French Bank Stocks Lead Market Drop After Macron Calls Snap Vote

(Bloomberg) -- French banks BNP Paribas SA and Societe Generale SA tumbled on Monday, leading losses on the Paris market after President Emmanuel Macron called a snap election following a drubbing for his group in weekend European parliamentary voting.

Most Read from Bloomberg

Russia Is Sending Young Africans to Die in Its War Against Ukraine

NYC Landlord to Sell Office Building at Roughly 67% Discount

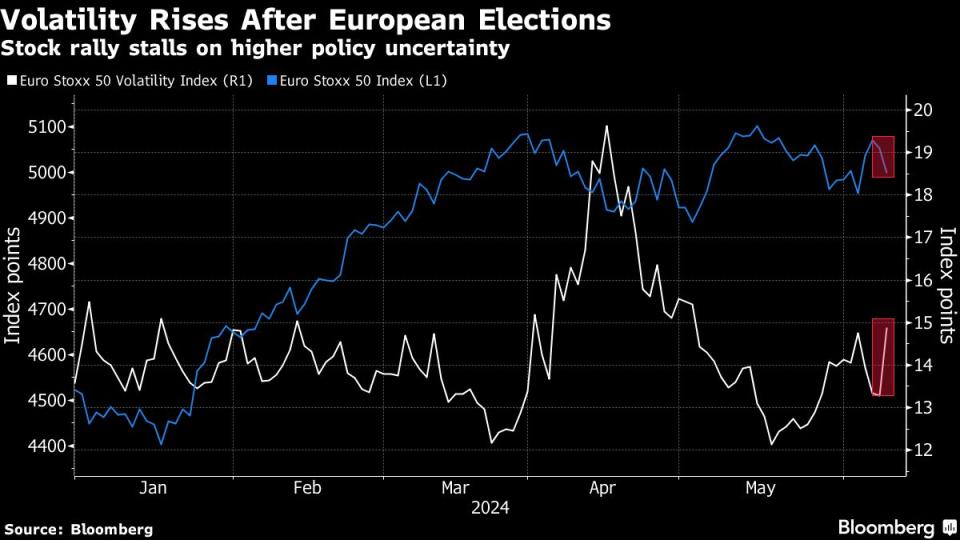

The moves weighed on the broader European equity market, with the Stoxx 600 Index closing 0.3% lower after paring some losses. The CAC 40 Index fell as much as 2.4%, the most in almost a year. Apart from banking stocks, French construction and materials sectors also retreated sharply.

Alexandre Hezez, chief investment officer at Group Richelieu, said the banking sector is likely to suffer the most due to the potential for growing concerns around French public finances.

“One takeaway is that reforms will be hard to implement in France, and as one has seen with the downgrade of S&P, there are concerns about the sustainability of French debt,” Hezez said.

The political chaos fueled worries across the continent, with the euro slipping to its lowest in a month.

“The surprise decision to call for snap elections adds to uncertainty, particularly as France could face an EU procedure for excessive deficits later on this month,” said Vincent Juvyns, global market strategist at JPMorgan Asset Management.

Deepening political angst in Europe is likely to add fresh pressure on the euro after parliamentary votes saw leaders in France and Germany suffer losses, according to strategists.

“One can see the euro trading lower, but I expect the spread between France’s sovereign debt and Germany to grow further,” added Juvyns.

--With assistance from Michael Msika.

Most Read from Bloomberg Businessweek

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

Sam Altman Was Bending the World to His Will Long Before OpenAI

©2024 Bloomberg L.P.