EU Tariffs on China EVs to Reach as High as 48% With New Levies

(Bloomberg) -- The European Union will impose additional tariffs on electric cars shipped from China starting next month, taking levies to as much as 48% in a move that further escalates trade tensions and adds to the cost of buying an EV.

Most Read from Bloomberg

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

US Inflation Broadly Cools in Encouraging Sign for Fed Officials

Fed Officials Dial Back Rate Forecasts, Signal Just One ‘24 Cut

Chinese Trader’s $20 Million Pile of Russian Copper Goes Missing

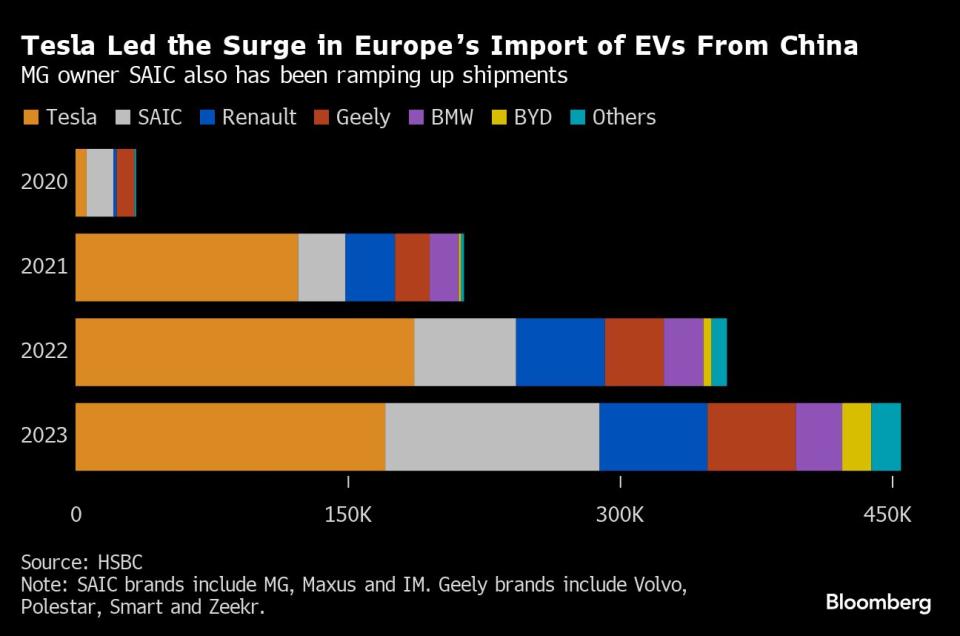

The bloc formally notified carmakers including BYD, Geely and MG owner SAIC of the charges on battery-electric cars due to be implemented around July 4, the European Commission said, following an investigation of subsidies that started last year. China’s EV manufacturers have been pushing more aggressively into Europe amid a domestic price war and years of building a lead in the technology.

The individual duties vary depending on the level of cooperation with the probe, the EU said, and will hit SAIC Motor Corp. hardest. The state-owned company owns the British brand MG, whose mass-market models like the MG4 are among those leading the charge into Europe. SAIC’s tariffs are set to increase by 38.1% on top of the existing duty of 10%.

“The EU ignored the facts and WTO rules, ignored repeated strong objections from China, and ignored the appeals and dissuasions of many EU member states’ governments and industries,” China’s Ministry of Commerce said in a statement. Beijing will “take all necessary measures to firmly safeguard the legitimate rights and interests of Chinese companies.”

Aside from SAIC’s top rate, BYD will have to pay an additional 17.4% levy, and Geely — which owns Volvo Car AB — faces an extra 20% charge. While the probe targeted Chinese-owned EVs, Western carmakers including Tesla, BMW and Renault that produce in China and ship to the EU also face higher costs. Those cooperating with the probe are set for extra charges of 21% based on a weighted average.

The measures are “a speeding ticket aimed to slow China,” said Bill Russo, founder and chief executive officer of Shanghai-based advisory firm Automobility. “This is Chinese companies being ahead of the game — let’s slow them down and let’s encourage them to maybe mitigate the tariffs with localization.”

