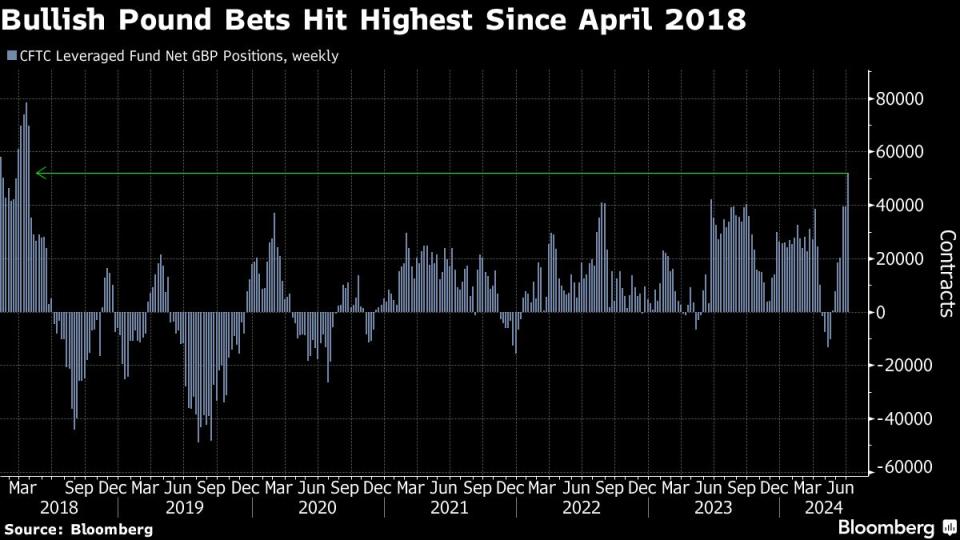

Hedge Fund Bets on Strong Pound Hit a Six-Year High Before Vote

(Bloomberg) -- Hedge fund bets for a stronger pound surged to their highest in more than six years ahead of last week’s UK election as investors were confident that a Labour victory would bring stability to the country’s politics and economy.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Microsoft Orders China Staff to Use iPhones for Work and Drop Android

The End of the Cheap Money Era Catches Up to Chelsea FC’s Owner

Asia’s Richest Banker Gets Caught in Adani-Hindenburg Crossfire

Net long pound positions held by leveraged funds jumped to their highest level since April 2018 in the week to July 2, the latest CFTC positioning data shows, just days before the July 4 vote. These speculative bets increased as the pound rallied to its strongest against the dollar in nearly a month, while hovering close to a two-year high versus the euro.

“The promised continuity in the UK’s fiscal rules had contrasted with the potential fiscal and policy changes seen emerging from the results of elections elsewhere,” said Michael Metcalfe, head of macro strategy at State Street Global Markets.

The pound posted its best winning streak against the dollar in four years last week, gaining for seven straight days as Labour’s overwhelming majority signaled a period of calm in UK politics, which many in the market expect will be positive for UK assets.

The view that the UK was becoming a “policy safe haven” was also improving sentiment for the pound among institutional investors, Metcalfe said, adding that flows tracked by State Street indicate that buy-and-hold investors have been squaring up their long-held underweight pound positions. Short positions held by asset managers shrank to their smallest in more than a year, according to CFTC data.

--With assistance from Anya Andrianova and Carter Johnson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.