The long game: Are investors helping drive up the cost of homes in N.B.?

Cory Allen owns seven units across two duplexes and a three-unit building, all on Fredericton's north side.

He says his costs to own and maintain the properties are so high that he's renting some of the units out at a loss to help keep rents low for his tenants.

But despite going into the red on his properties, he refuses to sell them, hoping their increased value later will help fiinance his retirement.

"What my hope is, is that the property values kind of stay with inflation so that when it's time for me to retire, I can sell these things, you know, and hopefully realize, kind of, the full growth."

Allen is part of a segment of homebuyers in Canada classed as investors — people who purchase residential properties aside from the one they live in.

According to the Bank of Canada, they've grown as a share of the people who buy homes across the country, while the share of people buying their first home has declined.

Allen said he's charging as little as he can in an effort to help his tenants, but experts say the growth in activity by investors like him is likely helping drive up costs for renters and for people looking to purchase a home just to live in.

"If more and more investors are buying up houses that maybe before would have been owned by an individual, you know, it is going to push up the price of that housing over the long run," said David Campbell, an economic development consultant based in Moncton.

High costs as a landlord

Allen, who lives just outside Fredericton, said he bought two homes in 2022 and the third in 2023, with the intent of renting them out.

Provincial property records suggest the two duplexes were occupied by their owners at the time, while the triplex was already non-owner-occupied.

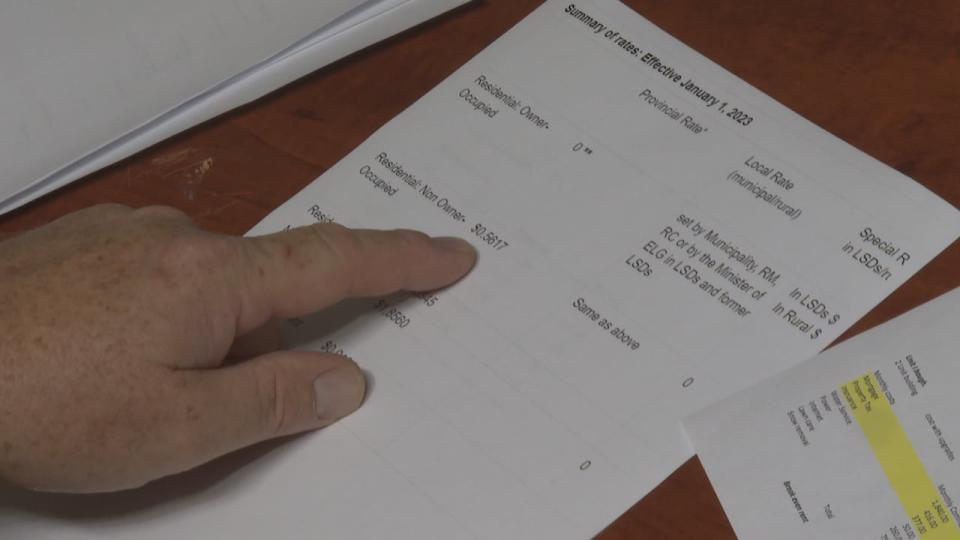

Allen says he thinks residential landlords are paying more than they should to own and maintain their properties, including through the additional portion of property taxes charged on non-owner-occupied buildings. (Shane Fowler/CBC)

He said the rents he charges range from $1,000 a month for a one-bedroom unit to $1,850 per month for a three-bedroom, utilities included.

Most months he either breaks even or sees a small loss.

Allen said he blames higher mortgage, insurance and tax costs his buildings incur because they are classed as commercial, non-owner-occupied properties.

He said he thinks landlords get a bad rap, but people don't understand all the costs that go into owning and maintaining a rental unit.

WATCH | Real estate investor blames government rules for driving up rents:

Allen said he'd even commit to reducing rents if the province dropped the tax rate on non-owner-occupied buildings, or if lenders and insurers offered lower rates for investment properties.

"I think that if we could get some of these costs reduced, so they weren't considered commercial, folks like myself would pass those cost savings on.

"And I think if enough of the small guys [landlords] lowered their prices ... the big guys would have to follow suit because everybody is … going to try to go to the lower prices, right?"

Soaring home prices

Allen purchased his three properties around the height of a home-buying frenzy in New Brunswick, which has seen the average price of a home spike from just under $180,000 in 2019 to $297,52 in 2023.

Experts have attributed the rise to surging demand for homes, driven in part by record inter-provincial and international migration into New Brunswick after the COVID-19 pandemic started.

