Modi’s Election Setback Only a Blip for Some Global Stock Funds

(Bloomberg) -- For many foreign investors, India’s near-$400 billion stock-market wipeout on Tuesday is just another opportunity to buy into what they see as one of the world’s most promising economies.

Most Read from Bloomberg

S&P 500 Hits 25th Record This Year as Tech Soars: Markets Wrap

BlackRock, Citadel Back Texas Stock Exchange in Challenge to NYSE

Billionaire-Friendly Modi Is Punished by Millions of Poor Voters

Goldman Sees ‘Wall of Money’ Fueling Stock Market’s Summer Party

While Prime Minister Narendra Modi will undoubtedly find it trickier to pass tough reforms after his party lost its majority in the lower house of parliament in the just-concluded national elections, several global money managers say the investment case for Indian stocks remains intact.

Arun Sai, senior multi-asset strategist at Pictet Asset Management, is among those who view Tuesday’s selloff in India’s NSE Nifty 50 Index as a “fantastic” chance to grab shares in some sectors such as banks.

“The first thing I did was message my portfolio managers who invest in India to say if Nifty banks are down because of a lower-than-expected mandate for Modi, it’s a buying opportunity,” Sai said in an interview on Tuesday.

“What the average foreign investor gets wrong about India is policy continuity. They think that if Modi gets less of a mandate, then a lot of the policies will go to the background,” he said. “The policy continuity is being underestimated; it isn’t too much of an issue in India.”

Sai’s views were echoed by a raft of fund managers and analysts, with the head of BNP Paribas SA’s wealth management arm describing the market reaction to the election outcome as short-sighted. Others such as Adrian Lewis at Aviva Investors and Rajiv De Mello at GAMA Asset Management SA said they would use the weakness to add exposure.

Modi’s Bharatiya Janata Party has vowed to retain power along with allies after it won 240 of the 543 seats in the lower house of parliament, versus 303 seats it secured in the 2019 election. Official results showed the BJP-led coalition secured enough seats to form a government if it sticks together.

The Nifty 50 index rebounded 3.4% on Wednesday, its biggest gain since early 2021, as one of the BJP’s key allies reaffirmed his party’s support. The benchmark had tumbled by the most in four years in the previous session.

“We have maintained a slight overweight position to India both before and after the election,” said Will Scholes, fund manager for the Premier Miton Emerging Markets Sustainable Fund. “While we may make some minor ‘like-for-like’ changes to the portfolio, they won’t change the overall profile of the fund meaningfully.”

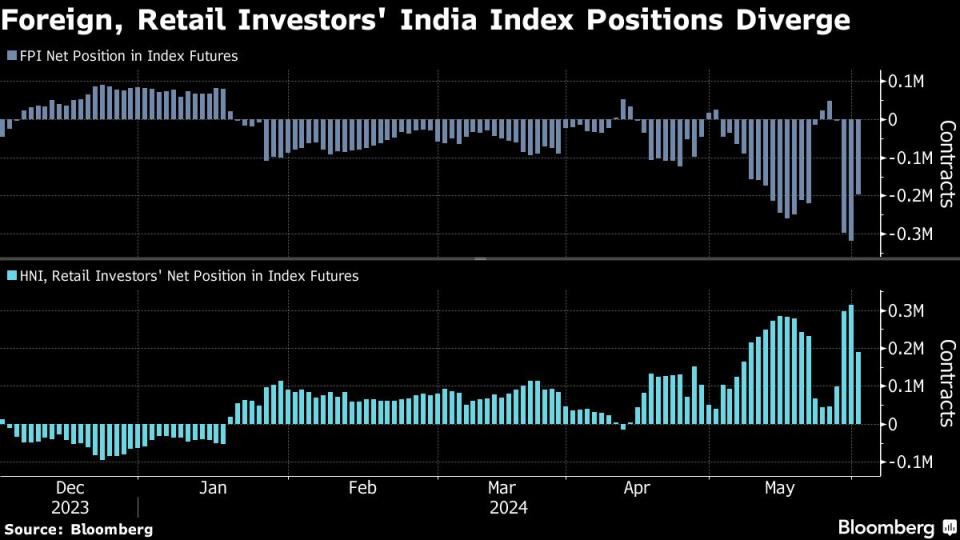

Foreign equity investors appear to have headed into the election relatively cautious, data compiled by Bloomberg suggests, contrasting with bullish futures positioning by Indian retail traders. Having got that right, offshore investors can now focus on the long-term positives in the infrastructure, consumer and services sectors.

The latest rout in India is “offering an entry opportunity to those who do not own it yet,” Mark Matthews, Singapore-based head of Asia research at Bank Julius Baer & Co., wrote in a note. The nation’s economic upcycle has several more years to go, and that should lead to annual earnings growth in the low teens, he added.

India’s economic growth and the value of its stock market have moved in tandem, growing multifold over the last 20 years. In the decade since Modi took power, the equity market has grown over 200%, with a value of nearly $5 trillion before Tuesday’s rout, of which $1.5 trillion was added in the past year. It’s on track for a ninth year of gains, outperforming the MSCI Emerging Markets Index.

The stock market has also faced shocks such as a 2023 short-seller report from Hindenburg Research, which fueled a rout in Adani Group companies and raised questions about corporate governance in India. Adani shares, which have rallied under the current government and hit record highs Monday in anticipation of a landslide Modi win, fell heavily in the following session. They finished mostly higher on Wednesday.

India is “an emerging economy that will deliver in the coming decade, it’s more promising than China in terms of growth,” said Vincent Juvyns, global market strategist at JPMorgan Asset Management.

--With assistance from Henry Ren, Lisa Pham, Julien Ponthus, Kit Rees, Abhishek Vishnoi, Ashutosh Joshi and Allegra Catelli.

(Updates levels in the eighth paragraph.)

Most Read from Bloomberg Businessweek

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

The Budget Geeks Who Helped Solve an American Economic Puzzle

©2024 Bloomberg L.P.