Dynatrace (DT) to Report Q2 Earnings: What's in the Cards?

Dynatrace DT is set to report second-quarter fiscal 2021 results on Oct 28.

For second-quarter fiscal 2021, non-GAAP earnings are expected between 9 cents and 10 cents per share.

Revenues are expected between $159 million and $161 million, implying a 25-26% increase year over year, adjusted for forex.

The Zacks Consensus Estimate for second-quarter fiscal 2021 earnings stayed at 10 cents per share over the past 30 days, suggesting 66.7% growth from the figure reported in the year-ago quarter.

The consensus mark for revenues is pegged at $160.6 million, indicating an increase of 24.2% from the year-ago quarter’s reported figure.

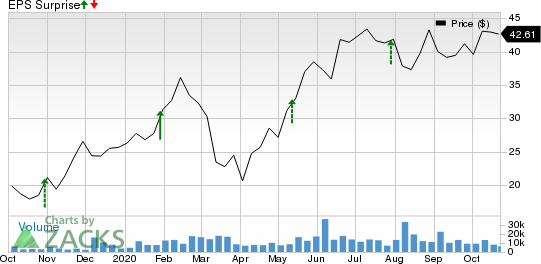

Notably, Dynatrace’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average being 46%.

Dynatrace, Inc. Price and EPS Surprise

Dynatrace, Inc. price-eps-surprise | Dynatrace, Inc. Quote

Let’s see how things are shaping up for the upcoming announcement.

Factors to Note

Dynatrace is expected to have benefited from strong demand for its APM solutions and an expanding clientele in the to-be-reported quarter. Markedly, the company’s target addressable market is worth more than $32 billion and comprises 15K global large enterprises with greater than $1 billion in revenues.

Moreover, coronavirus-led disruption has accelerated digital transformation among global enterprises. Dynatrace’s robust portfolio is anticipated to have helped it in tapping into this massive opportunity, thereby driving top-line growth in fiscal second quarter.

Moreover, extension of its Software Intelligence Platform to support all services from Amazon Web Services and integration with ServiceNow’s NOW Service Graph Connector Program are expected to have strengthened Dynatace’s portfolio, thereby helping it win new customers.

Notably, Dynatrace added 85 net new customers, ending the first quarter of fiscal 2021 with 2,458 customers. Further, net expansion rate was more than 120% for the 9th consecutive quarter.

Additionally, the company’s solid recurring-revenue base is a key catalyst. Total annual recurring revenues (ARR) at the end of the fiscal first quarter soared 39% year over year (at constant currency) to $609 million. ARR per Dynatrace customer also increased 10% year over year to $229K.

The trend is expected to have continued in fiscal second quarter, thereby driving up subscription revenues.

What Our Model Says

Per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Dynatrace has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a couple of companies worth considering as our model shows that these have the right combination of elements to beat on earnings in their upcoming releases:

Alphabet GOOGL has an Earnings ESP of +7.40% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Apple AAPL has an Earnings ESP of +2.97% and is #3 Ranked.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Dynatrace, Inc. (DT) : Free Stock Analysis Report

To read this article on Zacks.com click here.