Educational Development Corporation (NASDAQ:EDUC) Could Be Riskier Than It Looks

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

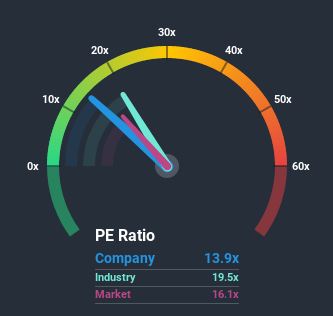

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider Educational Development Corporation (NASDAQ:EDUC) as an attractive investment with its 13.9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Educational Development over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Educational Development

Does Educational Development Have A Relatively High Or Low P/E For Its Industry?

An inspection of average P/E's throughout Educational Development's industry may help to explain its low P/E ratio. You'll notice in the figure below that P/E ratios in the Retail Distributors industry are higher than the market. So we'd say there is practically no merit in the premise that the company's ratio being shaped by its industry at this time. Ordinarily, the majority of companies' P/E's would be lifted by the general conditions within the Retail Distributors industry. We'd highlight though, the spotlight should be on the anticipated direction of the company's earnings.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Educational Development will help you shine a light on its historical performance.

How Is Educational Development's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Educational Development's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 2.1%. Still, the latest three year period has seen an excellent 75% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 12% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Educational Development's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Educational Development currently trades on a much lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. At least the risk of a price drop looks to be subdued, but investors think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Educational Development that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.