Can a MrBeast Game Show Bring More of Gen Z’s Spending Power to Amazon? | Charts

Amazon recently announced a new competition show featuring the famous YouTuber MrBeast with a headline prize of $5 million, touted as “the biggest single prize in the history of television and streaming.”

No streaming service has produced a competition reality series as successful as the long-running and expansive franchises that have been a staple of traditional linear TV. And the global share of demand for competition reality series has been on a steady decline over the last few years, sliding from a high of 4.5% of demand for all shows globally at the beginning of 2020 to a 3% share of demand today.

However, a few factors bode well for the success of Amazon’s new MrBeast competition. At the very least, the scale of the competition (1,000 competitors) and the size of the prize should attract a fair amount of attention.

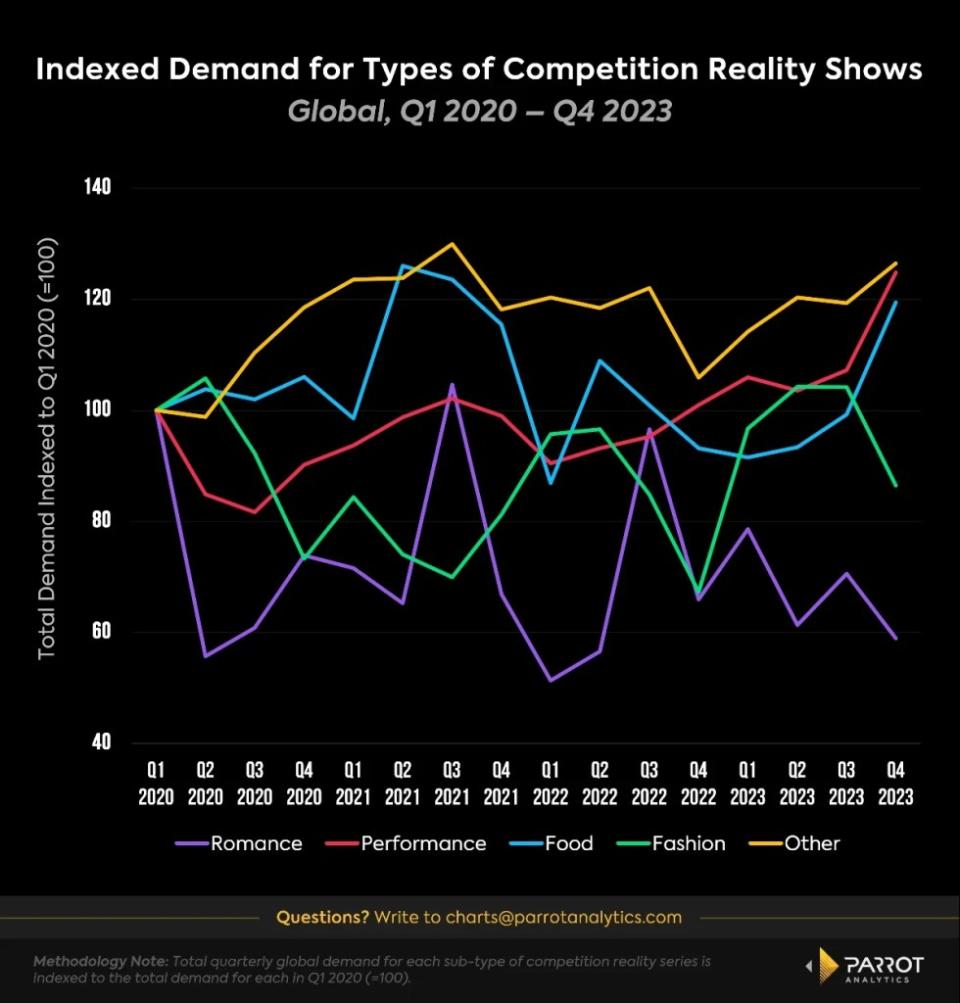

Looking at growth in competition reality shows — broken down into top categories of romance, performance, food, fashion and “other” — demand for “other” types of competition reality shows grew the most between 2020 to 2023. As of Q4 2023, the total global demand for these series was 26% higher than in the first quarter of 2020. That’s not as high as the phenomenal demand growth we have seen in some of the trendiest genres, but it does outpace the main types of competition shows. Examples of shows in this growing category of competition include “Taskmaster,” “Lego Masters,” and “Fear Factor.”

It is a positive signal for the new MrBeast show that audience demand for shows like these is growing. They all have contestants doing outrageous, extreme or novel challenges, similar to the outlandish stunts that have fueled MrBeast’s popularity on YouTube and will presumably feature in his new show.

