A crude correction: Why Nalcor must return 1.3 million barrels of Hibernia South production

A portion of Newfoundland and Labrador's equity stake in an offshore oil project has been stripped, and the Crown energy corporation that owns that asset, Nalcor Energy, will have to surrender 1.3 million barrels of oil to other companies involved in the project over the next two years.

That's the outcome of a redetermination of the ownership structure in the Hibernia South Extension, which has been producing oil in the Jeanne d'Arc Basin, 320 kilometres southeast of St. John's and the site of four producing oil fields, for the past decade.

But it's not all bad news for Nalcor: it appears there's more oil in Hibernia South than was originally projected.

An updated assessment indicates Nalcor will recover 11 per cent more crude during the life of the project, even at the reduced equity stake, according to a spokesperson for OilCo, the new provincial Crown corporation that manages Nalcor's oil and gas assets.

Nalcor paid for oil it did not own

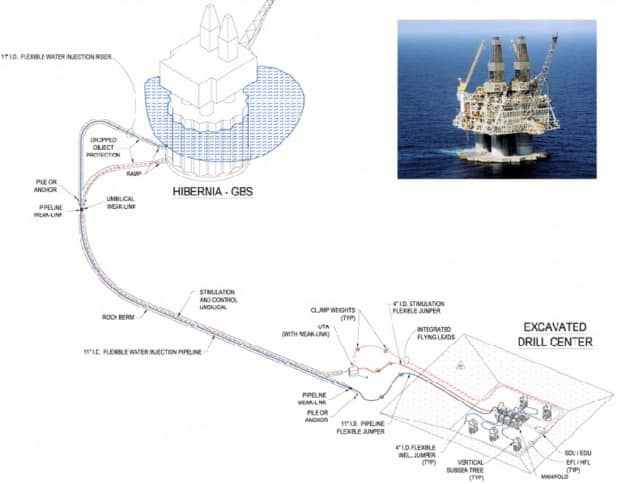

Hibernia South is a subsea project that ties back to the Hibernia platform, and involves the same consortium of six oil companies — led by ExxonMobil Canada — involved with the main Hibernia field, along with Nalcor.

Nalcor, which is being integrated into Newfoundland and Labrador Hydro and will soon disappear as a brand, formalized a deal to purchase a 10 per cent equity stake in Hibernia South in 2010.

So why was Nalcor's interest in Hibernia South reduced from 10 per cent to 8.7 per cent, effective March 31?

Nalcor has an ownership interest in two of the three Hibernia South licence areas, and the other partners also have different ownership interests across the three licences.

In scenarios like this, there is typically a rebalancing, or "true-up," of the resource among the partners following the commencement of commercial production, and owners get a better understanding of where, and in what quantities, the oil reserves are actually located, and what licence areas are most productive.

So in simple terms, Nalcor was being credited for more production than it was entitled to.

A rebate for Nalcor on capital, operating costs

That triggered the so-called redetermination, with 1.3 percentage points shaved off Nalcor's ownership, and a requirement that Nalcor will surrender 1.3 million barrels of future production to its partners over the next two years.

"With this change in working interest, Nalcor Oil and Gas has produced barrels, which it did not own and is required to repay oil received above the 8.7 per cent revised working interest," a spokesperson for OilCo wrote in an email to CBC News.

An OilCo official said Nalcor was not the only Hibernia South partner to see a reduction in its ownership stake, but declined to provide details on the new ownership structure.

A second and final redetermination of ownership interests is expected to occur in 2025, following the same formula to determine whether Nalcor's interests increase, remain static, or decrease again.

The true-up, however, does not include a cash debt from Nalcor to the other Hibernia South partners

"The goal of redetermination is to replace the oil, not the value," the spokesperson explained.

However, it's a significant financial setback for Nalcor, which is forecasting oil production to be down by 1.1 million barrels this year, largely because of the Hibernia South restructuring.

As of March 31, those 1.3 million barrels of Hibernia South crude would have been valued at $100 million, based on market conditions at that time.

Nalcor also has an equity position in Hebron, at 4.9 per cent, and a five per cent ownership in the White Rose Extension project.

In 2020, Nalcor's three oil assets generated a record $221 million in cash, from a production of 4.6 million barrels.

Meanwhile, Nalcor's shrinking equity stake in Hibernia South also means it had overpaid for its share of capital costs, and has received a refund. An official said the amount of that refund could not be disclosed without approval from the other partners in the project.

Nalcor's future operating expenses will also be reduced to reflect the lower ownership interest, according to OilCo.

As of Oct. 31, Nalcor has earned $823 million in revenue from Hibernia South, which has "greatly contributed" to the $535 million in dividends paid to Nalcor for its offshore ownership interests, according to a statement.

The provincial government has also received $127 million in royalties from Nalcor's ownership stake in Hibernia South, while Nalcor has paid nearly $600 million in capital and operating costs.

At the time the Hibernia South agreement was signed in 2010, there were projections of $13 billion in returns over the life of the project to the provincial government in the form of royalties, corporate income tax, and dividends to Nalcor.

CBC News has requested an update on those projections from the Department of Finance.