Imagine Owning Broadway Industrial Group (SGX:B69) While The Price Tanked 68%

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Broadway Industrial Group Limited (SGX:B69) shareholders for doubting their decision to hold, with the stock down 68% over a half decade. Shareholders have had an even rougher run lately, with the share price down 55% in the last 90 days. But this could be related to the weak market, which is down 28% in the same period.

Check out our latest analysis for Broadway Industrial Group

Broadway Industrial Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Broadway Industrial Group saw its revenue shrink by 14% per year. That puts it in an unattractive cohort, to put it mildly. Arguably, the market has responded appropriately to this business performance by sending the share price down 20% (annualized) in the same time period. It's fair to say most investors don't like to invest in loss making companies with falling revenue. This looks like a really risky stock to buy, at a glance.

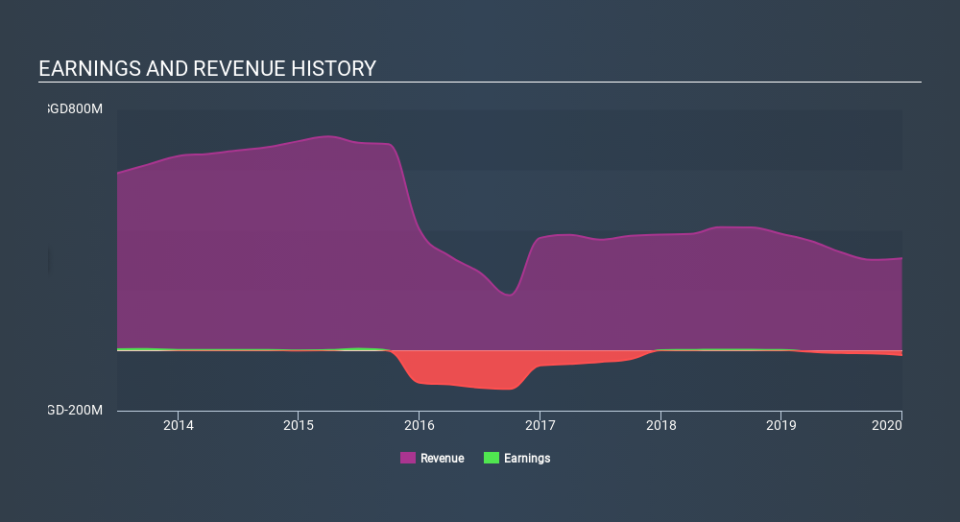

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Broadway Industrial Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Broadway Industrial Group's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Broadway Industrial Group's TSR of was a loss of 46% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Although it hurts that Broadway Industrial Group returned a loss of 3.3% in the last twelve months, the broader market was actually worse, returning a loss of 26%. Of far more concern is the 12% p.a. loss served to shareholders over the last five years. While the losses are slowing we doubt many shareholders are happy with the stock. It's always interesting to track share price performance over the longer term. But to understand Broadway Industrial Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Broadway Industrial Group , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.