Harsh reality setting in for cannabis merchants as pot shops multiply

If you're looking for legal weed in Ottawa's Glebe neighbourhood, you don't have far to travel.

There's the Prohibition era-themed High Ties at the corner of Bank Street and Second Avenue, one of the company's seven Ottawa-area dispensaries.

Locally owned The Good Cannabis Company occupies the former Mrs. Tiggy Winkle's toy store between Third and Fourth avenues.

You'll find Superette's second Ottawa location near the busy corner of Bank Street and Fifth Avenue.

A mere 130 metres to the south, Plateau's tiny storefront stares across Bank Street at the much larger One Plant dispensary, due to open soon on the ground floor of a new seniors' complex.

That's five cannabis retailers in fewer than five short blocks, but it's hardly an anomaly. The stores are multiplying at a dizzying rate across the city, often setting up shop a stone's throw from their competitors. On Wellington Street W., two dispensaries, High Ties and True North, are next door neighbours.

That intense clustering is causing concern over the growing homogeneity of Ottawa's high streets, but it's also prompting another question: How can so many competitors selling essentially the same product at essentially the same price possibly survive in such a crowded market?

They're not at the point of failure yet, but they probably see the writing on the wall. - Trina Fraser, Brazeau Seller Law

A CBC analysis shows they probably can't, and many industry insiders agree a correction is coming.

They include the interim president and CEO of Ontario Cannabis Store (OCS), the Crown corporation that manages wholesale distribution to all bricks-and-mortar cannabis retailers in the province.

"Ontario's open market is expected to grow in the months ahead, with 1,000 retail stores expected to open their doors by September 2021," David Lobo wrote in an annual market report released this spring. "Unfortunately, this rapid growth will likely result in some retailers being faced with increased competition and a crowded marketplace, which could result in some closures and market right-sizing."

"There's going to be a shakeout," agreed one store manager in Ottawa who wasn't authorized by his employer to speak to the media.

According to the latest information available from the Alcohol and Gaming Commission of Ontario (AGCO), the provincial agency that regulates the retail cannabis industry, 42 stores are now open or "authorized to open" in Ottawa. Ten more are "in progress" and the public notice period has ended for another 22.

That's a dramatic increase from the three dispensaries that opened in April 2019, winners of a provincewide lottery for then scarce retail licences.

With lots of demand and little competition, the lucky few who got into the game early reaped enormous rewards, according to Trina Fraser, partner at Ottawa firm Brazeau Seller Law.

"They were seeing daily sales that were huge … in some cases up to $30,000 a day, it was crazy," Fraser said.

But the boom hasn't lasted. As the province loosened the licensing process and more retailers entered the market, sales in Ottawa, and across the province, levelled off.

According to the latest available sales figures from OCS, total quarterly sales in Ottawa had plateaued at about $13 million by the end of March 2021, when there were only 28 stores open in the city. There are now many more, and there's no indication sales have risen to match.

(Provincewide, retail cannabis sales from April 1 to June 30, 2021 rose 18 per cent compared to the previous quarter, but the number of stores in Ontario increased by 46 per cent over the same period. OCS has not published local sales figures for that quarter.)

While it's difficult to say how much of that levelling off is due to the COVID-19 pandemic or changing consumer habits, many within the industry believe a major market correction is looming.

"Everybody expected … we would reach a point of oversupply and then have some sort of a correction," Fraser said. "There's going to be some consolidation of brands where we're going to ultimately see some of the larger chains grow and gobble up some of the smaller stores in desirable locations, and then there will be some that will just outright fail."

As he prepared for Friday's official opening of Purple Meadow Cannabis on Rideau Street, manager Peter Gauthier was well aware of the stiff competition along the dense downtown strip and in the nearby ByWard Market.

"It's obviously a worry when you're starting a new business, especially with many others offering the same thing," Gauthier said. "We're going to see how the next couple years go and hopefully get to ride the wave."

But for many of those who have already tested the water, it hasn't exactly been smooth sailing.

"It's actually been a very weird time to be an operator in retail," said Superette CEO Mimi Lam, citing both the pandemic and the sudden glut of direct competitors. "To say that there hasn't been an impact would be a lie."

Lam, who lived in the Glebe while attending Carleton University, said the company made a deliberate decision to locate its second Ottawa store there.

"That's a neighbourhood that's close to my heart," she said. "From Day 1 I wanted to open there."

But by the time the store opened in early June, some competitors had already set up shop down the street, and others were on the way.

