Mexico Inflation Slows Again Amid High Interest Rate and Strong Peso

(Bloomberg) -- Mexico’s inflation extended its gradual slowdown in early July, roughly in line with forecasts, helped by double-digit interest rates and the strongest peso since 2015.

Most Read from Bloomberg

The Bear Market Has Nearly Been Erased, Fewer Than 20 Months After It Began

US Recession Becomes Closer Call as Economists Rethink Forecasts

Oil Trader Vitol Doubled Average Pay on Record $15.1 Billion Profit

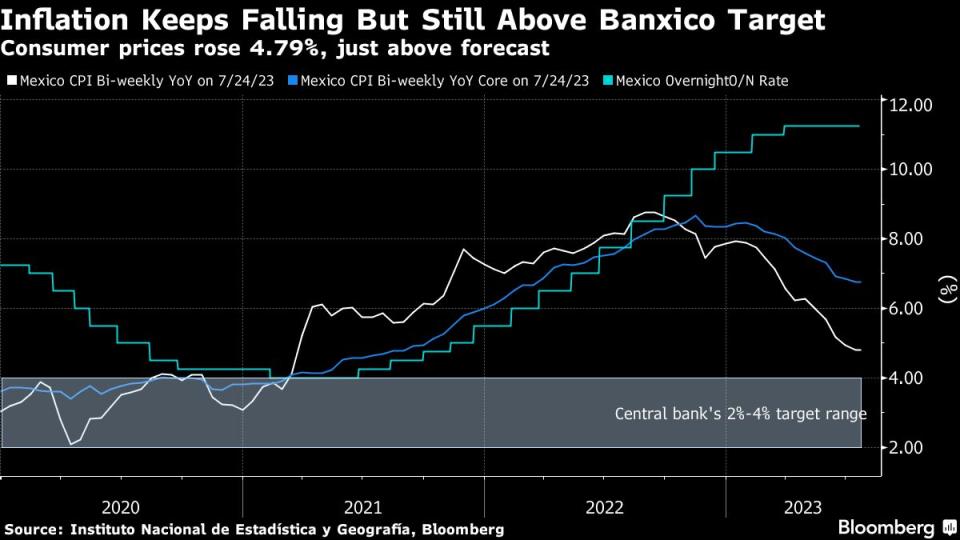

Consumer prices rose 4.79% in the first half of the month compared to the same period a year earlier, down from 4.93% in late June, the national statistics institute reported Monday. The result was just above the 4.77% median estimate of economists surveyed by Bloomberg.

Core inflation, which excludes volatile items such as fuel and food, was 6.76% on an annual basis, below the previous measure of 6.86% and just higher than the median estimate of 6.73%.

Consumer price increases continue to trend lower from last year’s peak, but remain above Banxico’s target of 3%, plus or minus a percentage point. The easing of cost pressures has been supported by the “super peso” as it extends its 12-month rally against the dollar.

Food items including avocados and onions were among the top consumer price drivers in early July, recording increases of 18.5% and 16.1%, respectively, while airfare tickets and travel packages also pressured inflation. On the other hand, gas fell 2.8% during the period.

“The deceleration of services inflation will be slower, but we’ll see that overall inflation will continue to moderate in the short-term,” said Andres Abadia, chief Latin America economist at Pantheon Macroeconomics. “What we’ve been seeing with the peso and PPIs have all been pointing to a deceleration, but it will be a very gradual process.”

The peso has been one of the most profitable currency trades of the last 12 months, with accumulated gains of roughly 21%. The currency’s sharp appreciation, however, has some economists concerned that it’s overvalued and at risk of reversal.

The peso rose 0.8%, making it the best performing major currency in the world early on Monday.

Inflation Outlook

While the process of disinflation is clearly underway, the short-term outlook remains less certain. The peso’s performance, the effect of the El Niño weather pattern on food prices, geopolitical tensions surrounding the war in Ukraine and how they will impact the price of grains could all pose risks to the current inflationary path, according to Abadia.

The central bank has kept a cautionary tone during its recent meetings, pledging to keep a restrictive policy until inflationary pressures decline in a “sustained manner.” Board members avoided discussing a time line for interest rate cuts at their last meeting, with a majority saying that it is too early to consider the start of an easing cycle even as inflation cools.

Banxico, as the central bank is known, left its key interest rate unchanged at 11.25% for the second consecutive month in June after a record 725-basis point hiking campaign that began in 2021. Borrowing costs are at their highest level since the bank started targeting inflation in 2008.

“The data reinforce Banxico’s communications that rates are on hold for an extended period of time,” said Brendan McKenna, an economist and foreign currency strategist at Wells Fargo Securities LLC. “Markets are still priced for cuts to begin in Q4. I think that will be repriced.”

Economists in the most recent Citibanamex survey published last week expect inflation at the end of 2023 to be 4.66%, down from a forecast of 4.99% in June, with the core forecast estimates inching down to 5.17% from 5.30%. Banxico’s key rate is still expected to end 2023 at 11%, while the economy is seen growing 2.4% this year and 1.5% in 2024, according to the survey’s results.

--With assistance from Rafael Gayol.

(Adds more detail from inflation report, economist quotes starting in fifth paragraph)

Most Read from Bloomberg Businessweek

No Testing, No Inspections: Contaminated Eyedrops Blinded and Killed Americans

This Supposed Mafia Manifesto Doesn’t Stand Up to a Google Search

Hot New Play in Stock, Bond Markets: Greece Is Suddenly Booming

©2023 Bloomberg L.P.