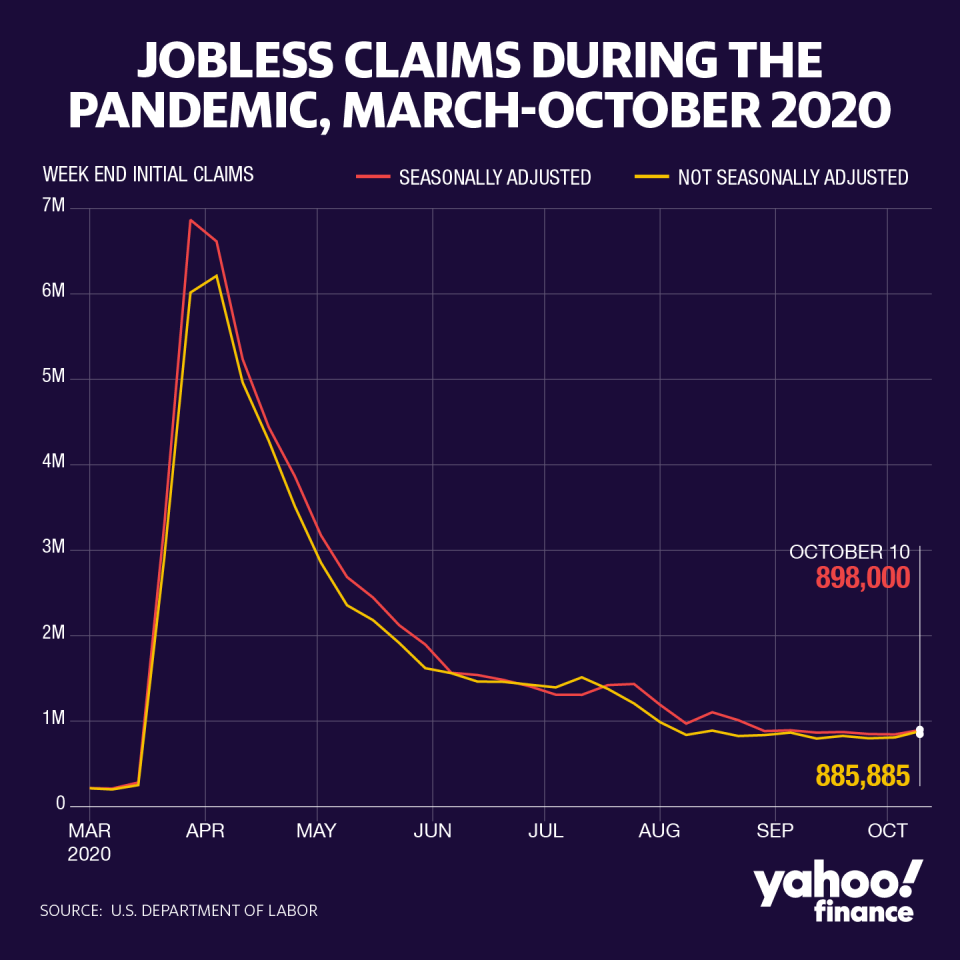

Jobless claims: Another 898,000 Americans filed new unemployment claims last week

U.S. states saw another 898,000 Americans file first-time unemployment insurance claims last week, representing an unexpected rise in new claims with the pandemic still under way and another round of fiscal stimulus still out of reach.

The U.S. Department of Labor (DOL) released its weekly jobless claims report at 8:30 a.m. ET Thursday. Here were the main metrics from the report, compared to Bloomberg estimates:

Initial jobless claims, week ended Oct. 10: 898,000 vs. 825,000 expected and 845,000 during the prior week

Continuing jobless claims, week ended Oct. 3: 10.018 million vs. 10.550 million expected and 11.183 million during the prior week

Jobless claims rose by 53,000 last week, after back-to-back weeks of improvements in new jobless claims.

At 898,000, the sum represented the seventh straight week that initial claims came in below the 1 million mark. However, new claims have held stubbornly above 800,000 for as many weeks, with a steady stream of new layoffs continuing to weigh on the economic recovery.

Continuing claims, however, trended lower. These claims, which are reported on a one-week lag and capture the total number of individuals still receiving unemployment benefits, fell by a greater than expected 1.17 million from the previous week’s upwardly revised level.

But other data underscored the ongoing strain on the labor market: unadjusted claims for Pandemic Emergency Unemployment Compensation jumped by more than 818,000 to 2.78 million for the week ended September 26, marking a surge in those who had exhausted state aid and moved to claim the federal program’s additional 13 weeks of benefits.

The jump in headline new jobless claims came even as California, the most populous state, continued with a pause in reporting new unadjusted claims to the national total, and again reported claims at its mid-September level. The state said earlier this month that it was temporarily halting processing initial claims to “reduce its claims processing backlog and implement fraud prevention technology,” according to a Labor Department’s statement.

At the national level, new jobless claims remain higher than their peak during the Great Recession, albeit well off their pandemic-era apex of nearly 7 million. And newly announced job cuts continue to roll in: Companies including AT&T’s Warner Media were reportedly planning thousands of job cuts, according to a Wall Street Journal report last week, and theater-operator Cineworld recently announced it was temporarily closing all its U.S. locations, in a move that would affect some 40,000 workers.

In Washington, a deal on further fiscal stimulus to help keep workers on payrolls and support unemployed Americans with augmented benefits remains elusive. On Tuesday, Senate Majority Leader Mitch McConnell said he planned to have the Senate take up relief legislation after the chamber’s return next week, with his narrower proposal set to include funds chiefly targeted to the Paycheck Protection Program. The deal is virtually certain to be rejected by the House, however, with House Speaker Nancy Pelosi having previously rejected slimmed-down stimulus proposals and deemed them inadequate.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Some wellness products growing ‘over 1,000%’ during pandemic: Ro CEO

What we can learn from the 17 stock market crashes since 1870

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.