Labour Plans Mortgage Guarantees to Help First-Time Buyers

(Bloomberg) -- Keir Starmer’s Labour Party plans to provide mortgage guarantees to first-time buyers in a bid to help young Britons get onto the housing ladder if it wins next month’s general election.

Most Read from Bloomberg

Putin Is Running Out of Time to Achieve Breakthrough in Ukraine

Singapore Retail Tycoon’s Son Seeks $62 Million Mansion Sale

Here’s Everything Apple Plans to Show at Its AI-Focused WWDC Event

Real Estate Investors Are Wiped Out in Bets Fueled by Wall Street Loans

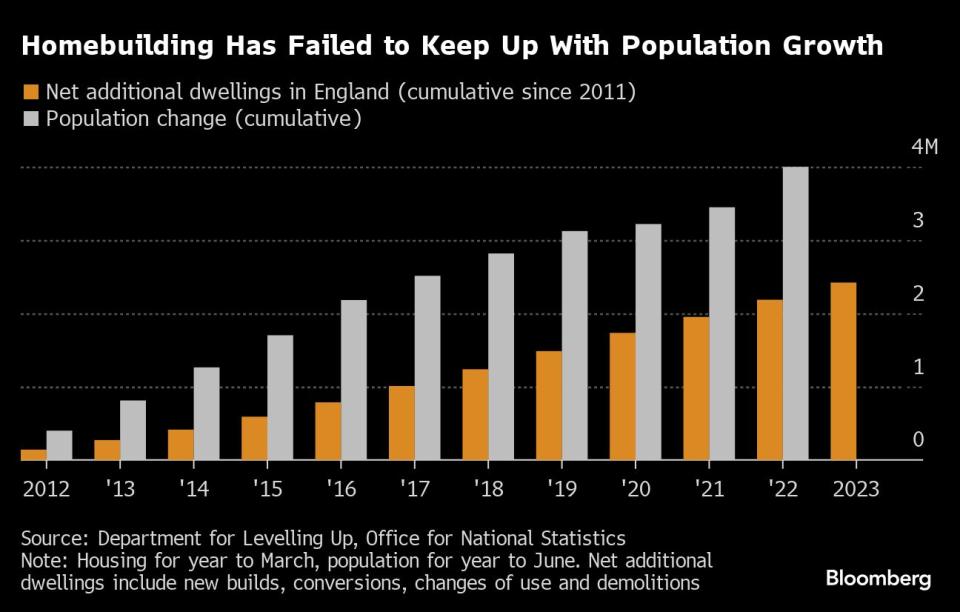

Under Labour’s proposals, the state will act as a guarantor for prospective owners unable to save for a large deposit, making permanent an expiring government scheme offering 95% loan-to-value mortgages. The plan forms part of the opposition party’s wider housing offer which also includes a pledge to relax planning rules, build 1.5 million homes over the next five years, and raise stamp duty for foreign buyers who are helping price young people out of the market.

“We will deliver more action on housing in the first year of a Labour government than this crumbling Conservative government has managed in over a decade,” Deputy Labour Party leader Angela Rayner, who also holds the party’s brief for housing, said in a statement.