MrBeast is a natural fit to host a competition reality series given the nature of his content on YouTube, which earned him his fame. For Amazon, the size of his audience, as well as the demographics of his fanbase, are likely appealing factors. MrBeast globally was the most in-demand YouTuber of 2023 and had the second most subscribed to a channel on YouTube. In much the same way that adaptations of existing IP can bring an already dedicated fanbase to a new show and increase its odds of success, if MrBeast is able to rally his fans to his new series it will be more likely to be worth Amazon’s investment.

Specifically, the demographics of MrBeast’s current audience make him an interesting fit for Prime Video. We previously highlighted how Prime Video has mastered “Dad TV.” While MrBeast’s audience skews heavily male (74%), his fans tend to be much younger than the current audience for Amazon Prime Video originals (nearly half of his audience is Gen Z). Similarly, the audience for competition series skews female (59.7%) although this likely varies widely across specific types of competition series. Getting MrBeast’s fans to turn out for a competition reality series on Prime Video could be a challenge, but also presents a big opportunity.

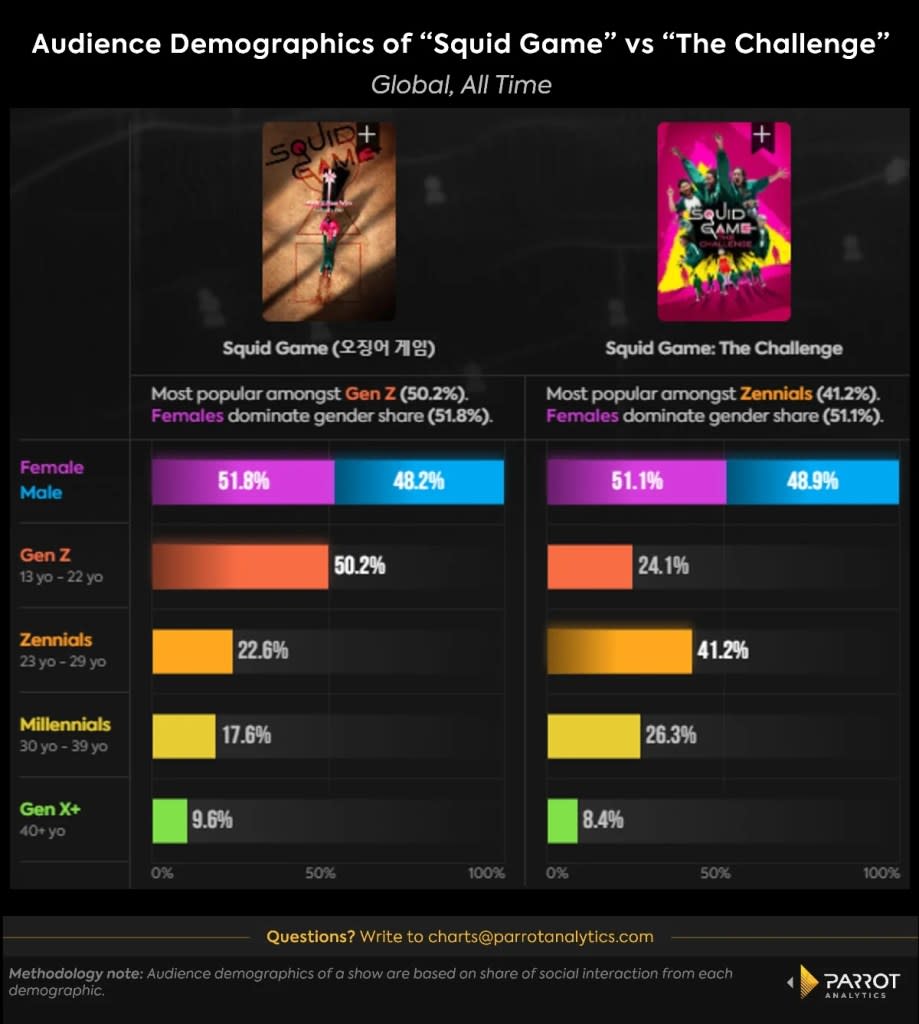

To understand how an existing audience may (or may not) turn out for a new series, it is helpful to look at the case of “Squid Game: The Challenge,” Netflix’s competition reality spinoff of “Squid Game.” While “Squid Game” had a very young audience, this didn’t necessarily transfer directly to the spinoff competition series. We found that the share of the Gen Z audience for “The Challenge” was about half of the Gen Z share of the audience for the original series. Two years before “The Challenge” premiered, MrBeast had already racked up hundreds of millions of views on his own Squid Game recreation.

On a final note, it is a smart move for Amazon to partner with MrBeast when you consider how Prime Video feeds into Amazon’s larger e-commerce strategy. Getting young subscribers onto your platform while habits can still be shaped has the potential to yield returns for years to come as these young consumers settle into their habits and increase their buying power.

The post Can a MrBeast Game Show Bring More of Gen Z’s Spending Power to Amazon? | Charts appeared first on TheWrap.