Hunt Says Lower UK Debt Interest May Give Room for Tax Cuts

(Bloomberg) -- UK Chancellor of the Exchequer Jeremy Hunt suggested falling debt interest costs may give him the headroom to deliver tax cuts at his budget in the spring, boosting the governing Conservative Party in what’s likely to be an election year.

Most Read from Bloomberg

Ethiopia Fails to Pay Coupon, Becoming Latest African Defaulter

Stock Futures Rise, Dollar Flat in Thin Trading: Markets Wrap

Goldman’s Painful 2023 Lesson on China Forces Rethink of Emerging Markets

Bank of Russia Governor Says She Is Bracing for More Sanctions

The government plans to “cut the tax burden if we are able to,” Hunt said on Wednesday in a Bloomberg Television interview. Nevertheless, he added that he will not know what is possible until he sees new Office for Budget Responsibility forecasts next year.

Hunt and Prime Minister Rishi Sunak are under pressure from members of their own Tory party to cut taxes in order to boost the party’s electoral prospects. With the ruling party trailing the Labour opposition by about 20 points in national polls, Sunak is expected to call a general election in 2024, and must do so by the end of January 2025 at the latest.

“If debt interest payments go down then potentially that gives me more headroom and I could use that in lots of different ways but I would never use it in a way that would compromise the battle against inflation,” Hunt said. “We would like to bring down the tax burden in a way that is responsible.”

With lower inflation changing the trajectory for market interest rates that determine borrowing costs for the national debt, the UK’s debt costs are already falling. Oxford Economics Chief UK Economist Andrew Goodwin this week estimated that the chancellor will have an extra £11 billion ($14 billion) of headroom after the fall in market rates over the past few weeks.

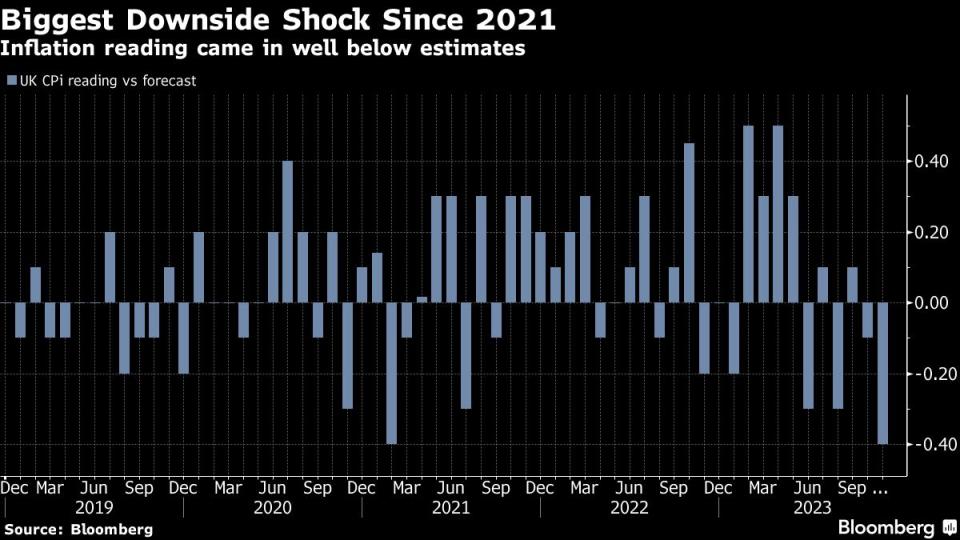

Since then, inflation has come in below expectations and markets have moved their rate expectations lower still. They now anticipate five quarter point cuts next year, taking interest rates from 5.25% down to 4%.

Both Hunt and Sunak have repeatedly said they want to cut taxes, and the matter has become a totemic issue within the Tories, who have long touted themselves as the party of low taxes. Despite that, Under the Conservatives, the tax burden is on track to hit a post World War II high.

The government is struggling to balance the books after the huge increase in borrowing over the pandemic, which has lifted the national debt to 97.5% of gross domestic product - its highest level since the 1960s.

The surge in interest rates to 5.25% from 0.1% over the past 24 months as the Bank of England battled to tame inflation, on top of the larger debt pile, has added around £60 billion to annual debt servicing costs, equivalent to the UK defense budget.

Hunt added that there was “still work to do” in cutting inflation, which has fallen to 3.9% from 11.1% last year, and that it remained the government’s immediate priority. Inflation is still twice the BOE’s 2% target.

He said the government would not settle ongoing doctor strikes by offering large wage deals. “We’re not going to agree to pay deals that threaten our progress in bringing down inflation,” he said. “The way to bring back industrial harmony is to bring down inflation.”

He also refused to comment on the outlook for interest rates but said: “I think people will start feeling more optimistic about their personal finances if they see interest rates on a downward trajectory.”

Hunt was speaking from Bern, where he signed a financial services deal between the UK and Switzerland that gives each nation access to the other’s financial markets. He said the mutual recognition agreement could be a model for future deals, including with the US.

“What we’re doing here is we’re saying that in the UK, we will allow Swiss companies to operate following Swiss regulatory structures and rules, and in Switzerland they will allow British-based companies to operate following UK rules and regulations — without the need for both countries to align their legal frameworks,” Hunt said. “And so in terms of the wholesale insurance market, asset management, banking, this is a really significant deal but also could be a template for the kind of deals that the UK does with other countries going forward.”

--With assistance from Bastian Benrath.

(Updates with comment from Hunt throughout.)

Most Read from Bloomberg Businessweek

What Dermatologists Really Think About Those Anti-Aging Products

What the Oldest Lab Rodents Are Teaching Humans About Staying Young

One Man’s Longevity Obsession Now Includes Fountain-of-Youth Injections

©2023 Bloomberg L.P.