Le Pen’s Finance Chief Says Don’t Compare Us to Liz Truss

(Bloomberg) -- Stop comparing a National Rally government in France to Liz Truss’s short-lived administration in the UK, Marine Le Pen’s party’s top finance official said.

Most Read from Bloomberg

Nvidia Rout Takes Breather as Traders Scour Charts for Support

BuzzFeed Struggles to Sell Owner of Hit YouTube Show ‘Hot Ones’

Jain Global Raises $5.3 Billion, Secures Cash From Abu Dhabi

How Long Can High Rates Last? Bond Markets Say Maybe Forever

Wikileaks’ Julian Assange to Plead Guilty, Ending Yearslong US Battle

Jean-Philippe Tanguy dismissed claims by President Emmanuel Macron’s team that a far-right National Rally government would spark a financial crisis on the same scale as that which forced former UK Prime Minister Truss to resign after just 49 days in office.

“Truss had policies that came out of nowhere after a political crisis,” Tanguy, a former member of the National Assembly’s finance committee, said on the sidelines of a presentation of Le Pen’s party’s key election promises. “Truss represented a rupture that nobody had spoken about before — she dug her own grave.”

According to Tanguy, French markets are less exposed to volatility because France doesn’t have pension funds to the same extent as the UK. He also said the Bank of England doesn’t have the same flexibility to act as a backstop as the European Central Bank does, and Truss’ policies were too radical.

Investors dumped French assets in the days after Macron’s surprise call for a vote to renew the National Assembly two weeks ago, fretting over how a new government could further stretch the country’s budget deficit. The turmoil pushed the risk premium on French bonds versus German ones to the highest since 2012 last week, though that spread narrowed slightly on Monday.

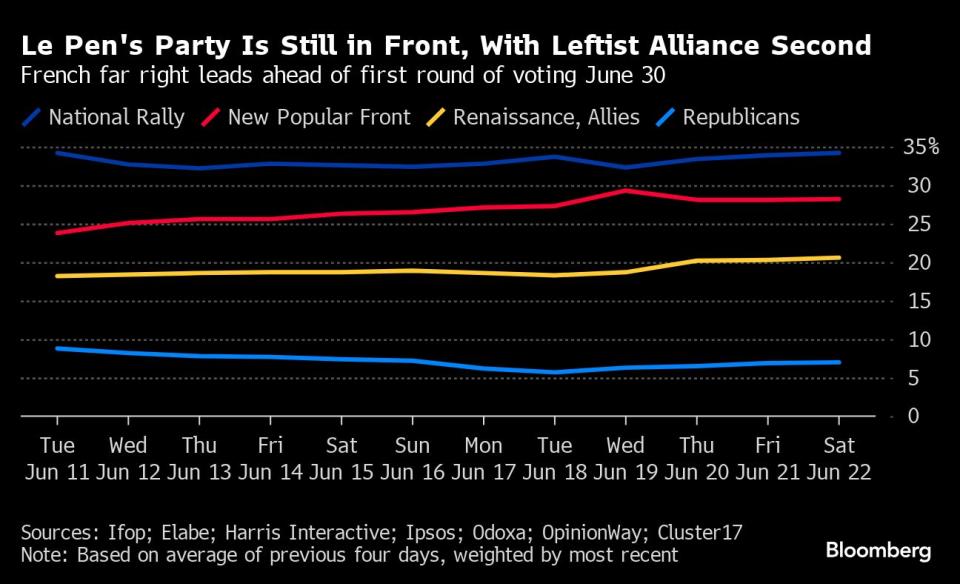

Le Pen’s National Rally would win the first round of the French legislative election with 36%, according to latest Ifop-Fiducial poll of voting intentions published Monday. An alliance of left-wing parties would get 29.5%, while Macron’s group would get 20.5%.

In the early days of the campaign, Finance Minister Bruno Le Maire warned that if the far right came to power a debt crisis and a “Liz Truss scenario” would be possible. Since then, Le Pen’s party has sought to reassure markets, presenting a program that tacks away from the more radical policies she presented in a 2022 manifesto for the presidential elections.

“There is no reason to worry,” Tanguy said. “I’m worried about the behavior of Le Maire who spends his time on TV reinforcing worries on markets and provoking extremely grave speculative and depreciative moves.”

Despite leading in the polls, both Le Pen’s party and the left-wing alliance have faced a hostile reception from entrepreneurs over their plans on how to fix public finances.

“The National Rally’s program is dangerous for the French economy, growth and jobs; that of the New Popular Front is just as dangerous, if not more,” Patrick Martin, the head of France’s Medef business lobby, said in an interview in Le Figaro last week.

On Monday, the National Rally reiterated that its first steps if elected would be limited to cutting the sales tax on energy and fuel — at a cost of €7 billion ($7.5 billion) in 2024, according to its own estimates. Tanguy said the measures would be financed by cutting support for immigration policies, paring back France’s contribution to the European Union and closing tax exemptions for some companies.

Further measures to support households will be conditional on a review of public finances, according to the party. It also intends to honor the overall fiscal plans of Macron’s current government.

“We will respect France’s commitments, we won’t have a runaway deficit, and we will put France on the trajectory foreseen by European treaties — not to please Brussels, but because it’s in France’s interest to control public finances,” Tanguy said.

Get Bloomberg’s coverage of the French election in your inbox by signing up to our newsletter, The Paris Edition. Terminal users can sign up here. If you’re reading this online, this is the link you need.

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

Independence Without Accountability: The Fed’s Great Inflation Fail

©2024 Bloomberg L.P.