Imagine Owning Meitu (HKG:1357) And Trying To Stomach The 80% Share Price Drop

Meitu, Inc. (HKG:1357) shareholders should be happy to see the share price up 24% in the last month. But that is meagre solace in the face of the shocking decline over three years. Indeed, the share price is down a whopping 80% in the last three years. So it sure is nice to see a big of an improvement. Only time will tell if the company can sustain the turnaround.

View our latest analysis for Meitu

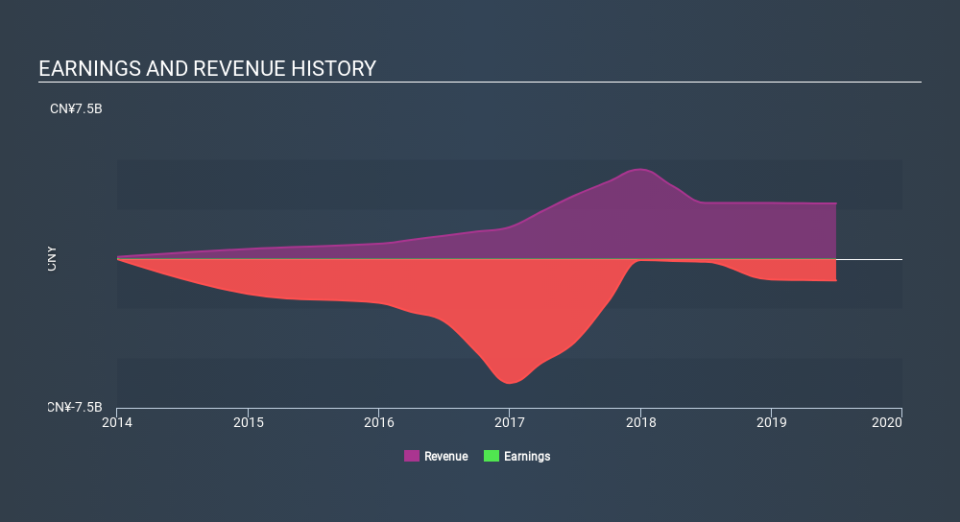

Meitu isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Meitu saw its revenue grow by 19% per year, compound. That's a pretty good rate of top-line growth. So it seems unlikely the 41% share price drop (each year) is entirely about the revenue. More likely, the market was spooked by the cost of that revenue. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Meitu in this interactive graph of future profit estimates.

A Different Perspective

The last twelve months weren't great for Meitu shares, which cost holders 22%, while the market was up about 6.1%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Unfortunately, the longer term story isn't pretty, with investment losses running at 41% per year over three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Meitu that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.