Europe’s Bond Sales See Last Flash of Activity Before Summer

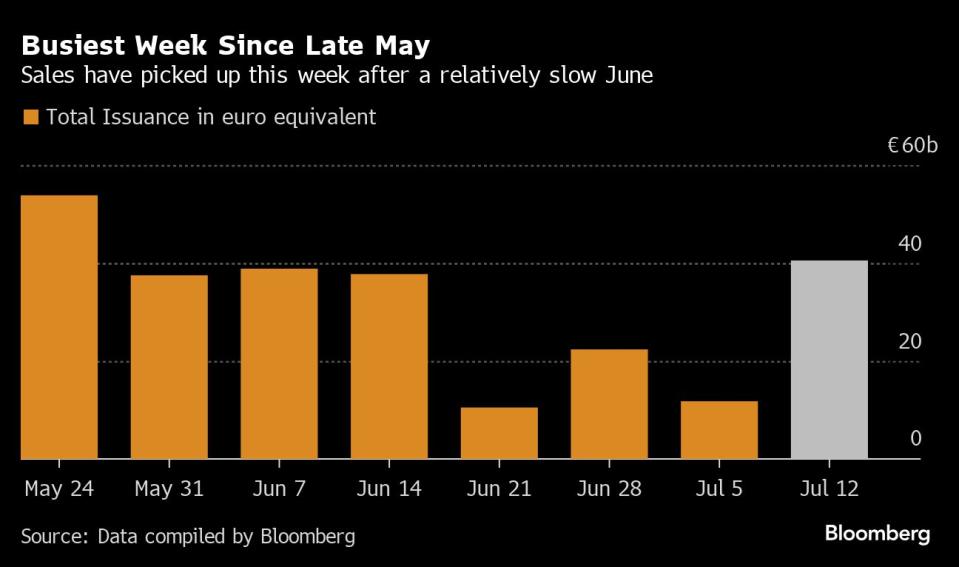

(Bloomberg) -- Europe’s market for new bond sales is headed for its busiest week since late May as sentiment recovers after the turbulent French elections and borrowers rush to get deals done before the region’s summer holidays.

Most Read from Bloomberg

Biden Vows to Stay in 2024 Race Even as NATO Gaffes Risk His Campaign

Tesla Delays Robotaxi Event in Blow to Musk’s Autonomy Drive

Stock Rotation Hits Megacaps on Bets Fed Will Cut: Markets Wrap

Issuance is set to reach at least €40.53 billion ($44 billion), the highest since the week ending May 24, according to data compiled by Bloomberg. Tuesday and Wednesday combined saw a higher volume than the total of the previous two weeks.

“It’s mainly down to the bounce after the French election — we have already met our expectations for supply in July,” said Marco Baldini, global head of investment-grade syndicate at Barclays Plc. “People who were planning to issue after summer have been positively surprised by how strong the market was this week, and accelerated their issuance.”

While a large chunk of the sales volume has come from the European Union’s €9 billion two-part deal and the UK’s £4.5 billion ($5.8 billion) inflation-linked gilt sale, there’s been 40 other borrowers, including the likes of John Deere Capital, Banca Monte dei Paschi di Siena SpA and junk-rated Vodafone Spain. French development bank SFIL SA even returned to the market with a green bond it postponed just after the election was called.

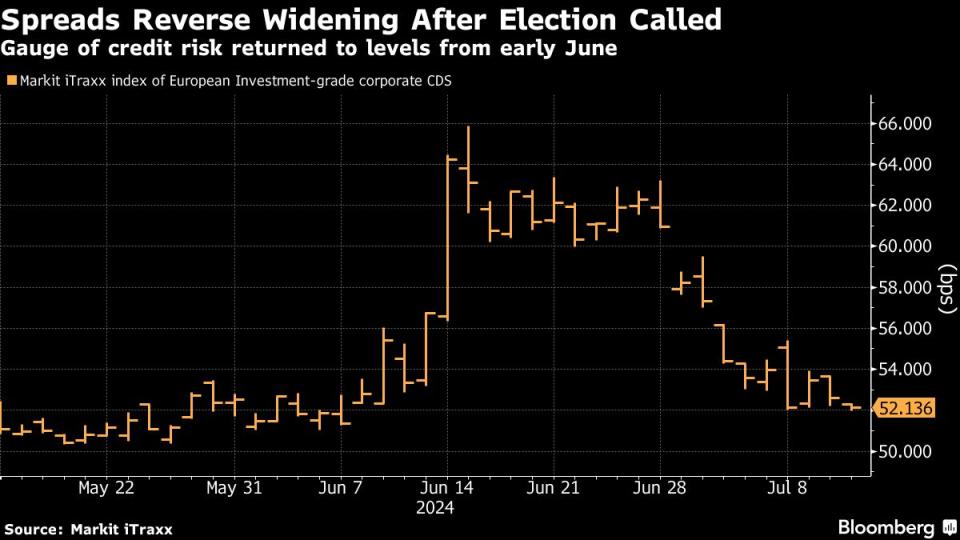

While the prospect of a win for the far-right or a left-wing coalition had created fears of looser fiscal policy in France, the result of a hung parliament means political gridlock is more likely, returning some calm to markets and spurring issuers back into raising debt.

“Many investors might point to the more extreme outcomes being avoided in the French election as the main catalyst for the recent rally,” said Ian Horn, co-lead portfolio manager at Muzinich & Co. “We also believe that technicals have played a significant part. Low inventories on the sell-side, quiet primary activity through much of June, and continued inflows to European investment grade have all supported a retracement of spreads.”

A credit risk gauge for European investment-grade corporate debt has reversed the spike seen last month, returning to levels from before the snap elections were called on June 9.

Still, it hasn’t been a completely flawless week for issuance. On Wednesday, Athene Global Funding, owned by Apollo Global Management, decided not to proceed with its deal, according to a person familiar with the matter. A spokesperson for Athene declined to comment.

From here, the seasonal summer slowdown for the bond market is expected to start. Bastille Day in France on Sunday typically marks the beginning of a period of reduced issuance as bankers, treasury teams and investors all head for the beach.

“Companies and banks are really well funded and many in earnings, so I expect it to drop off from here,” Baldini said.

--With assistance from Tiffany Tsoi, Colin Keatinge and Hannah Benjamin-Cook.

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

He’s Starting an Olympics Rival Where the Athletes Are on Steroids

©2024 Bloomberg L.P.