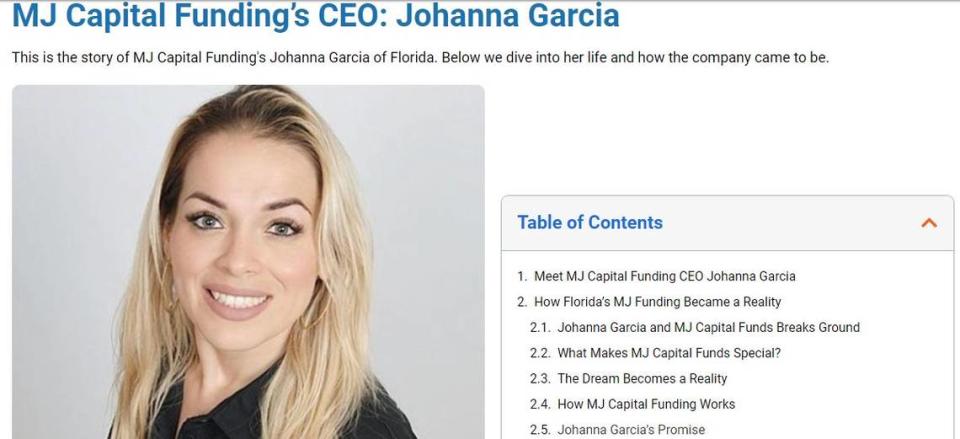

Things have gotten worse for North Lauderdale’s Johanna Garcia in the year since one of her MJ Capital Funding cronies was charged criminally and civilly for being part of a $190 million Ponzi scheme that Garcia is accused of orchestrating.

Here’s what to know:

▪ Garcia, 40, sits in Miami federal prison after Friday’s indictment on mail fraud and wire fraud charges. Garcia’s freedom got frozen by her arrest two years after her assets got frozen and a receiver took over MJ Capital Funding and MJ Taxes and More.

▪ On Thursday, Christian Gonzalez is scheduled to learn how long he’ll reside in federal prison after his conviction on two counts of money laundering. After the Securities and Exchange Commission charged Garcia, and a court-appointed receiver took over MJ Capital, Gonzalez began spending some of the $200,000 scam loot out of an account for “MJCF LLC.” When the account was down to $159,976, four months after the charges, Gonzalez moved $155,000 into an account for his United Capital Solutions company and kept the remaining $4,976.

▪ Pavel Ruiz, the Garcia crony charged a year ago, has pleaded guilty to conspiracy to commit wire fraud and will be sentenced Sept. 7. In his guilty plea, Ruiz, 29, gave up his role in the scam, but also some parts played Garcia, which his guilty plea calls “Co-Conspirator 1” as she had yet to be charged.

READ MORE: Broward man and “Mother Theresa” accused of running a massive Ponzi scheme