Almost one-fifth of battery-electric vehicles sold in the EU in 2023 were made in China, according to lobby group Transport & Environment. That figure is set to rise to 25% this year, T&E said.

China has threatened retaliation across agriculture, aviation and cars with large engines. Beijing has already launched an investigation into some types of European liquor.

“Our goal is to restore the level-playing field and ensure that the European market remains open to electric vehicles producers from China, provided that they play by globally agreed trade rules,” Valdis Dombrovskis, the European Commission’s vice president in charge of trade, said Wednesday.

Shares of Chinese EV makers declined in Hong Kong. Geely and Xpeng Inc. fell by more than 5%, while sector leader BYD lost as much as 3.9%.

The measures come as the EU walks a tightrope in trying to protect the region’s car industry with millions of well-paid jobs while also pursuing a green agenda focused on removing CO2 from transportation. The EU’s EV ambitions, with an effective combustion-engine sales ban for new cars by 2035, have run into trouble in recent months after markets like Germany withdrew subsidies for consumers.

The tariffs will likely cut imports from China by a quarter, amounting to a value of roughly $4 billion, according to Moritz Schularick, president of Germany’s Kiel Institute for the World Economy.

While the decision was justified in light of local government aid, “the expected increase in electric vehicle prices will make the climate transition more expensive,” Schularik said. “Finding the right balance between fair competition and promoting green technologies remains a key challenge.”

German Chancellor Olaf Scholz has warned against restricting automotive trade with China, saying earlier this month that “we do not close our markets to foreign companies, because we do not want that for our companies either.” German automakers including Volkswagen and BMW would be hit hardest in a trade spat, as they collectively sold 4.6 million cars there in 2022.

Western manufacturers have broadly rejected the tariffs, with Mercedes-Benz Group AG Chief Executive Officer Ola Källenius leading calls for open markets. The luxury-car maker counts China as its biggest market, at 36% of total deliveries, and is especially vulnerable to retaliation as it imports all of its lucrative S-Class sedans and Maybach limousines into China. The country is also the biggest market for VW and BMW.

“The timing of the decision is detrimental to the current demand” of EVs, VW said in a statement Wednesday. “The increase in import tariffs in the EU could trigger a fatal dynamic of measures and countermeasures and result in an escalation of trade conflicts.”

The EU has opened a barrage of trade probes against Beijing on the grounds of anti-dumping and unfair subsidies, especially in the clean-technology sector after losing much of its solar sector to China a decade ago. The steps on EVs follow the US, which last month introduced a more than 100% duty on Chinese EV imports, though that measure is more symbolic with hardly any vehicles currently shipped.

Final duty levels are expected to be adopted by November.

The EU’s move comes as the outlook for EV sales dims, with BloombergNEF reducing its battery-electric sales projections by 6.7 million vehicles through 2026 in a new report Wednesday. BNEF sees China continuing to dominate EVs, batteries and the global supply chains for raw materials and components.

China has urged Brussels to refrain from imposing the penalties and indicated it’s prepared to levy tariffs as high as 25% on imported cars with large engines, hitting the likes of Porsche, Mercedes and BMW. In recent weeks, Commerce Minister Wang Wentao and other officials have been crisscrossing Europe to push their case for Brussels to back down.

This included a letter Wang sent to Dombrovskis, the EU trade chief, threatening action against the aviation and agriculture industries. Brussels has long argued that its procedure is based on WTO rules.

--With assistance from Charlotte Yang, James Mayger, Ocean Hou, Christoph Rauwald, Craig Trudell, Ben Holland, Colum Murphy, Albertina Torsoli, Wilfried Eckl-Dorna, Anthony Palazzo and Monica Raymunt.

(Updates with comment from EU official in ninth paragraph. An earlier version of this story corrected the day of the announcement and the spelling of Geely Automobile.)

Most Read from Bloomberg Businessweek

Israeli Scientists Are Shunned by Universities Over the Gaza War

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

©2024 Bloomberg L.P.