GameStop shares surge again as Roaring Kitty teases $116m meme stock portfolio

Shares in GameStop, the video games retailer that became a wildly popular meme stock back in 2021, skyrocketed in value on Monday morning after influential tipster “Roaring Kitty” made a sudden reappearance on a Reddit forum.

Pre-market trading saw shares climb around 84 per cent in value to $42.55.

The surge came after trader Keith Gill, who also goes by the alias “DeepF***ingValue”, posted a screenshot on Reddit’s r/SuperStonk forum on Sunday night of what he said was his stock portfolio.

The screenshot revealed that he apparently holds five million common shares in GameStop – equating to an estimated $115.7m based on the $23.14 share price at the close of play on Friday.

His post also showed the account as having 120,000 call options in GameStop with a strike price of $20, which are due to expire on 21 June and were purchased for $5.68 each.

The “DeepF***ingValue” post has not been independently verified and did not appear in the WallStreetBets chatroom where Gill used to place his trading updates at the height of the GameStop phenomenon three years ago.

Gill’s latest appearance comes after he teased his return to social media three weeks ago with a cryptic post on X of a man sitting up in his chair — recognisable to his audience as a way of saying “things are about to heat up”.

That post sparked an instant buying frenzy in the meme stock GameStop, prompting the company itself to profit by selling off stock to the tune of $900m.

Gill posted an equally enigmatic tweet on Sunday evening, this time of a reverse card from the family game Uno.

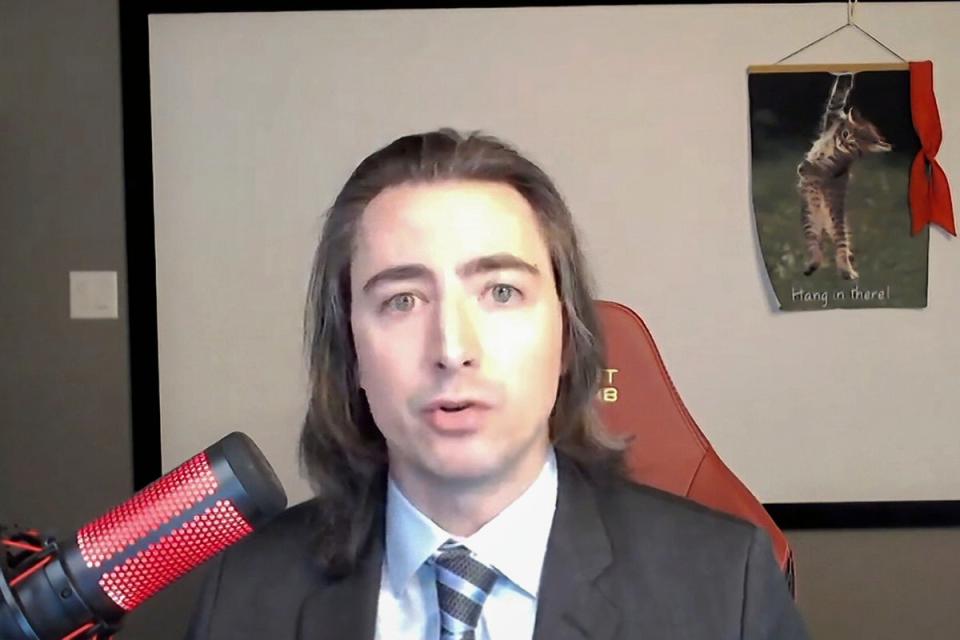

Previously a software developer and then a marketer with Massachusetts Mutual Life Insurance based out of Wilmington, Massachusetts, Gill rose to online fame with a series of Reddit posts and YouTube videos in January 2021 encouraging other amateur traders to buy up GameStop stock in order to thwart a short-selling campaign orchestrated by major Wall Street hedge funds.

The phenomenon was in part inspired by the investors’ genuine affection for GameStop’s brand and stores at a time when the company was struggling to adapt to the world of online gaming as sales of physical media dwindled.

— Roaring Kitty (@TheRoaringKitty) June 3, 2024

Such was the extent of the mania Gill inspired that brokerages like Robinhood were ultimately forced to limit trading in the shares.

Gill was eventually called to testify before a series of congressional hearings to discuss the gamification of trading platforms.

“I didn’t expect this,” he said of the extraordinary David-and-Goliath battle in an interview with The Wall Street Journal at the time.

“This story is so much bigger than me. I support these retail investors, their ability to make a statement.”