Under the current framework, retail licence applicants have no way of knowing how many others are planning to open in their vicinity until those applications reach the public notice period. Lam said that created an "information vacuum" for companies like Superette.

"Everyone was able to all of a sudden apply to become an operator, but no one really knew where another operator or another store might be, and so everyone was just heads down and signing up [for] these leases," she said.

Around the corner at Plateau, product, purchasing and training lead Sam Hunt agreed it probably would have been beneficial to know that One Plant was moving in across the street.

"I can't imagine that would have been the plan, to have a competitor so close," he said.

WATCH | Why clusters of cannabis stores are popping up in certain Ottawa neighbourhoods

Hunt said Plateau's strategy is to differentiate the locally owned company from its bigger, more brightly lit rivals by offering a shorter, simpler menu and personalized service that's laser-focused on each customer's unique needs.

"Just as there are three or four different fast-food restaurants on a street, there can be three or four different cannabis stores on a street, as long as they're each meeting a need that the consumers are dictating," he said.

Lam said her store, too, is trying to set itself apart by being "not just another dispensary but a retail experience," selling Glebe-themed T-shirts and other knick-knacks alongside its wide array of pot products and accessories.

But Fraser said no matter how hard retailers try to stand out from the crowd, she's already dealing with clients who are looking to sell franchises or escape from expensive commercial leases.

"They're looking to get out. They're not at the point of failure yet, but they probably see the writing on the wall," she said. "A cannabis retail licence now is not really worth much."

The abrupt rise in the number of bricks-and-mortar cannabis retailers in Ontario — by June 30 there were 834 stores in 160 communities, according to OCS's latest tally — can be traced back to December 2019, when the province decided to throw the market wide open.

Now, any applicant who meets the provincial requirements can obtain a retail licence, and with the exception of a 150-metre buffer zone around schools, can set up shop anywhere that's zoned by the municipality for commercial use.

The province is often hands-off, and then communities and cities face the challenges of poor planning. - Rideau-Vanier Coun. Mathieu Fleury

Neither the province, nor any municipality that has opted into the system, has any say over where the stores go, including their proximity to competitors.

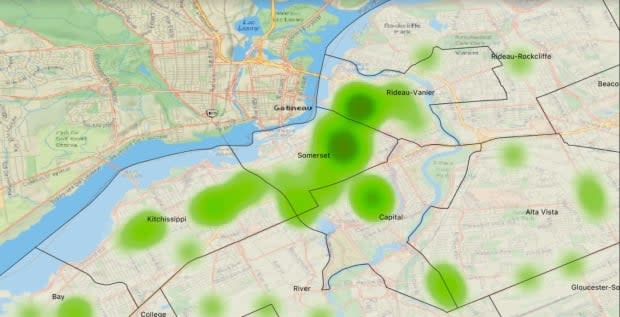

In Ottawa, that's led to a high concentration of cannabis retailers not just in the Glebe, but also in Centretown, along Rideau Street, Montreal Road and in the west end.

The two wards with the most stores — Somerset (17) and Rideau-Vanier (11) — also happen to have the city's lowest median household incomes.

While the AGCO and OCS celebrate the ever-shrinking distance the average Ontarian now must travel to reach their nearest cannabis retailer, not everyone's so pleased.

"The province is often hands-off, and then communities and cities face the challenges of poor planning," said Rideau-Vanier Coun. Mathieu Fleury.

Fleury led the charge to limit the concentration of payday loan outlets in his part of the city, and said he'd like to see similar restrictions for cannabis retailers.

"We don't want to see a monoculture of businesses in one area," Fleury said. "From an overall health and wellness of a commercial district, you want diversity."

That could mean granting cities more power to decide where cannabis retailers can go, as is the case in Alberta, where applicants must first seek the approval of the local development authority before obtaining a retail licence from Alberta Gaming, Liquor and Cannabis.

Calgary's land-use bylaw, for example, "requires separation distances to limit the sale of cannabis near ... other cannabis stores to manage potential environmental, social and aesthetic impacts; and to ensure opportunities for other businesses."

By contrast, legislation in Ontario prohibits municipalities from passing any bylaw that distinguishes cannabis dispensaries from any other kind of retailer.

Experts believe the more likely outcome in Ontario, where the province has so far been reluctant to cede any control over the industry, is that cannabis consumers will have the final say.

"They'll make their choice as to which one in their vicinity they favour, and the others will have a hard time surviving," Fraser said.