Mubadala’s Oil Refinery Bonds Take Hit From Petrobras’s New Policy

(Bloomberg) -- The new fuel policy implemented by state-run Petroleo Brasileiro SA is causing trouble for a Mubadala Capital-owned oil refinery, handing bondholders one of the worst returns in Latin America.

Most Read from Bloomberg

Musk Told Pentagon He Spoke to Putin Directly, New Yorker Says

Huawei Is Building a Secret Network for Chips, Trade Group Warns

Goldman Is Cracking Down on Employees That Aren't in Office Five Days a Week

Stocks Fail to Catch a Bid Before Nvidia’s Results: Markets Wrap

Borrowers With $39 Billion in Student Loans Finally See Relief

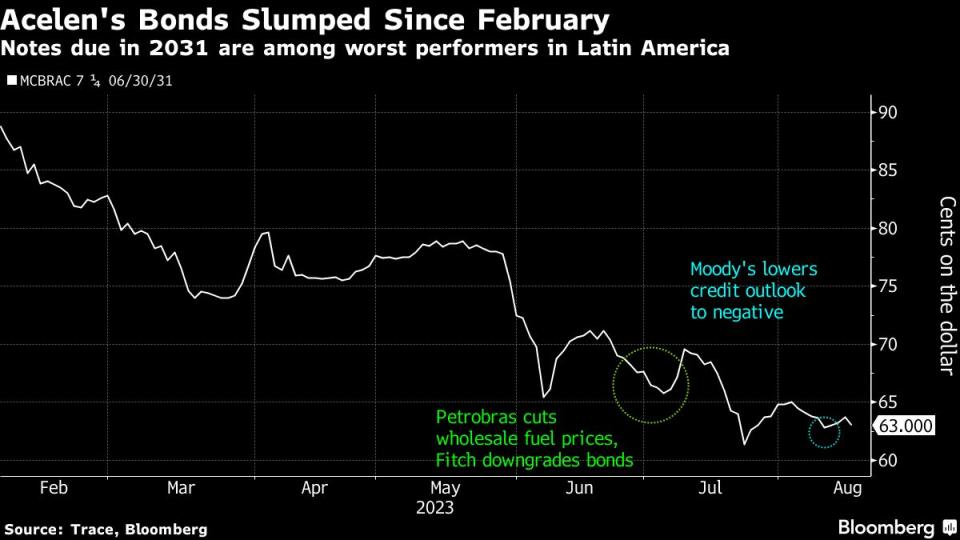

Mubadala’s Acelen, which operates the refinery in northeast Brazil, saw its notes fall into distressed territory at around 63 cents on the dollar, down 26 cents since February. The outlook for debt due in 2031 was cut to negative earlier this month by Moody’s Investors Service, which flagged growing risks to the firm’s cash generation.

The market’s increasing unease over the Mataripe refinery’s future says less about the company itself than it does about the fallout from Petrobras’ fuel policy. The government-controlled energy company has been selling gas and diesel in Brazil at a discount to international prices under President Luiz Inacio Lula da Silva, who began questioning why domestic prices were so high after taking office.

While the company raised fuel prices last week to reduce the gap with international levels, it has been selling fuels below international levels for much of this year.

Acelen says their refinery is at a disadvantage: On one hand, Petrobras, the dominant supplier in the country, is selling them crude at high prices. And on the other hand, they’re unable to compete with rival refineries that are putting out cheap gas and diesel to comply with the fuel policy. The allegations were made in a complaint to Brazil’s antitrust agency Cade in May.

Petrobras did not immediately reply to messages seeking comment.

“Petrobras is making life difficult for Acelen,” said Ezequiel Fernandez, an analyst at Balanz Capital Valores. That combination of factors adds pressure to the company’s so-called refining crack spreads — the difference between the price Acelen pays for the crude and the price it’s able to pass on to consumers.

On an adjusted basis, that spread tumbled 54% over the last year to $8.20 a barrel in the first quarter. As a result, quarterly sales fell 10% year-over-year to $2.2 billion.

“Brazil needs to ensure that the refining market is under fair and competitive conditions,” Acelen said in a written response to questions. Local distortions and a volatile international market — made worse by the Russia-Ukraine war and global economic factors — have hurt the company’s results, it said.

Acelen’s margins in recent quarters have been hurt by high freight costs in the international market for very-low sulfur fuel oil, costs associated with short-term contracts and the expense of ramping up production, according to Moody’s analyst Cristiane Spercel.

Those pressures are starting to abate, she said, “but 2023 will be a more challenging year in terms of cash generation.”

Acelen, also known as MC Brazil Downstream, was created after Mubadala — the $20 billion asset management subsidiary of the Abu Dhabi sovereign fund — purchased the Mataripe refinery from Petrobras in 2021 for about $1.65 billion.

The fact that bonds trade at such depressed levels suggests that investors are bracing for “substantial” odds of a credit event, Fernandez said, adding that an equity injection by Mubadala is likely if things deteriorate further and debt services becomes problematic.

Acelen said it’s “comfortable” with its liquidity and continues to move forward with its projects, declining to comment on the potential for a capital injection.

At current prices “we need to start weighing in eventual parent support,” said Fernandez, who has been holding an underweight recommendation. “The short case is not as compelling anymore.”

--With assistance from Maria Elena Vizcaino, Mariana Durao and Peter Millard.

Most Read from Bloomberg Businessweek

Never Mind Shrinking Households, Builders Are Adding Bedrooms

Drug Benefit Firms Devise New Fees That Go to Them, Not Clients

‘Don’t You Remember Me?’ The Crypto Hell on the Other Side of a Spam Text

GOP Presidential Hopeful Ramaswamy Sued Over Strive’s Practices

©2023 Bloomberg L.P.