Some Chinney Kin Wing Holdings (HKG:1556) Shareholders Are Down 44%

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Chinney Kin Wing Holdings Limited (HKG:1556) shareholders, since the share price is down 44% in the last three years, falling well short of the market return of around 13%.

See our latest analysis for Chinney Kin Wing Holdings

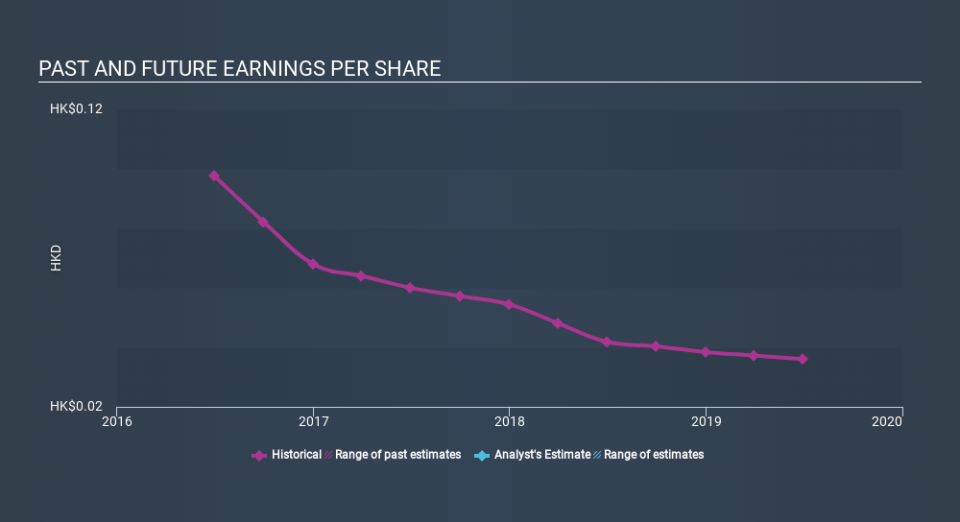

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Chinney Kin Wing Holdings saw its EPS decline at a compound rate of 28% per year, over the last three years. This fall in the EPS is worse than the 18% compound annual share price fall. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Chinney Kin Wing Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Chinney Kin Wing Holdings, it has a TSR of -28% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Chinney Kin Wing Holdings shareholders are down 7.5% for the year (even including dividends) , falling short of the market return. Meanwhile, the broader market slid about 1.6%, likely weighing on the stock. However, the loss over the last year isn't as bad as the 10% per annum loss investors have suffered over the last three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. It's always interesting to track share price performance over the longer term. But to understand Chinney Kin Wing Holdings better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Chinney Kin Wing Holdings (of which 2 are potentially serious!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.