India’s Growth Tops 8%, Giving Boost to Modi as Vote Ends

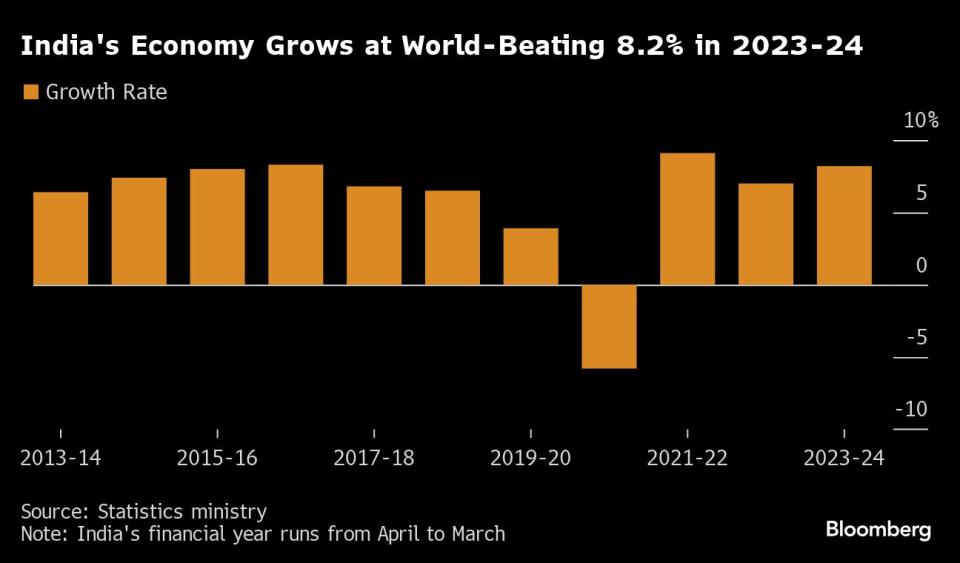

(Bloomberg) -- India’s economic growth topped 8% in the fiscal year that ended in March, faster than expected, giving Prime Minister Narendra Modi’s government a boost days before election results are announced.

Most Read from Bloomberg

Wall Street Billionaires Are Rushing to Back Trump, Verdict Be Damned

Modi Set for Landslide Election Win in India, Exit Polls Show

Here Are the Latest Verified Results From South Africa’s Election

Homebuyers Are Starting to Revolt Over Steep Prices Across US

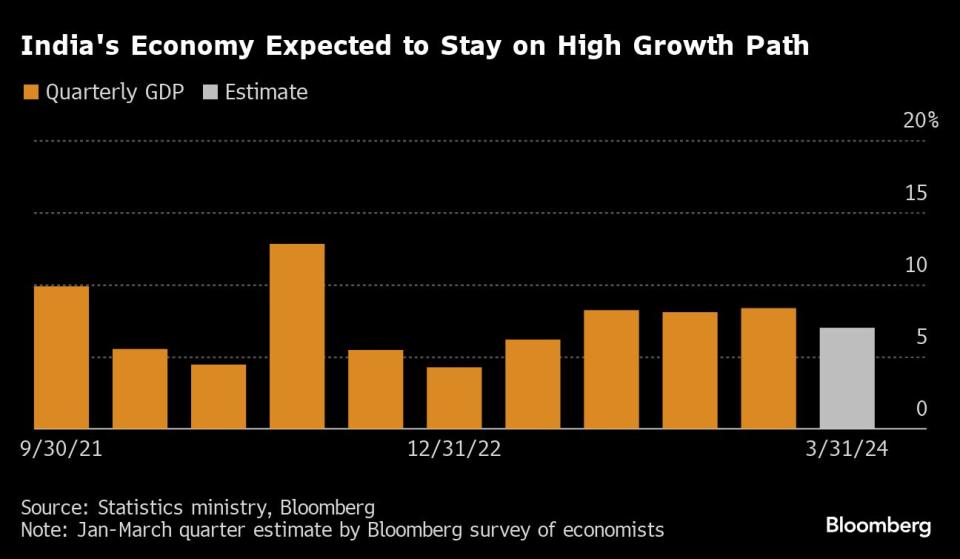

Gross domestic product rose 8.2%, the Statistics Ministry said Friday, above the 7.9% forecast by economists in a Bloomberg survey. For the January-March quarter, GDP grew 7.8% from a year ago, higher than expected, but lower than the revised 8.6% expansion in the previous quarter.

The data comes one day before India’s marathon elections end, with results to be announced on June 4. Modi’s Bharatiya Janata Party is widely expected to return to office, promising to continue investing in infrastructure and other growth-supporting measures.

The figures confirm India as the world’s fastest-growing major economy. The Reserve Bank of India predicts the economy will expand 7% in the current fiscal year, outpacing global growth that’s forecast to reach 3% in 2024.

There was a wide quarterly divergence in the two measures of growth — GDP and gross value added, or GVA — as was the case in the previous quarter. That suggests the calculation of the GDP data in the first three months was impacted once again by the net indirect tax category, largely due to a drop in government subsidies.

Economists had previously said GVA was a better measure of growth given the distortion to the GDP figure. GVA rose 6.3% in the first three months of the year from a year earlier, down from a revised 6.8% in the previous quarter, the statistics ministry said Friday.

“GVA is the better reflection of underlying economy as boost to GDP is technical in nature,” said Madhavi Arora, an economist at Emkay Global Financial Services Ltd. “GVA growth is relatively less volatile and the massive GDP-GVA wedge seen in FY24 will likely normalize by FY25.”

What Bloomberg Economics Says

The widening gap between headline GDP growth and gross value added is a real concern, especially if the central bank continues to use the former when it formulates its policy. Looking ahead, there’s a risk that high-for-longer rates could delay a structural upswing that would otherwise be unleashed by favorable demographics, improved infrastructure and political stability.

Abhishek Gupta, India economist

For the full report, click here

The rapid expansion in the economy will give the central bank room to keep interest rates unchanged for longer as it focuses on bringing inflation down to its 4% target. The RBI has kept interest rates on hold for seven straight meetings, with the monetary policy committee led by Governor Shaktikanta Das scheduled to make its next rate decision on June 7.

“Such a strong growth number suggests the MPC will see no urgency to cut rates,” said Shreya Sodhani, a regional economist at Barclays Plc. The RBI may also raise its growth forecast of 7% for the current fiscal year at the MPC meeting next week, she said.

Separately, the government also released data showing the fiscal deficit for the year through March was lower than budgeted, coming in at 16.54 trillion rupees ($198 billion), or 95.3% of what was estimated.

Anubhuti Sahay, an economist at Standard Chartered Plc, estimates the fiscal deficit for 2023-24 was probably 5.6%, compared with the government’s target of 5.8%.

“We see increased probability of the government lowering the target for the current financial year to 5%” after the RBI made a record dividend payment to the government, she said. The July budget will provide more clarity, she added.

Key highlights of the data:

Manufacturing rose 8.9% in the January-March quarter from a year ago, after expanding 11.6% in the previous three months

The farming sector grew 0.6%, compared with 0.4% in the previous quarter

Services, which includes trade, hotels and transport industries, expanded 5.1%, down from 6.9%

Private consumption growth was unchanged at 4% last quarter, while government spending grew 0.9% after contracting in the previous three months. Growth in investment eased to 6.5% from 9.7%

--With assistance from Anup Roy.

(Updates with comment from economist.)

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

US Malls Avoid Death Spiral With Help of Japanese Video Arcades

Israel Seeks Underground Secrets by Tracking Cosmic Particles

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

©2024 Bloomberg L.P.