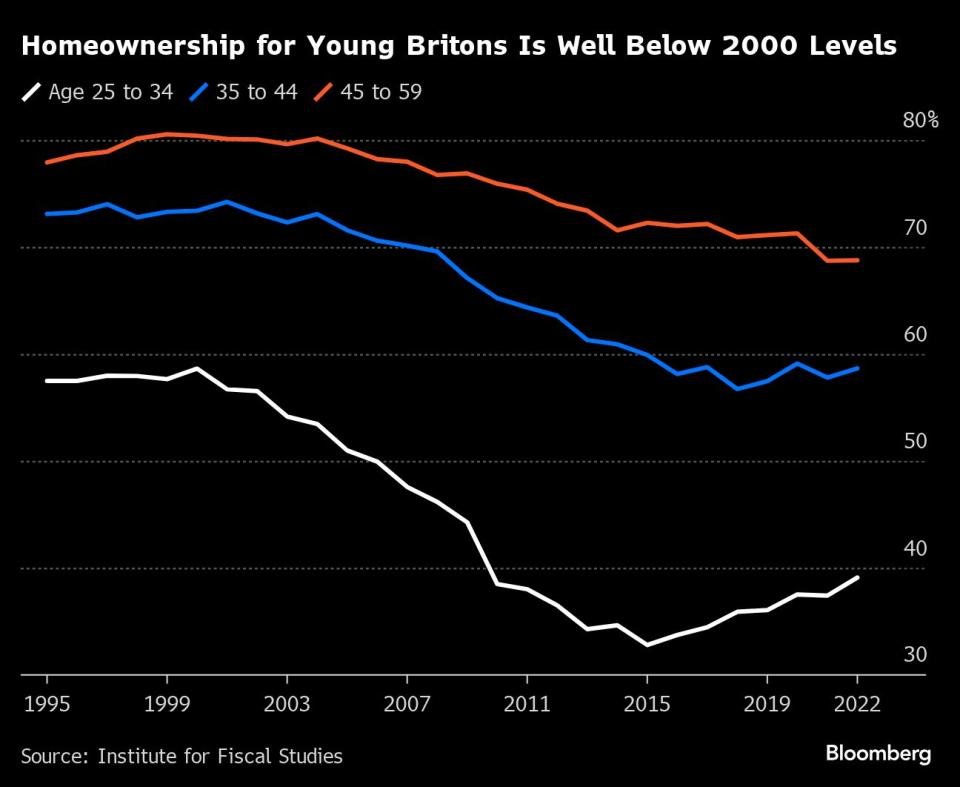

Labour is trying to address the growing difficulty faced by young Britons trying to get on the housing ladder. Data from mortgage lender Halifax showed the age of the average first-time buyer has increased to 32 from 30 in the past decade. Data from another mortgage provider, Nationwide, shows a typical UK house now costs 5.2 times average gross annual earnings, up from 4.4 when the Conservatives took power in 2010. That gap is even starker in London, where a typical home costs 8.5 times earnings, up from 6.2 in 2010.

“Imagine a young couple paying very high rents who can’t afford to save for a deposit and have no help from mum or dad,” Starmer told reporters on the terrace of new development Brent Cross Town in North London on Friday morning, where he was promoting the new policy. “This is a real game changer for them,” he said.

Starmer also took a tour around Brent Cross Town, much of which is still under construction, and sat down with Henry Jones, a first-time buyer with a baby girl who recently bought a property in the development.

Britain’s housing market has endured a downturn over the past 18 months, as higher interest rates and a cost-of-living squeeze crushed affordability at a time when the government was phasing out its Help-to-Buy program. That’s led to builders scaling back development as Britons struggle to scrape together a deposit for a home.

Labour said its new program — called “Freedom to Buy” — would guarantee part of the loan to first-time buyers and be fully integrated into the mortgage lending market as an established product. The party said it would also work with developers to ensure local people are given priority to buy into new developments, to end the “farce” of entire projects being sold off to international buyers first.

Labour’s pledge to build 300,000 homes a year matches the promise made in 2019 by the Conservatives, who have failed to deliver that target every year. Some housing experts, including former Bank of England rate-setter Kate Barker, have called the goal a “Herculean task” that would be “very difficult” to meet.

With the general election four weeks away, Prime Minister Rishi Sunak’s Conservative Party has sought to forge a dividing line with Labour over property taxes, promising on Wednesday to protect family homes from capital gains tax and increases in stamp duty, as well as ruling out increasing the number of council tax bands used to set local rates on properties of different market values. Starmer and his shadow chancellor Rachel Reeves “are coming for your family home,” Chancellor of the Exchequer Jeremy Hunt said in a statement, citing previous remarks by Reeves about overhauling council tax.

Starmer and his ministers have said Labour has “no plans” to raise taxes beyond those they’ve announced on ending preferential tax treatment for non-domiciled residents, private schools and private equity firms as well as extending a windfall tax on oil and gas giants.

Both parties have ruled out raising income tax, the national insurance payroll tax or the value-added tax sales levy — the Treasury’s three biggest revenue raisers. But analysis by Bloomberg Economics suggests that whoever wins will likely have to break their promises.

Aneisha Beveridge, head of research at broker Hamptons International, says Labour has gained support from mortgage-holders, a set of voters Starmer’s party is keen to woo ahead of the election.

“We saw in the local elections that much of the shift from the Conservatives to Labour came from mortgaged households,” Beveridge said. “That’s likely to play out in the main vote too.”

Labour says its mortgage program would help about 80,000 young people get on the housing ladder over the next five years. Take-up of the expiring government scheme has been modest also — with only 42,000 mortgages underwritten so far due to the numbers being curtailed by the unaffordability of high loan-to-value deals, according to Hamptons.

--With assistance from Charlotte Hughes-Morgan and Andrew Atkinson.

(Updates with comments from Keir Starmer in the fifth paragraph)

Most Read from Bloomberg Businessweek

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

Sam Altman Was Bending the World to His Will Long Before OpenAI

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

©2024 Bloomberg L.P.