Investor purchases likely had an effect as well, but to what extent is not fully understood, Campbell said.

"We know it's an increasing trend," he said. "Because of the frothy real estate market right now, a number of people have decided to invest in real estate as a long-term investment."

In 2022, the Bank of Canada published data showing the growth in home purchases by investors, first-time homebuyers, and repeat homebuyers, who include those selling their current home in order to purchase and move into another one.

The data showed growth in home purchases among the three classes was largely equal in 2019 and 2020, but starting in early 2021, purchases by investors began significantly outpacing purchases by the other two classes.

In a subsequent report, the Bank of Canada published more data, this time showing that investor purchases climbed from 20 per cent of all mortgaged home purchases in Canada in 2014, to 30 per cent in the first quarter of 2023.

At the same time, the share of mortgaged home purchases by first-time homebuyers declined, from 50 per cent to 43 per cent.

"House prices have climbed considerably since the start of the global pandemic," the researchers wrote in the report.

"Expectations of future price increases and strengthened investor demand likely contributed to this rise."

The Bank of Canada declined to provide an interview about the effect investor homebuyers are having on home prices in New Brunswick and said it did not have province-specific data to share.

Statistics Canada meanwhile has published limited province-specific data on investor-owned housing, which shows that 33 per cent of residential property in New Brunswick was owned by investors in 2020 and 2021.

Of all investment property types, single detached homes represented the largest share, at 64 per cent for both years. Out of all single detached homes in the province, about 14 per cent were classed as investments.

A Statistics Canada spokesperson said data wasn't available for previous years and that the agency is working on compiling data for 2022.

Better monitoring needed, says expert

A healthy housing market should have a certain combination of rental housing and owner-occupied homes, Campbell said.

However, if investors continue to compete more with first-time homebuyers, the upward pressure on home prices could force more people into renting, when they otherwise could have afforded to own, he said.

Campbell said the trend is one that is concerning and should be studied by the provincial government to better understand the effect that investors are having on the housing market.

WATCH | Economic development consultant on dynamics of housing market:[MEDIA]

"And then if required, you know, putting rules around this segment of the market to make sure it's not negatively impacting the overall environment for homeowners in the city," he said.

CBC News asked for an interview with Jill Green, New Brunswick's minister responsible for housing, but a spokesperson said the Finance Department would be better suited to respond.

CBC News then asked for an interview with Finance Minister Ernie Steeves about investor homebuyers in New Brunswick but did not receive one.

CBC News also asked the province by email whether it tracks investor activity in the housing market.

Spokesperson Mir Hyder provided a one-line email citing Statistics Canada's data showing 14 per cent of single detached homes were investment properties as of 2021.

Lack of rent control a problem

When an investor buys a home in New Brunswick, whatever costs they incur in paying the mortgage, insurance and property taxes can get passed down in full to the tenant.

That means whether or not the investment was sound, landlords can set the price wherever they want because there are no forms of rent control in the province, said Matthew Hayes, an urban sociologist and spokesperson for the New Brunswick Coalition for Tenants Rights.

Matthew Hayes of the New Brunswick Coalition for Tenants Rights is calling for rent caps. P.E.I. and Nova Scotia have them and still posted more housing starts than New Brunswick last year. (Pascal Raiche-Nogue/Radio-Canada)

"What we really needed to do was bring in rent control," Hayes said.

"We should have done that at the start of the pandemic when we could see this wave of investment coming into the sector. We didn't do it, and the result of that is that people have gotten poor while trying to keep up with their rent."

Hayes said rent control could have helped stem the appeal of purchasing homes as investments, thus keeping home prices more stable in recent years. That would have not only been a good thing for tenants and first-time homebuyers, but also for longtime homeowners, he said.

"As the Bank of Canada points out, there is a relationship between the the growth in investor home-buying ... and this is having not just an impact on people who someday want to own homes, it's having an impact on people who currently own their homes in New Brunswick and who are paying, you know, galloping [property] tax costs."

Housing fair game for investment, Allen says

Asked what he thinks about the ethics of buying homes as investments, Allen said there will always be a segment of the population looking to rent instead of own.

As to whether investors like him are contributing to soaring home prices, Allen acknowledged he's no expert on the topic, but said he thinks Canada's growing population, combined with increases in labour and material costs, are the main reasons.

"Again, it's an investment really in the future for myself, but there's some work that goes along with that," Allen said, referring to the costs and labour involved in maintaining the properties.

"I'd like to see some changes from the provincial and federal policies that, you know, let us classify these things as residential, and bring the cost down. I think that would help a lot."