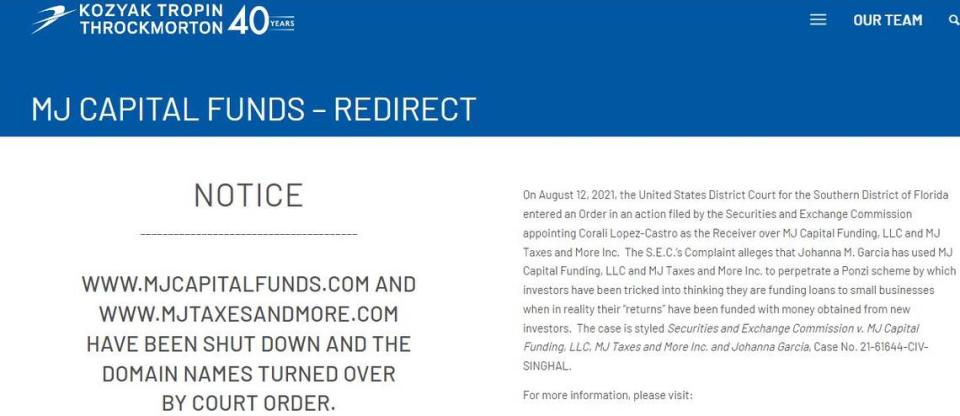

Garcia’s companies, MJ Capital Funding and MJ Taxes and More, have been under the control of a court-appointed receiver since an SEC filing on Aug. 12, 2021. In May, Kozyak Tropin Throckmorton’s Bernice Lee succeeded Corali Lopez-Castro as receiver as Lopez-Castro became a federal bankruptcy judge. Ruiz’s companies, MJCF and UDM Remodeling also have been put under Lee’s control.

MJ Capital and MJ Taxes former websites now kick over to Kozyak Tropin’s website updating investors and victims on the status of the related cases and efforts to get their money back.

‘Mother Theresa’ and the MJ Capital Funding scheme

Before MJCapitalFunds.com was devoted to status reports on indictments, sentencings and how to get your money back, a website blog claimed Garcia “is often referred to as ‘Mother Theresa’ in her community” because she found a way to “help hard working individuals make money and that she helps her merchant clients get the financing they need.”

What “Mother Theresa” found were merchant cash advances or MCAs, the same financial product used in Hallandale Beach’s 1 Global Capital investor fraud.

READ MORE: The CEO of a Broward company used for a $250 million Ponzi scheme fraud gets indicted

In simplest terms, MCAs are Amscot for small- or medium-sized businesses. Businesses that need money quickly get a short-term loan. For that loan, they make regular payments taken directly from the company bank account at a healthy interest rate or give up part of future receivables.

MJ Capital, run out of an Atlantic Boulevard strip mall in Pompano Beach, got its cash from investors, who were supposed to receive a percentage of the profit from the loan. Ruiz’s guilty plea says the investment contracts “included these representations: (1) guaranteed returns, typically 10% per month; and (2) guaranteed repayment of investment principal.”

(Standard investor yellow flag, often red flag: “guaranteed” anything.)

“The MJ Companies encouraged existing investors to refer other investors by offering to pay commission for referrals,” Ruiz’s guilty plea says. “The MJ Companies also allowed investors to become affiliated as ‘Account Representatives’ to raise new investment funds in exchange for commission-based compensation, typically 10% per month on· the amount of funds raised.”

MJ Capital Funding’s website bragged, “Proudly, MJCF can say that no purchaser has ever received a late payment from MJCF, let alone a missed payment. Johanna Garcia has an impeccable accounts payable department. Johanna and the whole company stands behind that.”

Never missing a payment becomes easier if you’re using Pedro’s money to pay Paul in a Ponzi scheme. And, that’s what Ruiz’s guilty plea describes.

“The representations that the MJ Companies were using investor money to fund MCAs, that MCAs generated revenue from which investor returns were paid and that investor money was secure were lies,” Ruiz’s guilty plea admission of facts said. “In fact, the MJ Companies earned little revenue from MCAs and, with rare exceptions, the MJ Companies did not use investor funds to make MCA loans.”

So, they paid earlier investors with money from new investors or got earlier investors “to roll over their investments into a · new investment agreement, thus deferring the MJ Companies’ obligation to repay investors’ back their principal.”

Ruiz’s guilty plea admits Pavel Ruiz MJCF LLC, registered with the state March 4, 2021, was created “to facilitate the receipt and handling of fraudulently obtained investors proceeds.”

Garcia’s indictment puts the total scheme amount at $190 million. Ruiz’s guilty plea says he raised $42,942,000 fraudulently, “thereby causing more than $25 million in losses to investors.”

In addition to his freedom, Ruiz likely will lose in forfeiture the 2021 Audi RS7 he bought during the fraud. Car And Driver puts the minimum retail price for that sports sedan at $115,045.

How to start a #smallbusiness in #florida https://t.co/tmTbZ2Z2Nd pic.twitter.com/UdIXNBbus2

— MJ Capital Funding (@MJCapitalFundi1) July 12, 2021