CBRM records a surplus, but CFO says concerns remain over finances

Cape Breton Regional Municipality's audited financial statements show it ended its last fiscal year on March 31 with a slight surplus, just after the COVID-19 pandemic was declared.

But the municipality's chief financial officer said there's still cause for concern.

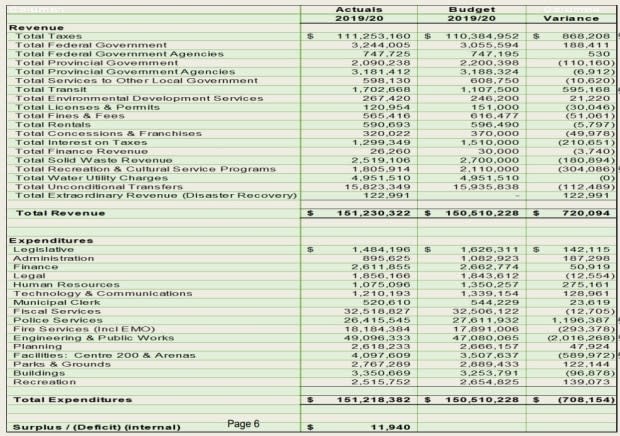

The municipality had been expecting to use its reserve accounts to cover an anticipated deficit, but unexpected revenues wiped that out and left CBRM with nearly $12,000 in surplus funds.

Still, the pandemic only needed two weeks to make things worse.

"The result was a loss of revenues in the last month of the [fiscal] year, as well as increased costs associated with pandemic response and that created a financial burden that we didn't expect," said Jennifer Campbell, the municipality's chief financial officer. "CBRM did manage, however, to squeak by with an operating surplus ... of $11,940."

The CBRM water utility also posted a surplus, thanks to rate increases three years ago that covered a deficit.

Campbell said the deficit has been wiped out and the utility ended the year with $2.8 million more in revenues over expenditures, with a remaining debt of $29 million.

An independent audit on the financial statements was done by accountants at MGM & Associates, which has since merged with MNP LLP.

The audit shows CBRM continues to reduce its debt and its reliance on transfers from other governments.

There are cautions over its uncollected taxes, liquidity and debt-servicing costs, and the municipality's reserve accounts remain a significant concern.

Campbell said the federal government recently doubled the gas-tax rebate to municipalities, but that goes not into savings, but toward an infrastructure deficit.

"We're constantly working to use as much funds as possible to invest in our infrastructure," she said. "We're doing the very best we can with the limited funds we have. However, until our tax base grows and our immediate infrastructure needs are addressed, it's unlikely that we're going to see improvements in this indicator in the near future."

Savings to remain low

Meanwhile, CBRM's savings accounts are not likely to improve anytime soon, Campbell said.

Council plans to take $2.5 million from reserve accounts to try to balance this year's budget, but with uncertainty around the continuing effects of COVID-19 on municipal revenues and expenditures, it's not likely the savings will grow for several years, she said.

Campbell also said the decreasing reliance on money from other governments isn't necessarily a good thing.

Provincial transfers to municipalities have been frozen for years, so any increase in local property taxes looks like an improvement, she said.

'Not indicative of the true need'

CBRM's revenues come mostly from residential taxes, Campbell said, and those are constrained by low growth and the province's capped assessment system.

"So while the indicator shows a calculated improvement, it's really not indicative of the [municipality's] true need for financial assistance," she said.

Despite the cautions and COVID-19's possible effects, the auditors say CBRM is not in dire straits.

"While there is uncertainty surrounding the global pandemic, there are no specific events or conditions identified that may cast significant doubt on the entity's ability to continue as a going concern," the auditors said.

MORE TOP STORIES